cold or warm

Guest

- Messages

- 58

- Likes

- 0

the week ?

DDC,

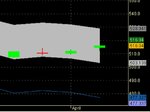

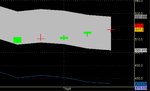

In the week chart, there are some signals which I am looking carefull at. You find my conclusions in the chart. Also another fact that stikes me is the ND from week ending 23-02 and 23-03, the first one since long time.

Enough for me to be carefull. And you know, Het kan Vriezen- het kan dooien 🙂)

KvKd

DDC,

In the week chart, there are some signals which I am looking carefull at. You find my conclusions in the chart. Also another fact that stikes me is the ND from week ending 23-02 and 23-03, the first one since long time.

Enough for me to be carefull. And you know, Het kan Vriezen- het kan dooien 🙂)

KvKd