You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

Swing traders specialize in using technical analysis to take advantage of short-term price moves. Successfully trading these swings requires the ability to accurately determine both trend direction and trend strength. This can be done through the use of chart patterns, oscillators, fractals, volume analysis and a variety of other methods. This article will focus on using oscillators and candlestick patterns as a quick and easy way to characterize a trend and successfully identify swing trades

Finding Potential

The first step is to find the right conditions for a reversal, which can be done with either candlesticks or oscillators. Candlestick reversal indicators are characterized by indecision candles, while oscillator reversal...

Many traders know that options strategies provide an abundance of choices. But is it possible to construct an options trading strategy that will hedge against bad news—whether expected or unexpected? The answer is yes and no. Let's explore.

Known events or unknown events

In the markets as in life, there are often "known unknowns" and "unknown unknowns." Sometimes, we know when an event is going to occur; we just don't know what the result will be. Examples of these "known unknowns" are:

• Earnings reports

• Drug trial results or FDA panel reviews

• Economic reports

• Monetary policy decisions

• Election results

Other times, we don't know what will occur, when it...

The use of the fundamental approach in trading has long been an object of argument between its followers and those who mercilessly deride the method's usefulness. We will not take sides in this eternal argument, but we will try to find out how the average trader can benefit from fundamental analysis. Read on to discover the strengths and weaknesses of fundamental analysis as a traders' tool.

The Mechanics

The fundamental approach is based on an in-depth and all-around study of the underlying forces of the economy, conducted to provide data that can be used to forecast future prices and market developments. Fundamental analysis can be composed of many different aspects: the analysis of the economy as the whole, the analysis of an...

OK…So, you’re in a trade and you hear a loud voice that sounds suspiciously like your mother say, “… No, don’t do that, you’ll lose!” But, even though the voice resonates in your head, this is in fact the only place that it can be heard; because it’s coming from you. Thoughts are part and parcel to the trading process. There are mechanical thoughts, for example: “…This zone is too tight so let me check the level on another time frame.” These thoughts have to do with the mechanics of your trade, as in your plan, rationale, set-ups, rules, target and stops; to name a few. There are also internal thoughts, for example: “I always screw up with these supply zones and it probably won’t be any different now.” Of course, internal thoughts are...

Traders will find it next to impossible to work their way through the typical book on trading without being exposed to the subject of "controlling one's emotions". Indeed, the conventional wisdom demands that controlling one's emotions is absolutely essential to trading success. And, technically, that's true. If one has them. But, contrary to conventional wisdom, emotions are not an unavoidable component to trading (granted, those who insist that emotions are unavoidable consider the selection of a shirt or of sunny-side up vs over easy to be emotional decisions, but this is about neurotic behavior: addictive, compulsive, illogical, irrational, obsessive, self-defeating, self-damaging behavior; revenge trading is neurotic behavior...

In this article I will give you methods which will increase your trading discipline most of which are based on scientific discoveries which are unknown for most traders. This should enhance your ability to gain a trading edge over others competing in the same markets.

1. Find a strategy and create a trading plan

Many traders just use some indicators and price action formations and make random decisions based on that. But it doesn’t work and when you don’t have a plan then first you need to define how to trade. It is proven that you have some resources of energy which you use on making decisions. But there is little sense in using this energy every day on defining “how to trade”. You should use it only once (when you choose your...

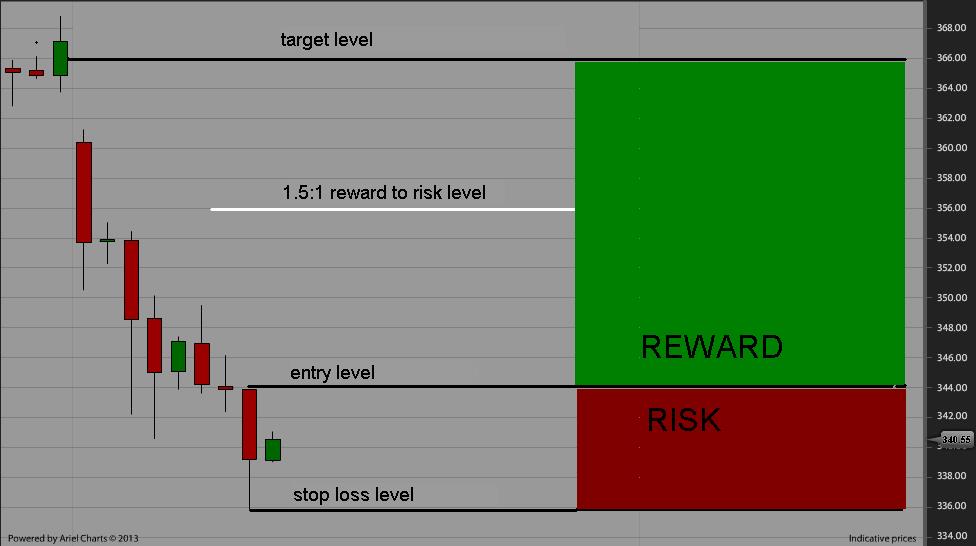

Trading is a game of probability. This means that every trader will be wrong sometimes. When a trade does go wrong, there are only two options: to accept the loss and liquidate your position, or go down with the ship.

This is why using stop orders is so important. Many traders take profits quickly but also hold on to losing trades - it's simply human nature. We take profits because it feels good and we try to hide from the discomfort of defeat. A properly placed stop order takes care of this problem by acting as insurance against losing too much. In order to work properly, a stop must answer one question: At what price is your opinion wrong? In this article, we'll explore several approaches to determining stop placement that will help...

Identifying when a change in trend is occurring is one of the most important skills a trader can learn. There are several methods that can be used to identify a possible change in trend; however, one of the easiest to spot is the emergence of a new pivot point. While identifying a pivot must always be done in hindsight, one can examine clues on a chart to determine whether the probability of forming a new pivot is high. One technique is to watch for a partial retrace after a trading range has been established.

When a stock refuses to honor an established range, it usually reverses to break the trading range in the opposite direction, thus establishing a new pivot point. By picking a bottom, a trader can benefit by getting in early on a...

When asked how he likes to trade, Dan Zanger responds using a race car analogy.

"I like to go 180 mph just inches from the wall. That means being margined 2 to 1 and either long or short a stock that is highly volatile and getting ready to make a big move," he says.

Zanger puts his money where his mouth is. He holds the unofficial record in trading stocks by turning $11,000 into more than $18 million in 18 months in 1999-2000. He grew that to an incredible $42 million in less than two years and has the tax receipts to prove it.

First introduced to stock markets in 1976, Zanger dabbled for a few years while working his full-time pool contracting business. His two biggest mentors during his formative years as a trader were Gene...

So, you've decided that buying iron condors is a strategy that meets your needs and will help you meet your financial goals. However, when you buy an iron condor, there are often many choices you can make that can affect its outcome. Among the decisions you must make when setting up an iron condor are the following:

How much you should try to earn per iron condor?

How much risk to take when trying to earn that profit?

Which options to trade?

How far out of the money (OTM)?

How much time before the options expire?

How wide are the call and put spreads?

Which underlying asset to choose?

Faced with these choices, it's possible to be frozen with indecision. This article provides guidance in helping you set up an iron condor...

I was quite shocked when timsk asked me to contribute a Member Profile, considering that I am at the opposite end of the experience spectrum from the other members whose profiles I’ve seen published so far. However, I understand that there are probably quite a few active or not so active members that are in similar circumstances to me. So, veteran members get ready to shake your heads at my mistakes and fellow newbies, nod along with sympathy.

My background

I grew up in Melbourne, Australia. After dropping out of university at the end of my first year of a marketing course, I took some time off to work and travel. It was during my time in the Greek islands that I met a very beautiful Italian girl - but we’ll get to that later. After a...

"All economic movements, by their very nature, are motivated by crowd psychology." -- Financier Bernard Baruch

At times, a market will appear to move based on fundamentals, while at other times, the same market will move in the opposite direction on the same news! The key to understanding the highest probability move is to understand the psychology associated with that market. You must also understand that markets move in trends but reverse at extreme levels of bullishness (tops) and bearishness (bottoms). This characteristic is best explained through the words of the English economist Arthur C. Pigou. He explained that "an error of optimism tends to create a certain measure of psychological interdependence until it leads to a crisis...

