week 10.

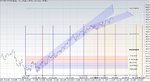

Even tough the last weeks drop was expected some time ago the delay in time of it caused some disturbance and even the doubt popped up if at all. It’s all history and I sincerely hope you had a blast like myself. Something did change last week and the preferred pattern shows a wave 409,56-512,47 indicating a second wave down presently. Due to the serious price movement near the 38,2% retracement at 473,16 the wave counter signals wave 2 potential although it must be noted that the inter wave time relations are way off. In the back of my mind I am picturing a pattern with a wave III at 512,47 which would be the perfect fit for the 4 years cycle drop typical activity. Just a scenario to keep in mind when looking at the total picture for 2007.

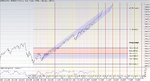

First things first and that’s the question whether or not the move down will be completed to fit in the above 38,2% retracement level even closer or will the AEX move up first to confirm the trend change from positive into negative. So let’s look at the preferred Elliott pattern from 512,47 for a minute and the picture tells more than a thousand words I refer to attachment 1. Just allowing myself one observation and that’s the wave IV at 486,19 on Friday morning and isolate that piece to take you one step beyond (Madness). And the surprise is complete if we look at attachment 2 leaving us the question what wave 5 will bring us: a) the normal version and b) the extended version. The riddle of the week now is for you to find the a and b answer since it has been published already last Friday.

Given the close in Yank’s-land and more specific the movement after we closed it might be a fair estimate to presume wave 5:3:3 (see the attachments) to continue. So in preparing for the trades to win we need to cover two issues; 1) getting our act together for the wave 5 including the turn up 2) finding out as soon as possible the bigger picture. The first issue has already been covered so let’s move on to the second one: I have been implementing a more sophisticated piece of the puzzle in order to effectively re-engineer the RSI boundaries which I generate out of the home made dynamic Range Rule RSI. Mind you these values were calculated with last weeks EOD data so each and every completed day of week will change the values so when appropriate I might update them but let’s face reality. The first three levels of Range Rule Resistance (RRR) are the dynamic OS values at a Monday’s close 482,73 484,11 and 485,58. The second level of resistance is the dynamic Bear Range Rule value at Monday’s close 487,15 488,81 490,59 492,50 and 494,55. The next level is the level where the Range Rule Trend Change (RRTC)which I am not going to add here as I do not want to dazzle you with a huge number of numbers and values.

The tough part now is the trend and the way trends within the trend are captured even within the very same timeframe used. To avoid a debate whether the trend is positive or negative I will work out something like this for Monday: 9-10u rrt: - rrr = 479,84 rrtc = 482,53. And immediately the first interpretation issue pops up, the rrr value is below the close value of 17-18u on Friday so it should be support in stead of resistance. This is one I now – it’s Saturday morning – will not bother to explain rather than maybe suggest to wait until Monday morning.

The observing reader might have concluded already that the hourly range rule trend readings could be used as a trailing stop-loss. There is however a vacuum area which exposed itself when trading last Friday when the AEX closed above the rrr level and below the rrtc level. Straight forward the rrt remains negative and the shorts could be left open the but however is your own gut feeling which tells you 30 index points down in a couple of day’s wow. So I have to turn to other techniques and or indicators for help here it doesn’t matter what I do or try there seems to be no single simple straight forward solution. So the 512,47 intraday trend can be captured as done so far quite successful with a Gann Fan and the AEX is below this line the above range rule trend readings even fit within the Fan which provides me the evolution route to follow.

The last piece I contribute in this weekly is especially for those people that turn away each time the word Astro pops up even without the difference between Astronomy and Astrology. Reading bits and pieces on the first I can not avoid to pick up something about the second and it must be said that I am impressed with the Mercury Retrograde effect once again. So I told myself to be less reluctant towards the subject. In my Astronomy study’s I stumbled over something last week which I attached here as projected astronomy events in the bull run AEX chart starting in March 2003.

Have fun trading.