You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

For many investors, the futures markets, with all of the different terms and trading strategies, can be both confusing and daunting. There are opportunities to limit losses on your portfolio or enjoy significant profits by using the futures markets, but it is important that you understand how these derivative products work and how you can achieve those profits consistently. This article explains how each market works and the different strategies that can be used to make money.

How Can You Be Successful?

The futures markets are where those hedging and those speculating meet to predict whether the price of a commodity, currency, or particular market index, will rise or fall in the future. Like any market, this one has risks when trading...

Although many traders know how to use volume in their technical analysis of stocks, interpreting volume in the context of the futures market may require additional understanding because considerably less research has been conducted on the volume of futures than that of stocks. Here we take a general look at some of the things you should know when looking at volume in the futures market.

Volume Reports and Liquidity

The volume of each futures contract (where individual contracts specify standard delivery months) is widely reported along with the total volume of the market, or the aggregate volume of all individual contracts. These volume figures are reported one day after the trading day in question, but estimates are regularly posted...

What Is a Futures Contract Rollover?

In the futures market, the transition from an expiring futures contract to a new futures contract is called a rollover. Since futures are derivatives contracts that control an underlying asset they, like many contracts, have a start and finish date. Because there is a shelf life to futures markets, traders must close their existing positions in the contracts that are close to expiring. If they elect to continue trading that asset, before the contract expires they will rollover their position (close the expiring position and open a new position) which will trade until the next cycle of expiration, usually several months into the future.

Timing of Futures Contract Expirations

To someone new to trading...

Futures and options are both derivative instruments, which means they derive their value from an underlying asset or instrument. Both futures and options have their own advantages and disadvantages. One of the advantages of options is obvious. An option contract provides the contract buyer the right, but not the obligation, to buy or sell an asset or financial instrument at a fixed price on or before a predetermined future month. That means the maximum risk to the buyer of an option is limited to the premium paid.

But futures have some significant advantages over options. A futures contract is a binding agreement between a buyer and seller to buy or sell an asset or financial instrument at a fixed price at a predetermined future month...

Individuals seeking income and/or the preservation of capital often consider adding bonds to their investment portfolios. Unfortunately, most investors don't realize the potential risks that go along with an investment in a debt instrument. In this article, we'll take a look at some of the more common mistakes made - and issues overlooked - by fixed-income investors.

Interest Rate Variability

Interest rates and bond prices have an inverse relationship. As rates go up, bond prices decline, and vice versa. This means that in the period prior to a bond's redemption on its maturity date, the price of the issue will vary widely as interest rates fluctuate. Many investors don't realize this.

Is there a way to protect against such price...

To many traders and investors, the Bond markets are complex and intimidating. However, if you’re looking for a quality set of trading markets and/or if interest rates matter to you at all then understanding the bond markets is key for your financial well-being. In this article, I want to help simplify the powerful and important Treasury markets for you and focus on three reasons why you may want to pay a little more attention to them.

Trading Income

Bonds and, most importantly, bond and note futures are fantastic trading and investing vehicles. You can trade the bond market through multiple channels including Futures, ETFs, Bond funds and more. The major Bond markets, such as the 10 Year Note and 30 Year Bond in the USA and the Bund...

Key Points

Trading always involves some level of risk, but “risk” can be defined in many different ways.

Is it the probability of profit compared to the probability of loss? Or is it the amount you could earn compared to the amount you could lose?

Plus, how do you quantify risk? Is it the number of shares or the dollar amount?

Is options trading risky? This is a harder question to answer than you might think, because it depends upon how you define “risk.”

Most traders define risk in one of two ways. The first method is the probability of earning a profit versus the probability of incurring a loss. The second way is the amount of money you could lose compared to the amount of money you could earn. Let’s look at both...

There is a constant push for portfolio diversification into alternative investments, such as futures and commodities, but oftentimes it is difficult to make the leap. That's where the concept of synthetic futures comes in. For those looking to avoid a huge initial investment and manageable risk, synthetic futures provide an opportunity to help you ease into portfolio diversification without betting the farm.

An Influential Study

In 2004, a brief but powerful white paper was put out by the Yale International Center for Finance. The paper was entitled "The Facts and Fantasies about Commodity Futures". In the paper, the authors set out to answer two questions

Are commodity futures riskier than stocks?