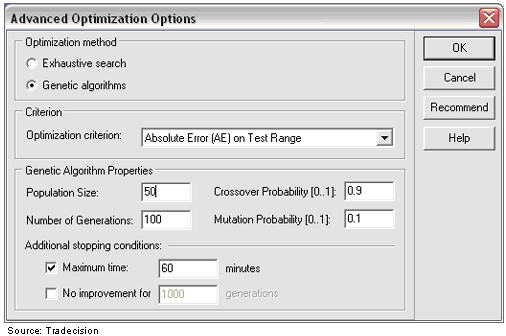

Neural networks are state-of-the-art, trainable algorithms that emulate certain major aspects in the functioning of the human brain. This gives them a unique, self-training ability, the ability to formalize unclassified information and, most importantly, the ability to make forecasts based on the historical information they have at their disposal.

Neural networks have been used increasingly in a variety of business applications, including forecasting and marketing research solutions. In some areas, such as fraud detection or risk assessment, they are the indisputable leaders. The major fields in which neural networks have found application are financial operations, enterprise planning, trading, business analytics and product...

Oscillators tend to be somewhat misunderstood in the trading industry, despite their close association with the all-important concept of momentum. At its most fundamental level, momentum is actually a means of assessing the relative levels of greed or fear in the market at a given point in time. Markets ebb and flow, surge and retreat - the speed of such movement is measured by oscillators.

Oscillators are most useful and issue their most valid trading signals when their readings diverge from prices. A bullish divergence occurs when prices fall to a new low while an oscillator fails to reach a new low. This situation demonstrates that bears are losing power, and that bulls are ready to control the market again - often a bullish...

Many people believe that the markets are random. In fact, one of the most prominent investing books out there is "A Random Walk Down Wall Street" (1973) by Burton G. Malkiel, who argues that throwing darts at a dartboard is likely to yield results similar to those achieved by a fund manager (and Malkiel does have many valid points).

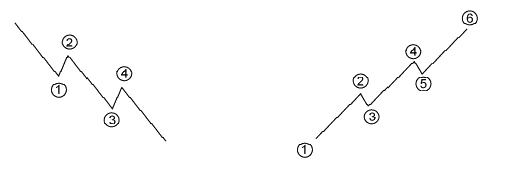

However, many others argue that although prices may appear to be random, they do in fact follow a pattern in the form of trends. One of the most basic ways in which traders can determine such trends is through the use of fractals. Fractals essentially break down larger trends into extremely simple and predictable reversal patterns. This article will explain what fractals are and how you might apply them to...

Being of Prussian descent, I’ll admit to a certain fascination for all things Teutonic, especially in the field of technical analysis. One of these is the Hindenburg Omen (HO), a fairly obscure indicator named after the German zeppelin that crashed in a fiery explosion in May 1937. The urban myth surrounding the HO is that it accurately predicts market crashes.

The creation of the HO dates to the 1990s and is generally credited to a blind former physics teacher named Jim Miekka who died in 2014. When the HO flashes a signal it is often front page news in major financial newspapers.

Miekka claimed in a 2011 interview that the Omen has appeared ahead of every market crash in the U.S. from 1987 but he also admitted that not every...

Most options traders - from beginner to expert - are familiar with the Black-Scholes model of option pricing developed by Fisher Black and Myron Scholes in 1973. To calculate what is deemed a fair market value for any option, the model incorporates a number of variables, which include time to expiration, historical volatility and strike price. Many option traders, however, rarely assess the market value of an option before establishing a position

This has always been a curious phenomenon, because these same traders would hardly approach buying a home or a car without looking at the fair market price of these assets. This behavior seems to result from the trader's perception that an option can explode in value if the underlying makes...

A view of the forest (from the top of the tallest tree)

There was a time when volume data wasn’t available until a day or days after a trade. But in today’s electronic age, live volume is at our fingertips. The beauty of volume as an indicator in live trading is the fact that it is the ONLY leading indicator among the hundreds of possibles. Everything else derives value from what price is doing, lagging the price action. That means changes in volume can impact what price will do before it happens.

Volume plays such an important role in our trading, we mustn’t neglect the messages it sends. For example, one key to this important strategy is the function of volume spikes. It is these spikes that suggest possible market turns. The chart...

