You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

Following a move to the USA, it led me to thinking more about the world of Forex Markets and how it has such a huge impact on all of our lives as a result of its movement, yet so few of us are even aware of just how important this impact really is.

Whether we like it or not, when we live in a particular country and are earning and saving as much of that nation’s currency as we can, we are effectively long that currency. If you live in Great Britain, then basically you are long GBP. If you live in Japan, you are long the Yen. And, if you live in the USA, you are long the dollar and you have a passive interest in the value of the dollar going up. Think about it like this: if you bought a stock and owned it for the long term, you are long...

The Ichimoku Kinko Hyo or equilibrium chart isolates higher probability trades in the forex market. It is new to the mainstream, but has been rising incrementally in popularity among novice and experienced traders. More known for its applications in the futures and equities forums, the Ichimoku displays a clearer picture because it shows more data points, which provide a more reliable price action. The application offers multiple tests and combines three indicators into one chart, allowing the trader to make the most informed decision. Learn how the Ichimoku works and how to add it to your own trading routine.

Getting to Know Ichimoku

Before a trader can trade effectively on the chart, a basic understanding of the components that make...

When volume is high, those traders unlucky enough to be losing money in their positions feel the sharp sting of their losses. In order to alleviate the pain, these traders quickly close their positions (at a loss). As losers exit the market, a trend based on high volume is likely to be short lived. But a trend based on moderate volume can last an extremely long time since small losses can accumulate over time into what may become very large losses. The longest trends are probably driven by markets either going nowhere, changing moderately or even moving both up and down day after day, forming only a gradual trend, which is apparent when viewed in retrospect.

But there's still more to the volume story that pertains to market psychology...

Predicting the future is impossible, right? If he were around today, W.D. Gann would beg to differ. His first prophecy is believed to have happened during World War I when he predicted the Nov. 9, 1918, abdication of the Kaiser and the end of the war. Then in 1927, he wrote a book entitled "Tunnel Through The Air," which many believe predicted the Japanese attack on Pearl Harbor, and the air war between the two countries.

His financial predictions were perhaps even more profound. In early 1929, he predicted that the markets would probably continue to rally on speculation and hit new highs… until early April. In his publication, The Supply and Demand Letter, he delivered daily financial forecasts focusing on both the stock and commodity...

In September 2014, we introduced OMI (Option Mobility Index), an analytical tool measuring trending potential of the S&P500 index, which supplemented the ODI (Option Deviation Index) concept published in 2005. It didn’t take long to prove its usefulness, as the market ended its over 5-year bullish run and turned into a sideways moving phase, which for this index is very common.

Traditional trading using futures contracts for low-trending market conditions is a challenging task, as even though the market may stay within a certain range, its turning points usually flip through various levels within the channel. But for any market condition there is always an options strategy which may be applied.

As trading conditions get tougher...

The world of investment presents us with many paradoxes. One of these is the fact that, although there is an enormous body of literature out there, in the form of books, magazines, newspaper articles, seminars, internet sites, TV programs and so on, investment remains a tricky business, fraught with dangers and risks of various kinds. It is just not easy to earn a consistently good return at a reasonable level of risk without something or other going wrong at various times. This all raises a fundamental question: What and how much can one really learn?

Fundamental Barriers to Learning

At almost any point in time, there are some people who claim that the markets will go up and others who claim that it will drop, according to says German...

