If anyone has forgotten how volatile financial markets can be, the beginning of 2016 has certainly served as a stark reminder. In turbulent times it is even more important than usual to have a robust risk management system, and one that can adapt to changing levels of volatility.

Most traders are aware that there will always be losers, no matter how accurate the trade selection methodology. But what some don’t consider is the probability of a devastating string of losses. Consider these statistics from hedge fund manager Larry Hite. Assuming 50% of your trades are winners, over a series of ten trades you can expect at some point to have three losers in a row; over a series of 100 trades the expected run of sequential losses rises to seven. Over a longer trading career, say 10,000 trades, the number rises to thirteen.

Knowing this, we need a system that can handle both the inevitable run of bad trades and, as mentioned above, a system that takes into account changing levels of volatility. While there are many different money management strategies that have been described, here is one that I have found particularly useful for trading equities.

This system is based on the following concepts:

• Risk Amount

• Initial exit price and risk per share

• Positions sizing

• Maximum allocation

Risk Amount

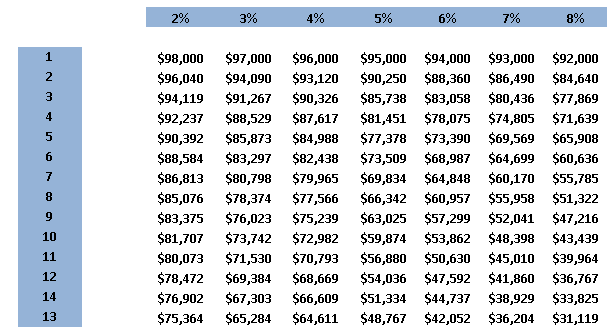

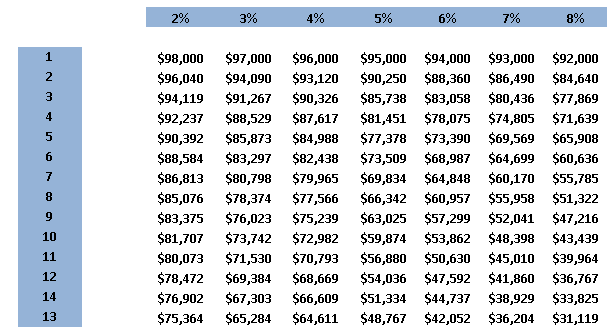

Risk amount refers to the maximum amount you are willing to lose on one trade and is usually expressed as a percentage of your trading account size. Many stock traders tend not to risk much more than 2-3% of their account value per trade. So, for example, if you have a $100,000 trading account and generally risk 2% per trade, your risk amount is $2000. The exact percentage you choose is, of course, a matter of choice, but keep in mind the probabilities of a run of losing trades that we mentioned earlier. The chart below is instructive. It shows the ending account equity of a $100,000 account after different numbers of sequential losing trades using varying percentage risk amounts.

Notice, for instance, that when risking 8% per trade after only eight losing trades in a row you have lost almost half of your account value.

I suggest, though, that no matter what percentage you choose, consider keeping it the same on all of your trades, because if you don’t you in are, in effect, starting to handicap your trades. When I cover this point in my webinars some of the attendees say to me, “I risked a higher percentage of my account on Trade A then Trade B because A looked better,” to which I respond ,” Why would you enter a trade that looked less than perfect and didn’t meet all of your trade selection criteria?” The reality of trading, of course, is that we never know which of our individual trades will work out. We only know that over a series of trades we should win “X%” of the time based on our particular trade selection methodology.

Risk per Share

The difference between your entry price and your initial stop or exit price is the trade’s risk per share. Many traders will set their stop level somewhere below a support level for a trade on the long side and above a resistance level for a short. But how far above or below these levels should the stop be placed? Support and resistance levels are generally more porous in volatile markets. Common sense suggests that, in these conditions, you should give the trade more room.

The indicators True Range and Average True Range (ATR) can be helpful tools in this regard. They are measures of volatility that take into account not only the size of daily trading ranges but also the fact that stocks gap up and down. True range is defined as the greater of:

1. Daily high less the daily low

2. Daily high less the previous close (absolute value)

3. Daily low less the previous close (absolute value)

ATR is simply the average of the true range values over a certain period of time. When markets are turbulent, ATR will obviously be greater than when conditions are calmer. Setting your stops below support or above resistance by one or two ATRs thus adjusts your exits based on the current level of volatility.

Position Sizing

Now that you have a volatility adjusted stop price you can calculate the proper position size. Simply divide the trades risk amount (based on a percentage of your account size) by the trades risk per share.

Here is an example:

A trader has a $100,000 trading account and decides to risk 2% on the next trade; thus, the trade has a risk amount of $2000. The stock is trading at $40, support is at $37 and the ten day ATR is $2. A stop set 1.5 ATRs under support would be at 34, making the trade’s risk per share $6. The proper position size would be $2000 divided by $6 - 333 shares.