Can commodity futures...

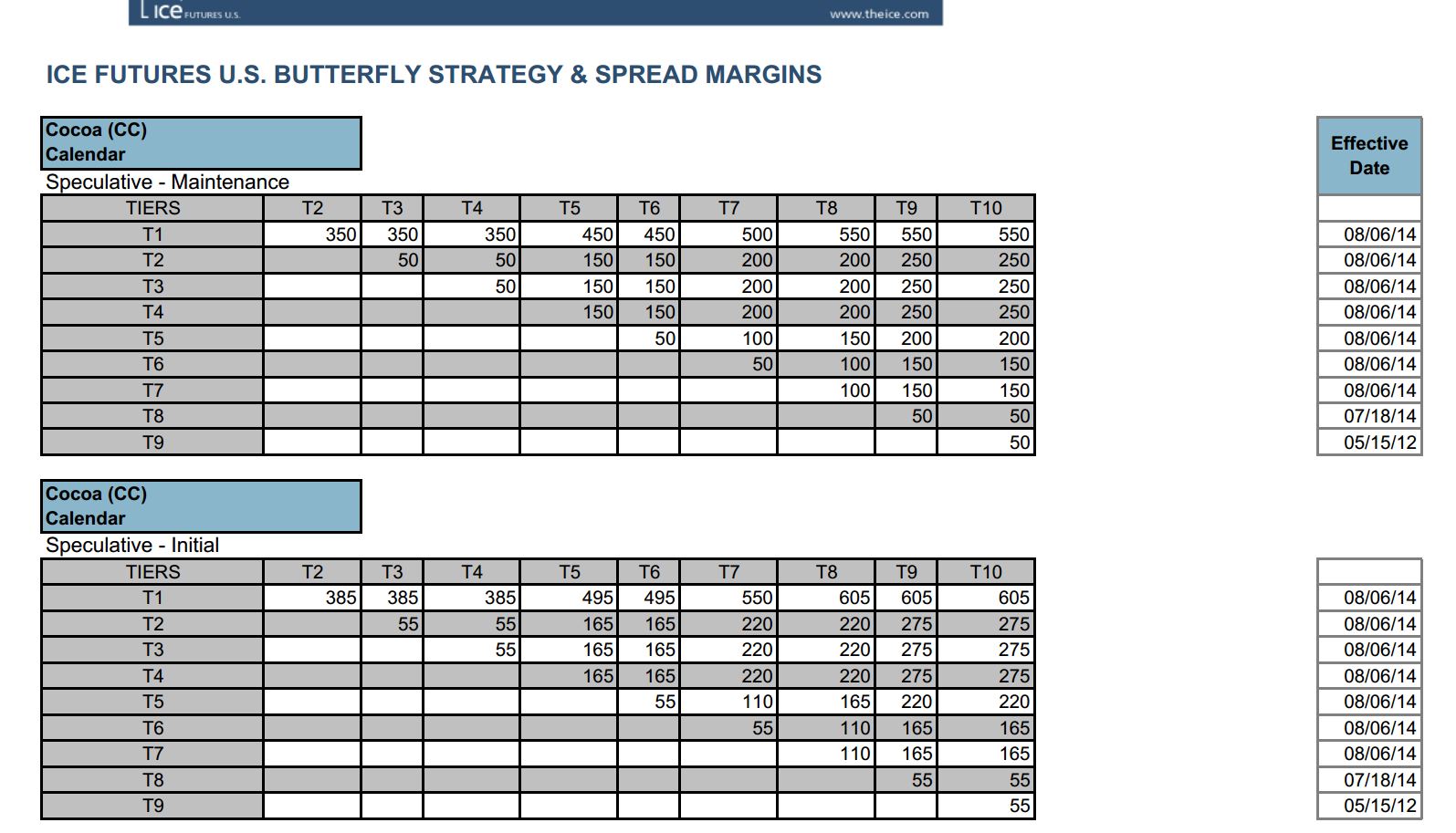

I received an email from a student in Singapore regarding the margin for Spread trading and where to find it. Spread trading is gaining more popularity, even internationally based on the emails I have been receiving. Let’s now look at two different Futures Exchanges and identify the process of figuring out how much Margin (capital) is required to trade these things called Spreads.