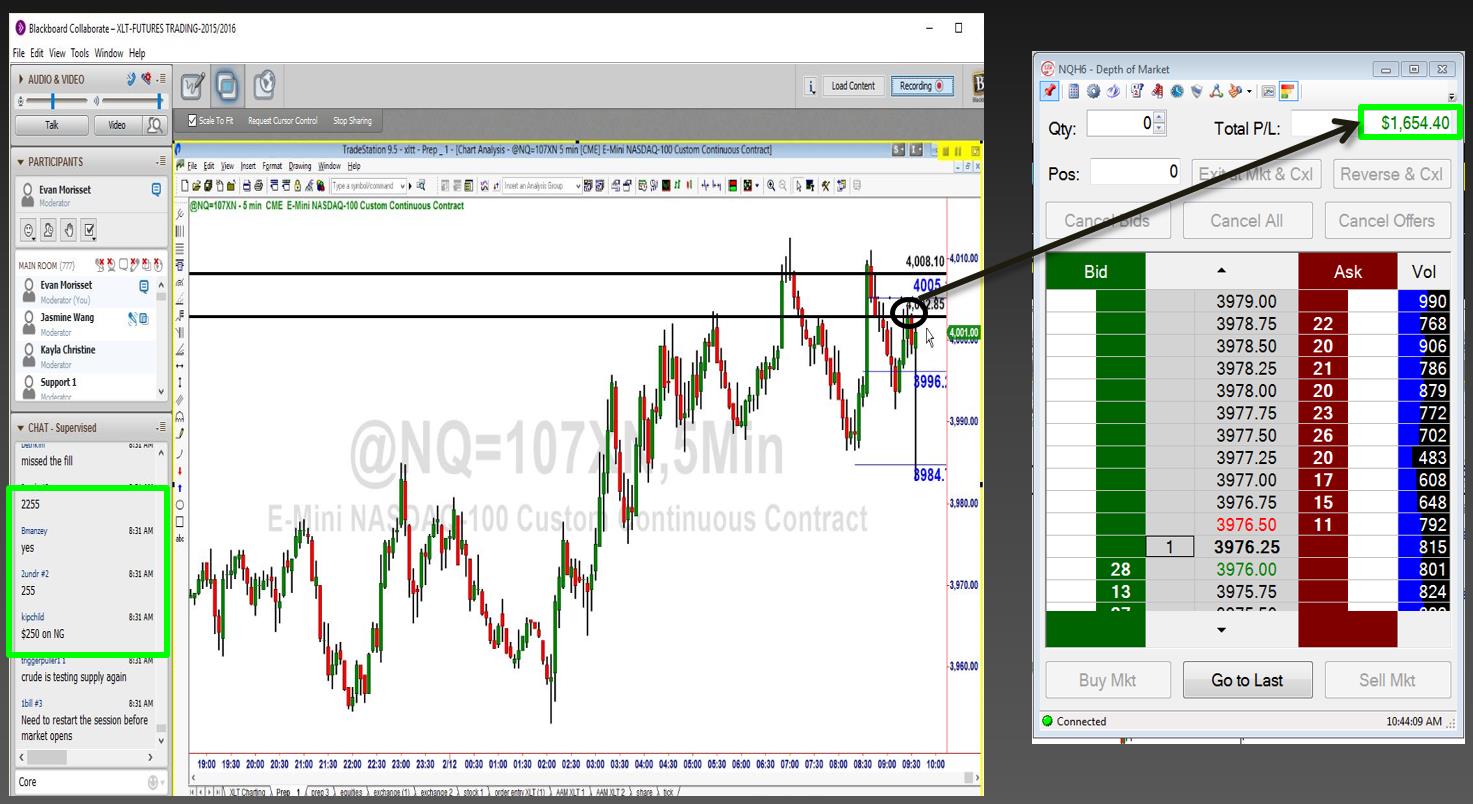

How many times have you heard someone say, “Trading is an art, not a science.”? I have heard that for years and years and I have to say, it is probably the most ridiculous statement I have heard when it comes to trading and, as we all know, there are some pretty ridiculous statements in the trading world. There is absolutely nothing artistic about trading at all. This is, 100%, a numbers game… How much willing demand and supply there is at each price level is what determines price turns and movement. It’s the buy orders vs. the sell orders and, again, it all comes down to the numbers on both sides of that equation and nothing else. To think Picasso or Van Gough should be brought into this discussion is rather amusing if you think about...

When shorting equities, one often faces the challenge of distinguishing between a topping formation and a change in trend. Many successful short sellers will try to focus their efforts by looking at clues that are offered from the schools of technical analysis and fundamental analysis. Read on to find out how studying these different methods a trader can gain confidence in shorting the market

Technical Analysis

Since the equities markets are primarily dominated by long traders, short traders try to prey on the weak longs to trigger breaks and start downtrends. They try to put enough pressure on the market to create situations where the weaker long gets out because of the fear of giving back gains. It is the job of the short seller to...

My Background

Growing up in suburban NW London, by the time I was taking my ‘A’ Levels, I had absolutely no idea what career I wanted to pursue. Through lack of any inspiration, I was signed up to City University (a Polytechnic in those days) to do a foundation course in accountancy. With all due respect to the number crunchers of the world, I’m sure it’s a wonderful career, but it just wasn’t for me. My parents noticed an ad’ in a paper: ‘Domestic & International Metal Traders require a trainee’. Apart from being in Kentish Town, it sounded exotic and that was my intro’ into the world of trading.

After a couple of years there I moved onto the London Metal Exchange (LME) and, at 20 years old, found myself transferred to New York for a...

If anyone has forgotten how volatile financial markets can be, the beginning of 2016 has certainly served as a stark reminder. In turbulent times it is even more important than usual to have a robust risk management system, and one that can adapt to changing levels of volatility.

Most traders are aware that there will always be losers, no matter how accurate the trade selection methodology. But what some don’t consider is the probability of a devastating string of losses. Consider these statistics from hedge fund manager Larry Hite. Assuming 50% of your trades are winners, over a series of ten trades you can expect at some point to have three losers in a row; over a series of 100 trades the expected run of sequential losses rises to...

We often hear market analysts or experienced traders talking about an equity price nearing a certain support or resistance level, each of which is important because it represents a point at which a major price movement is expected to occur. But how do these analysts and professional traders come up with these so-called levels? One of the most common methods is using pivot points, and here we take a look at how to calculate and interpret these technical tools.

How to Calculate Pivot Points

There are several different methods for calculating pivot points, the most common of which is the five-point system. This system uses the previous day's high, low and close, along with two support levels and two resistance levels (totalling five price...

You can never really understand investing until you weather a market downturn. The valuable lessons learned can help you through the bad times and can be applied to your portfolio when the economy recovers. Listed below are some common investor experiences during tough economic times and the lessons each investor can come away with after surviving the events.

Lesson 1: Evaluate Your Egg Baskets

You're pulling your hair out because everything you invest in goes down. The lesson: Always keep a diversified portfolio, regardless of current market conditions.

If everything you own is moving in the same direction, at the same rate, your portfolio is probably not well diversified, and you could stand to reconsider your asset-allocation...

As I’m writing this, it is the afternoon of January 6, 2016. The stock market has been in full-blown meltdown mode for the last five trading days. The S&P 500 index has dropped by about 4% in that time. The Chinese stock market is down much more after dropping 5% yesterday alone. Crude oil has dropped over 6% in that time. This is high volatility in anybody’s book.

And yet, there was one type of volatility that was curiously muted: implied volatility in the options market.

Implied volatility is the name we give to the fear reflected in options prices. The more fear there is, the more people are willing to pay for the insurance offered by options. This fear factor for the stock market as a whole is measured by the VIX, or Volatility...

A moving average is the average price of a security over a specified period of time. Analysts frequently use moving averages as an analytical tool to make it easier to follow market trends, as securities move up and down.

Moving averages can establish trends and measure momentum, therefore, they can be used to indicate when an investor should buy or sell a specific security. Investors can also use moving averages to identify support or resistance points in order to gauge when prices are likely to change direction. By studying historical trading ranges, support and resistance points are established where the price of a security reversed its upward or downward trend, in the past. These points are then used to make, buy or sell decisions...

Introduction

Many traders think that to make consistent profits in the markets, all you need is a holy grail. From my experience, a trading methodology or system is only one of the ingredients of success. The advancement of technology blinds us into thinking that all we need to be successful is state-of-the-art kit and the latest software. After all, banks fit into this category and they tend to do pretty well. However, technical wizardry is only of value if you know what to do with it. Does Warren Buffett rely on the latest technology to make his investments, or does he put his faith and his money into time tested principles of yesteryear? Modern technology is a useful tool for many traders, but to ensure it’s used wisely and to full...

The global forex market boasts over $4 trillion in average daily trading volume, making it the largest financial market in the world. Forex's popularity entices traders of all levels, from greenhorns just learning about the financial markets to well-seasoned professionals. Because it is so easy to trade forex - with round-the-clock sessions, access to significant leverage and relatively low costs - it is also very easy to lose money trading forex. This article will take a look at 10 ways that traders can avoid losing money in the competitive forex market.

1) Do Your Homework – Learn Before You Burn

Just because forex is easy to get into doesn't mean that due diligence can be avoided. Learning about forex is integral to a trader's...

Psychopaths are people who don’t care about social rules and the media has made well known for committing awful crimes. Whilst this is true, it is also the case that many successful businessmen, lawyers, politicians and also traders share the same characteristics.

Of course successful people don’t usually commit crimes but they use the same skills when they deal with some problems in a work environment. For example, they focus on their goal, don’t care what other people think about them and do everything they can to achieve their goal.

Oxford University psychologist, Kevin Dutton explored the similarities between psychopaths and successful people and discovered that many, if not all, successful traders share psychopathic...

Your brain is the most awesome mechanism in the Universe … as we know it. Babies, both pre- and post-natal are metaphorical sponges of data and information. Also, brains have the ability to adapt to disease and injury by having one part of the brain take over the functions of another part of the brain that has been compromised; for example disabling injuries to the speech centers of the left brain can be “learned” by the right brain as a compensatory measure. Additionally, as late as about 30 – 40 years ago it was thought that once brain cells were lost or destroyed through any number of ways, not the least of which being alcohol intoxication, the conventional wisdom was that you would not and could not recover, that brain cells once...

My Background

Last month I turned 40. I have spent my life in equal thirds in Germany, New Zealand and the UK. Initially I qualified as a chartered accountant in NZ. But since the age of 25 I have always worked as a contractor, a freelancer or just independently in some form. I have tried and failed and tried and succeeded at quite a few things. I developed a habit of putting money to the side when the ‘sun was shining’, and that’s allowed me to get involved in various opportunities and to have a bankroll when needed.

Since August 2013 I have been trading full-time once again. In the two years since then, I have not made any profits from trading. I have not lost a lot either – I have approximately gotten to the point where I am...

Moving averages (MA) are a popular trading tool. Unfortunately, they are prone to giving false signals in choppy markets. By applying an envelope to the moving average, some of these whipsaw trades can be avoided, and traders can increase their profits.

What Is an Envelope?

Moving averages are among the easiest-to-use tools available to market technicians. A simple moving average is calculated by adding the closing prices of a stock over a specified number of time periods, usually days or weeks. As an example, a 10-day simple moving average is calculated by adding the closing prices over the last 10 days and dividing the total by 10. The process is repeated the next day, using only the most recent 10 days of data. The daily values are...

Traders have an expression for attempting to pick a market top or bottom - they call it trying to catch a falling knife. As the expression implies, it can be downright dangerous and is not normally recommended. But here is a method that may help lower the risk.

Sushi Roll Anyone?

In his book, "The Logical Trader," author Mark Fisher discusses techniques for identifying potential market tops and bottoms. While they serve the same purpose as the head and shoulders or double top/bottom or triple top/bottom chart patterns discussed in Bulkowski's seminal work "Encyclopedia of Chart Patterns," Fisher's techniques give signals sooner, providing an early warning alert to possible changes in the direction of the current trend.

One technique...

Insider buying and selling data can be extremely valuable for the individual investor. That is, if one knows how to use that data and interpret it so that a meaningful investment decision can be made.