Maximum Allocation

Notice, in the above example, the trader would be buying 333 shares of a $40 stockand is thus committing $13,320 to the trade, or 13% of the account value. To protect against a devastating loss due to an unusual gap down, many traders will also limit the maximum dollar exposure to a single position to 10 or 15% of the account size. In our example, if we used a maximum 10% allocation the position size would be decreased to 250 shares.

Trading in volatile markets offers both enhanced rewards and risks. Using a common sense risk management strategy that can adjust to volatility, such as the one described here, can make it easier to navigate in turbulent waters.

Lee Bohl can be contacted at Charles Schwab UK Ltd

Most traders are aware that there will always be losers, no matter how accurate the trade selection methodology. But what some don’t consider is the probability of a devastating string of losses. Consider these statistics from hedge fund manager Larry Hite. Assuming 50% of your trades are winners, over a series of ten trades you can expect at some point to have three losers in a row; over a series of 100 trades the expected run of sequential losses rises to seven. Over a longer trading career, say 10,000 trades, the number rises to thirteen.

Knowing this, we need a system that can handle both the inevitable run of bad trades and, as mentioned above, a system that takes into account changing levels of volatility. While there are many different money management strategies that have been described, here is one that I have found particularly useful for trading equities.

This system is based on the following concepts:

• Risk Amount

• Initial exit price and risk per share

• Positions sizing

• Maximum allocation

Risk Amount

Risk amount refers to the maximum amount you are willing to lose on one trade and is usually expressed as a percentage of your trading account size. Many stock traders tend not to risk much more than 2-3% of their account value per trade. So, for example, if you have a $100,000 trading account and generally risk 2% per trade, your risk amount is $2000. The exact percentage you choose is, of course, a matter of choice, but keep in mind the probabilities of a run of losing trades that we mentioned earlier. The chart below is instructive. It shows the ending account equity of a $100,000 account after different numbers of sequential losing trades using varying percentage risk amounts.

Notice, for instance, that when risking 8% per trade after only eight losing trades in a row you have lost almost half of your account value.

I suggest, though, that no matter what percentage you choose, consider keeping it the same on all of your trades, because if you don’t you in are, in effect, starting to handicap your trades. When I cover this point in my webinars some of the attendees say to me, “I risked a higher percentage of my account on Trade A then Trade B because A looked better,” to which I respond ,” Why would you enter a trade that looked less than perfect and didn’t meet all of your trade selection criteria?” The reality of trading, of course, is that we never know which of our individual trades will work out. We only know that over a series of trades we should win “X%” of the time based on our particular trade selection methodology.

Risk per Share

The difference between your entry price and your initial stop or exit price is the trade’s risk per share. Many traders will set their stop level somewhere below a support level for a trade on the long side and above a resistance level for a short. But how far above or below these levels should the stop be placed? Support and resistance levels are generally more porous in volatile markets. Common sense suggests that, in these conditions, you should give the trade more room.

The indicators True Range and Average True Range (ATR) can be helpful tools in this regard. They are measures of volatility that take into account not only the size of daily trading ranges but also the fact that stocks gap up and down. True range is defined as the greater of:

1. Daily high less the daily low

2. Daily high less the previous close (absolute value)

3. Daily low less the previous close (absolute value)

ATR is simply the average of the true range values over a certain period of time. When markets are turbulent, ATR will obviously be greater than when conditions are calmer. Setting your stops below support or above resistance by one or two ATRs thus adjusts your exits based on the current level of volatility.

Position Sizing

Now that you have a volatility adjusted stop price you can calculate the proper position size. Simply divide the trades risk amount (based on a percentage of your account size) by the trades risk per share.

Here is an example:

A trader has a $100,000 trading account and decides to risk 2% on the next trade; thus, the trade has a risk amount of $2000. The stock is trading at $40, support is at $37 and the ten day ATR is $2. A stop set 1.5 ATRs under support would be at 34, making the trade’s risk per share $6. The proper position size would be $2000 divided by $6 - 333 shares.

Maximum Allocation

Notice, in the above example, the trader would be buying 333 shares of a $40 stockand is thus committing $13,320 to the trade, or 13% of the account value. To protect against a devastating loss due to an unusual gap down, many traders will also limit the maximum dollar exposure to a single position to 10 or 15% of the account size. In our example, if we used a maximum 10% allocation the position size would be decreased to 250 shares.

Trading in volatile markets offers both enhanced rewards and risks. Using a common sense risk management strategy that can adjust to volatility, such as the one described here, can make it easier to navigate in turbulent waters.

Lee Bohl can be contacted at Charles Schwab UK Ltd

Last edited by a moderator: