You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Clown's Weekly 30.

- Thread starter The Dutch Clown

- Start date

- Watchers 10

Are you using Babelfish?Cassandra said:Dear jvdlow, the futures next which the lows take of Friday seem a test with higher European floors probable.

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

Well jvdlow,

What can I say, for somebody who needs to tell the world that I am trading the ulimate short term (eventhough my own statements on my trading scope differ) you yourself are looking at an even shorter term. And as I explained to you previously it's not quite according to what you have read in the book.

An other observation is that you obviously did not pick up the main issue on the Range Rules as written in chaper 1.

This week I am pre occupied with other matters than trading so I will not catch all the waves.

Have FUN.

What can I say, for somebody who needs to tell the world that I am trading the ulimate short term (eventhough my own statements on my trading scope differ) you yourself are looking at an even shorter term. And as I explained to you previously it's not quite according to what you have read in the book.

An other observation is that you obviously did not pick up the main issue on the Range Rules as written in chaper 1.

This week I am pre occupied with other matters than trading so I will not catch all the waves.

Have FUN.

Is this a rollercoaster?

...........8/1................8/2..............8/3................8/4............8/7

AEX

RSI 58,6378...........................57,4545........................56,3111

................................62,5480...........................61,2210

EOD 449,96.............................450,65...........................451,09

................................455,30.............................455,80

First Row RSI and first row EOD: positive reversal

Second row RSI and second row EOD: bearish divergence

So tomorrow we should go up again and maybe make a new bearish divergence for wednesday?

If that should be the case, then Bernanke is going to raise interestrates?

...........8/1................8/2..............8/3................8/4............8/7

AEX

RSI 58,6378...........................57,4545........................56,3111

................................62,5480...........................61,2210

EOD 449,96.............................450,65...........................451,09

................................455,30.............................455,80

First Row RSI and first row EOD: positive reversal

Second row RSI and second row EOD: bearish divergence

So tomorrow we should go up again and maybe make a new bearish divergence for wednesday?

If that should be the case, then Bernanke is going to raise interestrates?

Attachments

Last edited:

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

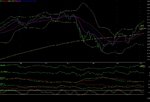

Yesterday's AEX movement was relevant if we take a took at the EOD chart where the index travelled below the 422,71 trend line and closed under it as well. Very close to the upward trendline and a bit more movement down towards the downward trend line. The RSI is moving down no divergence no reversal a early channel might be seen but use a trend line at the top side for now to exit down movement.

Bernanke faces a clasic catch 22 so what even he is going to do or say it will show...

Bernanke faces a clasic catch 22 so what even he is going to do or say it will show...

Attachments

Hurricane's

op http://www.expiratievoorspelling.nl/

is een poll gestart op bovenstaade page welke hurricane zal in het nieuws zijn

er staan daar 18 namen dus als u wil meewerken graag.

Verleden jaar kwam verrasend katrina uit de poll

groet BenCramer

@ http://www.expiratievoorspelling.nl/

is started a poll about wich hurricane will be in the news, you wil find there 18 names

Last year we did the same poll and as a suprise Katrina was the one

So I want to ask you go to that page and vote

Thanks in advance

Ben Cramer

op http://www.expiratievoorspelling.nl/

is een poll gestart op bovenstaade page welke hurricane zal in het nieuws zijn

er staan daar 18 namen dus als u wil meewerken graag.

Verleden jaar kwam verrasend katrina uit de poll

groet BenCramer

@ http://www.expiratievoorspelling.nl/

is started a poll about wich hurricane will be in the news, you wil find there 18 names

Last year we did the same poll and as a suprise Katrina was the one

So I want to ask you go to that page and vote

Thanks in advance

Ben Cramer

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

It's a bit early but there is a reversal signal that might become interesting to trade to win... well after confirmation that is the winning strategy...

The Dutch Clown said:It's a bit early but there is a reversal signal that might become interesting to trade to win... well after confirmation that is the winning strategy...

Dear Clown,

Thanks for your advice.

Y hope you have some information more.

With great Respect

Clown,The Dutch Clown said:It's a bit early but there is a reversal signal that might become interesting to trade to win... well after confirmation that is the winning strategy...

a little bit more information wouldn't hurt. What reversal and where. In the daily there is no reversal. Maybe in the hourly, 15 min, 1 min. Is it positive or negative? Or, maybe more to the point: is it an iron roof or a pizza bottom?

Pacito

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

It's just out there to pick it up.

Well Pacito,

If you mean that there is no Reversal in the EOD chart you overlook the so called "hidden" signals, maybe a bit more clear to see is the signal in the 1 minute chart. Also the exit signal should be a concern at least in the EOD chart and bare in mind what the actual formula is, in order to read the relevant signal at the relevant time.

It took C. Brown a couple of year's, so we have some time left to get a grip on things... even 9 years to get it in.....

Have fun and remember trade to win.

Well Pacito,

If you mean that there is no Reversal in the EOD chart you overlook the so called "hidden" signals, maybe a bit more clear to see is the signal in the 1 minute chart. Also the exit signal should be a concern at least in the EOD chart and bare in mind what the actual formula is, in order to read the relevant signal at the relevant time.

It took C. Brown a couple of year's, so we have some time left to get a grip on things... even 9 years to get it in.....

Have fun and remember trade to win.

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

No Sir,

Did have a look at CI but don't use it, might change but the Gann stuff is more important right now and I do not want to spend too much more extra time and money right now. My present tool set is not yet fully up to speed and mind you it generates consistant profit trades and since the start of this year not one loss trade... none nikkes nada; all win trades....

Did have a look at CI but don't use it, might change but the Gann stuff is more important right now and I do not want to spend too much more extra time and money right now. My present tool set is not yet fully up to speed and mind you it generates consistant profit trades and since the start of this year not one loss trade... none nikkes nada; all win trades....

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

niet voor pubers

jvdlow,

Note that the PR in the 1 minute chart was followed by disproportional movement and formed a NR.. this has to be taken out or score the target to be calculated...

RR come in effect and the other techniques help also since support was found on two Gann lines.... trendline of the pivot-up is nearby so ....

Have Fun..... again the trade of this morning is a winning one....

jvdlow,

Note that the PR in the 1 minute chart was followed by disproportional movement and formed a NR.. this has to be taken out or score the target to be calculated...

RR come in effect and the other techniques help also since support was found on two Gann lines.... trendline of the pivot-up is nearby so ....

Have Fun..... again the trade of this morning is a winning one....

Similar threads

- Replies

- 446

- Views

- 104K