Insiders (executives and beneficial owners) must file what is called a Form 4 with the Securities and Exchange Commission (SEC). The form essentially outlines the date and price at which a given executive has completed a large transaction in a stock. This data is then used by the investment community as a gauge of insider sentiment.

But what specifically should an investor look for in this information and what should be ignored? Here we'll provide some guidelines for interpreting insider data.

Clusters

There are many reasons why an...

From gold exchange-traded funds (ETFs) to gold stocks to buying physical gold, investors now have several different options when it comes to investing in the royal metal. But what exactly is the purpose of gold? And why should investors even bother investing in the gold market? Indeed, these two questions have divided gold investors for the last several decades. One school of thought argues that gold is simply a barbaric relic that no longer holds the monitory qualities of the past. In a modern economic environment, where paper currency is the money of choice, gold's only benefit is the fact that it is a material that is used in jewelry.

On the other end of the spectrum is a school of thought that asserts gold is an asset with various...

My Background

Wow…so where do I start? Those of you who know me on here know me as ‘chronictrader’. (Don’t ask me where that name came from – I put Chronic in everything!) Those in ‘real life’ know me as Mike. At the grand old age of 24, I am probably one of the younger traders on here and work full time as a Management Consultant. It is a very broad profession, but summed up nicely in this quote: “A consultant is someone who saves his client almost enough to pay his fee and talks enough sensible nonsense to sell on more work”. I am the oldest of 3 boys, love football and love the gym – I always have a protein shake… or two with some green tea besides me whilst trading – always helps to feed those brain muscles! And the arms too. From...

There is a constant push for portfolio diversification into alternative investments, such as futures and commodities, but oftentimes it is difficult to make the leap. That's where the concept of synthetic futures comes in. For those looking to avoid a huge initial investment and manageable risk, synthetic futures provide an opportunity to help you ease into portfolio diversification without betting the farm.

An Influential Study

In 2004, a brief but powerful white paper was put out by the Yale International Center for Finance. The paper was entitled "The Facts and Fantasies about Commodity Futures". In the paper, the authors set out to answer two questions

Are commodity futures riskier than stocks?

Can commodity futures...

Surfing is very popular where I live in Southern California. It is a sport that I took up while living on the beach. Analyzing and trading in the markets is very similar to that sport. In fact, many technical analysts have compared the market fluctuations to the waves of the ocean. Just like a surfer, it is easier to travel in the direction of the waves than to paddle against it.

The waves of the market are the trends. It is crucial for a trader to identify the trend that they can surf to profits. If you keep trying to paddle against the waves, you can make some progress but it is much easier to ride the waves to larger profits.

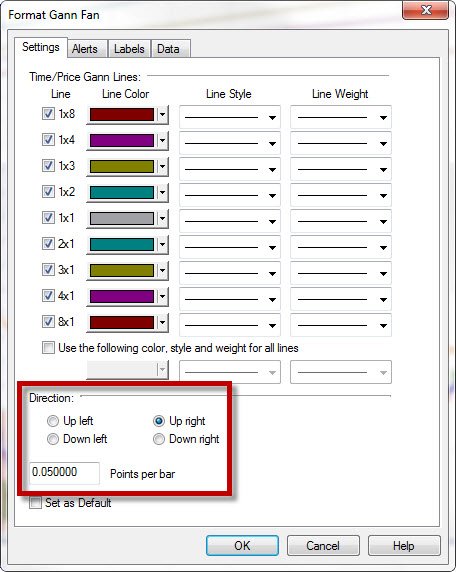

There are several ways to identify the trend you are trading or investing in. W.D. Gann was a trader in...

