You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Clown's 2007 outlook is work in progress

- Thread starter The Dutch Clown

- Start date

- Watchers 26

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

een twe drie vier.... hoedje van

Blinker,

The AEX from 549,02 until 537,76 at this point in time has the highest score when referenced towards an ideal model as a completed impulsive wave pattern called Extension3C. This would implicitly mean you are looking for a second wave at the relevant retracement levels. From the projected pattern perspective this second wave qualifies time wise at the day high yesterday which from a traders perspective offers you an interesting setup.

Have fun trading to WIN.

Blinker,

The AEX from 549,02 until 537,76 at this point in time has the highest score when referenced towards an ideal model as a completed impulsive wave pattern called Extension3C. This would implicitly mean you are looking for a second wave at the relevant retracement levels. From the projected pattern perspective this second wave qualifies time wise at the day high yesterday which from a traders perspective offers you an interesting setup.

Have fun trading to WIN.

En als het hoedje dan niet past...

Dear Pacito and Clown,

Thank you for your reply. First of all I think timing is essential for trading, but the place in time is something else. A wave 5 is more or less as long (in time) as the first one. The second and fourth are the difficult one's. Never the same! Is it an normal flat, or a combination of double and triple threes? These are the hardest one's......

This extension 3C You see as wave 1? Because I thought something different. We are in the fourth wave (see picture)

We share the same conclusion... the AEX haven't found the bottom yet.....

Success....

Dear Pacito and Clown,

Thank you for your reply. First of all I think timing is essential for trading, but the place in time is something else. A wave 5 is more or less as long (in time) as the first one. The second and fourth are the difficult one's. Never the same! Is it an normal flat, or a combination of double and triple threes? These are the hardest one's......

This extension 3C You see as wave 1? Because I thought something different. We are in the fourth wave (see picture)

We share the same conclusion... the AEX haven't found the bottom yet.....

Success....

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

Week 41.

For a number of reasons including using different techniques I do not agree with the analyst view that would implicate the end of the economic society as we currently have. The primary reason for that dramatic view is based on an Impulse wave count for the 563,98 – 479,49 fractal, in order to get some feel for where the serious Bear people are coming from I have attached an Elliott Wave count on the DJIA datafile (starting in 1897 until last Friday), which I by the way, at least not at this stage, can’t qualify as best scoring scenario. Just to get some respect for the things the human race has accomplished the last hundred years or so and more specifically the post WOII generation.

The wave count 563,98 – 479,49 has a corrective structure and the best scoring wave pattern is called TripleZigZagC and since this pattern has five corrective waves I can imagine the alleged impulsive character found by people why only look at it from a distance without utilizing the power of the Elliott Wave Principle. The more interesting part is the beyond 479,49 bit and to start with the more exciting part the vary same applies to this wave analysis. At a first glance one might find an impulsive wave structure, also since one would expect it at there when labeling 563,98 as the third wave and 479,49 as the fourth wave in the wave starting at 217,80. In order for this wave part to be a fifth wave it will have to be impulsive.

The Elliott Wave Principle is founded on Rules and Guidelines and there is for instance no rule which tells you that a second wave is not allowed to retrace 80% of the first wave in an impulsive wave pattern. For corrective wave patterns there are Rules and Guidelines for a number of different wave pattern families you can find in the literature. A corrective second wave might retrace 100% or even substantially more in a number of wave pattern options. And when trading one has a completely different angle since the P is dominating everything you do. A reservation will have to be made here I think since markets today are operating a bit different just look at what the FED caused in August. What I am considering is that even though the actual pattern is corrective (you can see a three stroke in your own chart) one should perhaps discard that since it was externally forced upon the market.

So given the fact that the wave structure beyond 479,49 is corrective I utilized each and every pause in that move and hit the exit including the most recent one last week. Officially the last one has not yet violated the 80% boundary so I might have an other go at it next week when a new entry is triggered. When we look at the wave structure and want to stick a pattern to the part beyond 479,49 a DoubleZigZagC pattern comes close even though both price and time have run out a bit. The next pattern possibility is probably going to be a TrippleZigZagC pattern although at this point in time the suspected fourth wave has factual challenges.

The GJN taught trending methodology modus remains negative and the Technical Analysis New School already provided it’s price target. However it must be mentioned that the August/September correction also provided a number of Bull targets so from an Analysts point of view the sequence of events is going to be the differentiator. The K.I.S.S. trending methodology continues to show higher highs and lows although this is not going to last. If you recall the first rule in the Clowns Trading Almanac you understand why I am looking at what trading positions. It’s not just sticking to a view no matter what happens it’s merely the risk/reward based getting those P’s in until proven otherwise.

The Astro Finance Analysis track I am currently pursuing does include the major market moves however the time indication fades a bit and I am still figuring out how to more accurately implement this. It looks like there is a level of delay involved but this is something I will have to study a bit further before concluding. October was/is a low in the AFA and if the decline we have seen in August/September has been completed the next high is January 2008. Needless to say what if not.

Have fun trading to WIN.

