'T is vandaag wat heïg

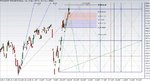

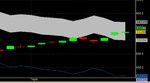

As Clown would say "today, the derivative did its thing again." We have seen the 0,618 of the last decline already. Together with the shortterm trend we could brake it today. The 503 trend you see as the blue line.

The red one direct above at 521,** is the trend from the 5th of march.

So shortterm is up, first target is 526.40 in the fti.

Second picture is the (left) daily- and (right) weekly oscillator. The daily is still down, could pick up some strength. But if the weekly turns down......

@ Clown,

First of all I want to thank you for you're compliment 2 weeks ago on the other forum. I needed that.

Second, I'm not sure what you ment by 'the present'. Is it the PR or the crossing of the der. osc? Or maybe something else? Thank you for sharing.

Success to all of you....

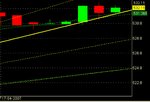

Edit: remember the fibo nivo's... 523,70 Today's close at 523,68