You’re a trader, right, not a shopkeeper and there can’t possibly be any common ground between the two can there? Just a minute, though, both are trying to make a profit from the transactions they undertake and both are concerned about their bottom line and their overall and continued profitability. In short, both are in business.

As a trader it is quite likely that your Trading Plan will concentrate its focus on how you will approach individual trades. It will probably have quite a lot about how and when you will enter a trade, rather less about how you will guard against excessive loss and less again about how and when you will take your gains. Your bottom line probably won’t rate much of a mention at all. A Business Plan, however...

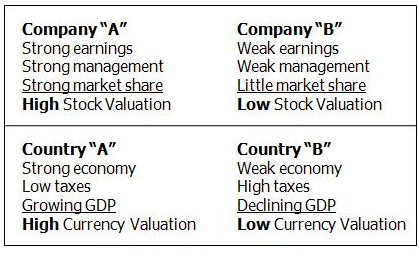

One of the main problems new traders have when they begin their journey down the education path to self-empowerment is that they skip the most important first step, how to properly “think” money and markets. Many of my articles deal with thinking about the trading side of the equation; everything from the mechanics of when to buy and sell to understanding the psychology of you and the person on the other side of your trade. Today, let’s take a walk through the history of one of the best trending markets in the world, Forex. It is an important first step in properly thinking the Forex markets, which is key when attaining an edge in anything we do. The more prepared we are, the more we understand, the better the results.

Strong economies...

In the late 1950s, Nicolas Darvas was one half of the highest paid dance team in show business. He was in the middle of a world tour, dancing before sell-out crowds. At the very same time, he was on his way to becoming a long forgotten Wall Street legend, buying and selling stocks in his spare time researching only in Barron's weekly newspaper and using telegrams to communicate with his broker. However, Darvas turned a $36,000 investment into more than $2.25 million in a three-year period. Many traders argue that Darvas' methods still work, and modern investors should study his 1960 book, "How I Made $2 Million In The Stock Market". Read on as we cover the Darvas Box trading method.

Darvas Who?

The path Nicolas Darvas took to stock...

In order to consistently make money in the markets, traders need to learn how to identify an underlying trend and trade around it accordingly. Common clichés include: "trade with the trend", "don't fight the tape" and "the trend is your friend".

Trends can be classified as primary, intermediate and short term. However, markets exist in several time frames simultaneously. As such, there can be conflicting trends within a particular stock depending on the time frame being considered. It is not out of the ordinary for a stock to be in a primary uptrend while being mired in intermediate and short-term downtrends.

Typically, beginning or novice traders lock in on a specific time frame, ignoring the more powerful primary trend. Alternately...

There is more to the world of Fibonacci than retracements, arcs, fans and timezones! Every year new methods are developed for traders to take advantage of the uncanny tendencies of the market towards derivatives of the golden ratio. Here we will discuss some of the more popular alternative uses of Fibonacci, including extensions, clusters and Gartleys, and we'll take a look at how to use them in conjunction with other patterns and indicators.

Fibonacci Extensions

Fibonacci extensions are simply ratio-derived extensions beyond the standard 100% Fibonacci retracement level. They are extremely popular as forecasting tools, and they are often used in conjunction with other chart patterns.

The chart in Figure 1 shows what a Fibonacci...

The Fibonacci studies are popular trading tools. Understanding how they are used and to what extent they can be trusted is important to any trader who wants to benefit from the ancient mathematician's scientific legacy. While it's no secret that some traders unquestionably rely on Fibonacci tools to make major trading decisions, others see the Fibonacci studies as exotic scientific baubles, toyed with by so many traders that they may even influence the market. In this article we'll examine how the Fibonacci studies may influence the market situation by winning the hearts and minds of traders.

The Famous Italian

It was during his travels with his father that the Italian Leonardo Pisano Fibonnacci picked up the ancient Indian system of...

Scalping, a subset of day trading, is a strategy that involves frequent entry and exit in a trade in order to realize small but multiple gains from the intra-day movement during the trading session. Traders who employ the scalping technique are called scalpers. Scalpers indulge in numerous trades during a day’s trading session with each position held for a very short span of time, ranging from few seconds to minutes. Scalping is not only used with stocks, but also with futures and forex.