For a number of reasons including using different techniques I do not agree with the analyst view that would implicate the end of the economic society as we currently have. The primary reason for that dramatic view is based on an Impulse wave count for the 563,98 – 479,49 fractal, in order to get some feel for where the serious Bear people are coming from I have attached an Elliott Wave count on the DJIA datafile (starting in 1897 until last Friday), which I by the way, at least not at this stage, can’t qualify as best scoring scenario. Just to get some respect for the things the human race has accomplished the last hundred years or so and more specifically the post WOII generation.

The wave count 563,98 – 479,49 has a corrective structure and the best scoring wave pattern is called TripleZigZagC and since this pattern has five corrective waves I can imagine the alleged impulsive character found by people why only look at it from a distance without utilizing the power of the Elliott Wave Principle. The more interesting part is the beyond 479,49 bit and to start with the more exciting part the vary same applies to this wave analysis. At a first glance one might find an impulsive wave structure, also since one would expect it at there when labeling 563,98 as the third wave and 479,49 as the fourth wave in the wave starting at 217,80. In order for this wave part to be a fifth wave it will have to be impulsive.

The Elliott Wave Principle is founded on Rules and Guidelines and there is for instance no rule which tells you that a second wave is not allowed to retrace 80% of the first wave in an impulsive wave pattern. For corrective wave patterns there are Rules and Guidelines for a number of different wave pattern families you can find in the literature. A corrective second wave might retrace 100% or even substantially more in a number of wave pattern options. And when trading one has a completely different angle since the P is dominating everything you do. A reservation will have to be made here I think since markets today are operating a bit different just look at what the FED caused in August. What I am considering is that even though the actual pattern is corrective (you can see a three stroke in your own chart) one should perhaps discard that since it was externally forced upon the market.

So given the fact that the wave structure beyond 479,49 is corrective I utilized each and every pause in that move and hit the exit including the most recent one last week. Officially the last one has not yet violated the 80% boundary so I might have an other go at it next week when a new entry is triggered. When we look at the wave structure and want to stick a pattern to the part beyond 479,49 a DoubleZigZagC pattern comes close even though both price and time have run out a bit. The next pattern possibility is probably going to be a TrippleZigZagC pattern although at this point in time the suspected fourth wave has factual challenges.

The GJN taught trending methodology modus remains negative and the Technical Analysis New School already provided it’s price target. However it must be mentioned that the August/September correction also provided a number of Bull targets so from an Analysts point of view the sequence of events is going to be the differentiator. The K.I.S.S. trending methodology continues to show higher highs and lows although this is not going to last. If you recall the first rule in the Clowns Trading Almanac you understand why I am looking at what trading positions. It’s not just sticking to a view no matter what happens it’s merely the risk/reward based getting those P’s in until proven otherwise.

The Astro Finance Analysis track I am currently pursuing does include the major market moves however the time indication fades a bit and I am still figuring out how to more accurately implement this. It looks like there is a level of delay involved but this is something I will have to study a bit further before concluding. October was/is a low in the AFA and if the decline we have seen in August/September has been completed the next high is January 2008. Needless to say what if not.

Have fun trading to WIN.

Attachments

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

Week 47.

The festivity of Technical Analysis New School Recognition once again is complete as the AEX not only delivers in accordance with it’s trending operating modus the AEX also delivered as the leading trending index as well since Yanks Land followed. The three main “reading” arguments to look for a turn below the 563,98 were: a) negatively trending modus according to the GJN trending methodology b) moving within the page 58 definition c) the nature of the wave fractals is corrective rather than impulsive. At this point in time my favorite EWP scenario has TripleZigZagC patterns that form the two waves starting at 563,98 so the third wave is currently running from 559,43. The AEX has arrived in the 500 area and the favorite indicator is pointing OverSold which basically invites Technical Analysts to look for bottom signaling.

Last week the favorite indicator tricked the old school TA by showing PD on Thursday and taking it out on Friday a clear signal for the new school TA people. Just to provide you a feel for how much lower the AEX might close on Monday based on the favorite indicator history; 495,78 ; 494,70 ; 493,16. Needless to point out that intraday there is even more low potential so you will have some indication. A higher close on Monday (or later) would even generate considerably lower values compared to the above three. Simply use the K.I.S.S. methodology to define your trending modus if you are not yet practicing Technical Analysis new school but do it yourself in a disciplined manner, the “Gassies” of this world showed you how to not do it. The trend is your friend and implicitly tells you how to value resistance and support levels.

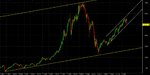

In week 45 the AEX left the MLT upwards trending area and last week (46) the weeks high could be considered as a pullback so the multi million dollar question is, is this a classic UPG move. Mind you the previous time the AEX tried to get out of this MLT trending area the FED interfered. If we consult the LT upwards trending area we find additional downside potential. These trending area’s are homemade in the Circus so you will not find them anywhere else, to give you an idea I picture the more traditional way of channeling. The EWP offers some guidance of position/direction by channeling wave label degrees in order to visualize similar to what old school TA does. On the attachment you find two levels; the white shows you that a wave four on 479,49 is becoming critical and the yellow shows you downside potential. The old school TA people use a large number of lines and change them when they have become obsolete by the actual movements without providing the complete overall picture. So here it is, scares the hell out your bull scenario, no worries mate eat your soup hotel warm.