Let's take a trip off the beaten path. We'll administer some necessary medicine to a revered technical indicator - the moving average convergence divergence (MACD). Enough articles have been written about the MACD to depopulate half the world's rain forests, but little has been said about the downsides of using this very popular tool. In short, the MACD doesn't work as well as some say it does. It's a glorified moving average, and it's weak at forecasting price direction. In this article we'll cover the controversial perspective of those who spurn the use of this prevalent indicator and what can be used in its place

The MACD's Seduction

When applied over a long time frame, the signals generated by a given moving average will often seem...

Research analysts use multivariate models to forecast investment outcomes to understand the possibilities surrounding their investment exposures and to better mitigate risks. Monte Carlo analysis is one specific multivariate modeling technique that allows researchers to run multiple trials and define all potential outcomes of an event or investment. Running a Monte Carlo model creates a probability distribution or risk assessment for a given investment or event under review. By comparing results against risk tolerances, managers can decide whether to proceed with certain investments or projects.

Multivariate Models

Multivariate models can be thought of as complex, "What if?" scenarios. By changing the value of multiple variables, the...

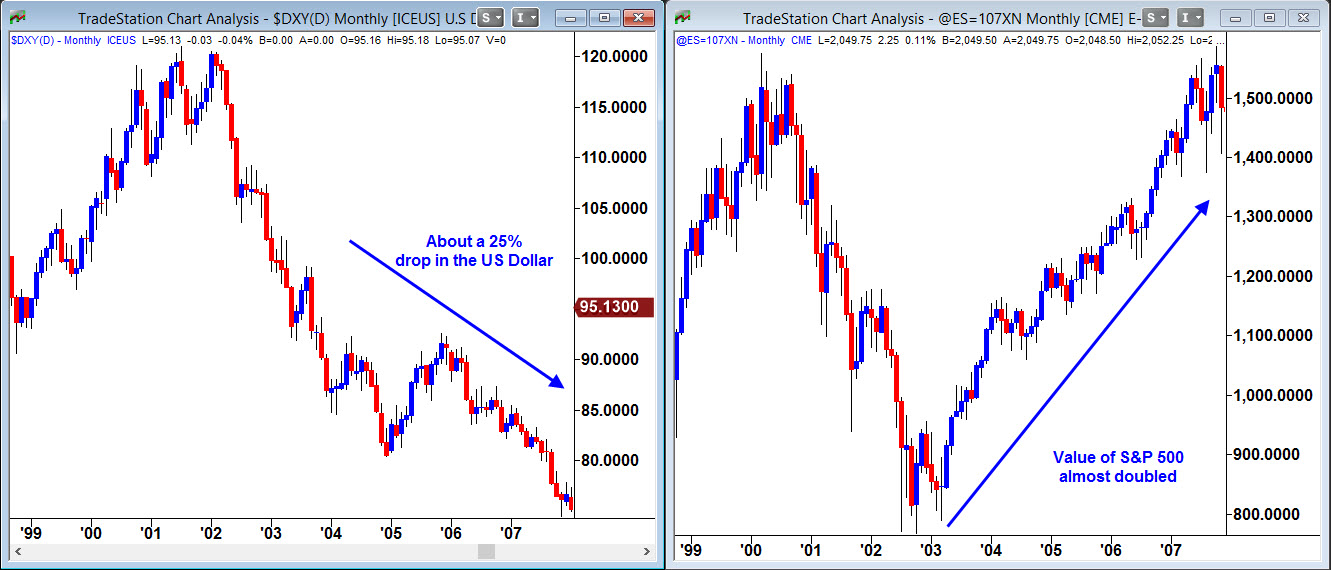

Single-market analysis is the study of one asset class or market in a single country. Intermarket analysis, on the other hand, is the study of multiple asset classes in a variety of markets in nations around the globe. Do investors and traders using the second technique have a significant advantage over those using the first when it comes to returns?

We have all heard financial experts sing the praises of the diversified portfolio. "It is never a good idea to put all your eggs in one basket," they say. What they mean is that limiting your investments to just a few companies greatly increases your risk, especially if one or two of your major holdings experiences a meltdown.

Investors who heed this conventional wisdom own a number of...