With low barriers to entry in the trading world, the number of people trying their hands at day trading and related strategies such as scalping has increased. Scalping is not the best trading strategy for rookies as it involves fast decision-making...

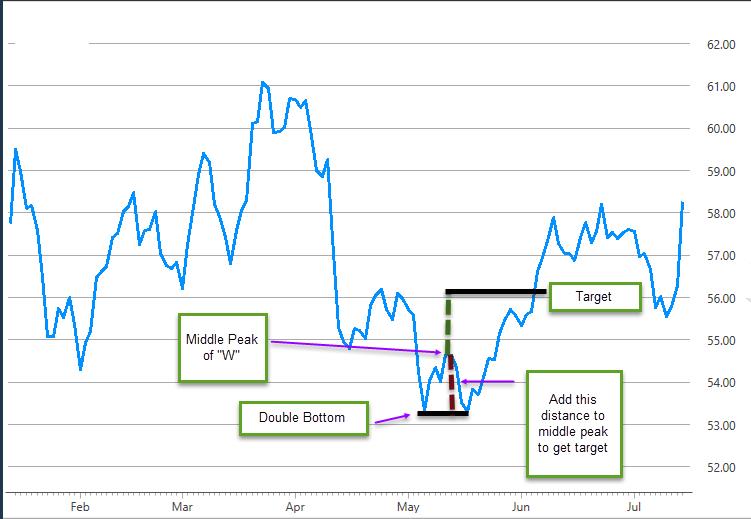

Most traders who have even a passing acquaintance with technical analysis have heard about a classic chart pattern called the double bottom. It looks like a “W” on the chart. The standard trading methodology suggests buying when the stock breaks out past the middle peak of the W” and setting an initial target by adding the distance between the bottoms and the middle peak to the breakout price. (See figure 1). By buying the breakout a trader is hoping for a higher probability that the stock will reverse as opposed to going sideways. However, the temptation is always there to try and enter the trade earlier and capture some of the move up from the second bottom to the middle peak, which can sometimes be substantial, especially when...

When it comes to trading, most of it is done by making a directional bet. In other words, if the probabilities are high that the market will decline, we short it anticipating we will make money as it moves lower. Conversely, when the prevailing odds are that a given market will move higher, we buy it with the hope that we will sell at higher prices in order to garner a profit. In addition, to exercise sound risk management we will cut our losses swiftly if the market proves us wrong. This is conventional market speculation.

There is however, a lower risk method to participate in the markets. This method is not as widely known, or practiced for that matter, but can be a viable method to making money in any market. What I’m referring...

Psychology: Most traders neglect one of the most important parts of trading: The psychology of the game. How mentally prepared are you for the trials and tribulations that are important in the trading activity?

After a few trading experiences it becomes obvious how important your mental approach (psychology) is to the market. In fact, your trading success, the difference between winning and losing, depends upon your mental attitude. It is the main factor, before anything else, that determines whether you win or lose.

It is obvious how much training is necessary to learn the technical aspects of trading. Hundreds of books and courses have been written on every tiny aspect of trading, each with something worthwhile. The internet...

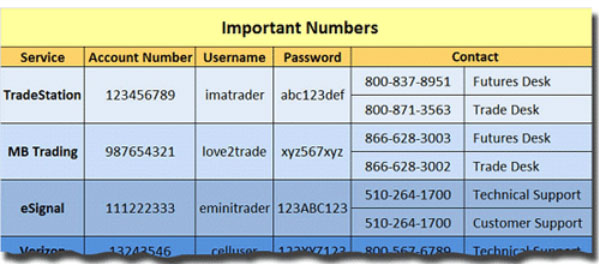

Just like good boy scouts, traders need to be prepared for the unexpected. It is virtually inevitable that part of a trader's workstation will melt down at some point, and this can lead to a financial loss. Platforms can experience problems, including surprises in strategy automation, for which traders need to plan. And, although it (thankfully) doesn't happen very often, entire exchanges can even shut down. All traders need a well thought out plan - in writing - to deal with these types of eventualities. If traders are ready to deal with problems as they arise, they'll be back to trading sooner - and hopefully with a minimum of stress and financial loss. Think of this preparation as a form of risk control.

Important Numbers

At the...