The present outlook from 563,98 prefers a third wave down starting at 559,43 and looking at that bit again a third wave which has probably not yet been completed. Given the fractal structure I favor a corrective scenario which implicates one will have to reference the previous wave label for target practice. There is no such thing like the Holy Grail to tell you what exactly is going to happen exactly when, so in order to make money trading/investing you will have to combine a number of techniques to generate a collection of criteria. This offers you a number of alternatives you can simply combine to obtain a roadmap to profitable trading so I hereby wrap up this 2007 thread.

Have fun trading to WIN.

The festivity of Technical Analysis New School Recognition once again is complete as the AEX not only delivers in accordance with it’s trending operating modus the AEX also delivered as the leading trending index as well since Yanks Land followed. The three main “reading” arguments to look for a turn below the 563,98 were: a) negatively trending modus according to the GJN trending methodology b) moving within the page 58 definition c) the nature of the wave fractals is corrective rather than impulsive. At this point in time my favorite EWP scenario has TripleZigZagC patterns that form the two waves starting at 563,98 so the third wave is currently running from 559,43. The AEX has arrived in the 500 area and the favorite indicator is pointing OverSold which basically invites Technical Analysts to look for bottom signaling.

Last week the favorite indicator tricked the old school TA by showing PD on Thursday and taking it out on Friday a clear signal for the new school TA people. Just to provide you a feel for how much lower the AEX might close on Monday based on the favorite indicator history; 495,78 ; 494,70 ; 493,16. Needless to point out that intraday there is even more low potential so you will have some indication. A higher close on Monday (or later) would even generate considerably lower values compared to the above three. Simply use the K.I.S.S. methodology to define your trending modus if you are not yet practicing Technical Analysis new school but do it yourself in a disciplined manner, the “Gassies” of this world showed you how to not do it. The trend is your friend and implicitly tells you how to value resistance and support levels.

In week 45 the AEX left the MLT upwards trending area and last week (46) the weeks high could be considered as a pullback so the multi million dollar question is, is this a classic UPG move. Mind you the previous time the AEX tried to get out of this MLT trending area the FED interfered. If we consult the LT upwards trending area we find additional downside potential. These trending area’s are homemade in the Circus so you will not find them anywhere else, to give you an idea I picture the more traditional way of channeling. The EWP offers some guidance of position/direction by channeling wave label degrees in order to visualize similar to what old school TA does. On the attachment you find two levels; the white shows you that a wave four on 479,49 is becoming critical and the yellow shows you downside potential. The old school TA people use a large number of lines and change them when they have become obsolete by the actual movements without providing the complete overall picture. So here it is, scares the hell out your bull scenario, no worries mate eat your soup hotel warm.

The present outlook from 563,98 prefers a third wave down starting at 559,43 and looking at that bit again a third wave which has probably not yet been completed. Given the fractal structure I favor a corrective scenario which implicates one will have to reference the previous wave label for target practice. There is no such thing like the Holy Grail to tell you what exactly is going to happen exactly when, so in order to make money trading/investing you will have to combine a number of techniques to generate a collection of criteria. This offers you a number of alternatives you can simply combine to obtain a roadmap to profitable trading so I hereby wrap up this 2007 thread.

Have fun trading to WIN.

Attachments

Dear Clown,

After a long time of reading your thread, my first post. Ill first introduce myself, I am a first-year econometrics student, with a huge interest in the financial markets. I have been reading your updates for several months and I am trying to understand them, although that isn't really that easy all the times. I am also studying 'the famous book with page 58' at the moment. Now, i can remember from long ago you have a book-list somewhere about 'what to read', but i can't find it anymore and because I would like to advance in TA, i would like to ask if you still have it somewhere on your computer. Any tips or whatsoever are welcome!

Thanks in advance!

After a long time of reading your thread, my first post. Ill first introduce myself, I am a first-year econometrics student, with a huge interest in the financial markets. I have been reading your updates for several months and I am trying to understand them, although that isn't really that easy all the times. I am also studying 'the famous book with page 58' at the moment. Now, i can remember from long ago you have a book-list somewhere about 'what to read', but i can't find it anymore and because I would like to advance in TA, i would like to ask if you still have it somewhere on your computer. Any tips or whatsoever are welcome!

Thanks in advance!

Dear Clown,

After a long time of reading your thread, my first post. Ill first introduce myself, I am a first-year econometrics student, with a huge interest in the financial markets. I have been reading your updates for several months and I am trying to understand them, although that isn't really that easy all the times. I am also studying 'the famous book with page 58' at the moment. Now, i can remember from long ago you have a book-list somewhere about 'what to read', but i can't find it anymore and because I would like to advance in TA, i would like to ask if you still have it somewhere on your computer. Any tips or whatsoever are welcome!

Thanks in advance!

http://www.trade2win.com/boards/showthread.php?p=263208#post263208