Spread trading involves the simultaneous purchase of one month and simultaneous sale of another month of the same Commodity to be an Intra-Commodity Spread. To simultaneously purchase and sell related Commodities is known as an Inter-Commodity Spread.

The Intra-Commodity Spread is the least volatile and risky of the two. Notice I said “least” not “risk...

Every March, and other quarterly months (June, September, and December) the futures contracts that track interest rates, currencies, and the stock index futures come to the end of their contract life, and expire. This necessitates the need for traders engaged in these markets to exit these contracts and roll them over to the next quarterly month.

This phenomenon is unique to the futures market and to someone new to trading these markets it can sometimes be confusing. Because March is the end of the quarter, the “Rollover” event is happening throughout the month across most futures contracts, particularly in the financials since they expire quarterly. We tend to get many questions from our newer futures traders regarding this topic...

One of the charting differences between Equities and Futures is that some Futures trade for almost 24 hours per day. Once Equities stop trading at 16:00 EST, the last price that a trader sees on their chart is usually the closing price. The next morning when the market opens at 9:30 EST and the price is higher or lower than the previous closing price, then the trader effectively has a gap opening.

Before electronic and 24 hour trading came to the Futures markets, we were able to do the same thing and be within one or two price ticks of the actual closing price. Now, we have different trading sessions to contend with. In a recent article, I wrote about these two different sessions:

Regular Trading Hours (RTH) – This session is always...

I started my 24th year of Futures trading this month and have been reminiscing about the path that the Futures industry and I have both taken during this time:

Instant fills on electronic platforms compared to waiting minutes to hours for a price fill from the exchange floor

No more watching price trade through your limit order in the Bond pits and then calling to ask for your fill price and hearing "unable to fill, still working the order"

Computers that now plot charts as far back as 25 years or more on some markets with just the click of a mouse instead of paper charts plastered to the office walls with X's and O's all over them

News on your screen almost as fast as it happens instead of reading about it in the paper the next...

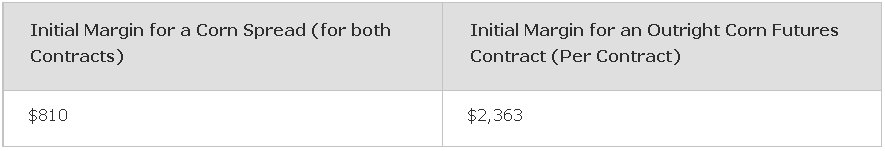

Spread trading is very good for the smaller account traders after they figure out how to trade Spreads. The capital required to trade these Spreads is a fraction of an outright Futures contract. Figure 1 shows a comparison of a Corn Spread to an outright Corn position.

Figure 1

Spreads generally move much slower than outright Futures positions, thus reducing some of the risk involved. By combining the use of Spreads and Seasonal Patterns of Commodities, we can get that added edge that most traders don't have. Spread trading is one of the best kept secrets on the exchange trading floors. Not many small traders follow these, but you can be assured that the large traders and commercial traders are looking at and using these Spreads...

One the many questions traders have once they have learned how to trade is, which market or markets should I trade? While there are many things to consider when making this decision, I wanted to share with you today a market that I consider to be one of my favorites, the Ten Year U.S. Treasury Note (TY) Futures. This is one of the biggest and most important global treasury markets. Interest rates that affect all of our lives from a financial perspective are determined here. In other words, this is the free market for interest rates. There are other bond/treasury markets as well but this is one of the biggest.

This market is attractive for a few reasons. First, the Ten Year U.S. Treasury Note Futures market has tons of volume making it...

In this article we will examine a specific case of a debit and a credit spread in order to point out that there is virtually very little difference between the two.

Instead of attempting to explain the concept by using a fictitious example, the stock XYZ with the one strike price being at this level and the other one at that level, etc, we shall utilize a couple of my recent trades for the same purpose. Again, this scrutiny is for education purposes only and it is not intended to be a recommendation of any kind.

My normal criteria for trading optionable stocks is the liquidity which is evident in the volume of the underlying as well as the high open interest and volume on individual strike prices. The Chevron Corporation has passed...

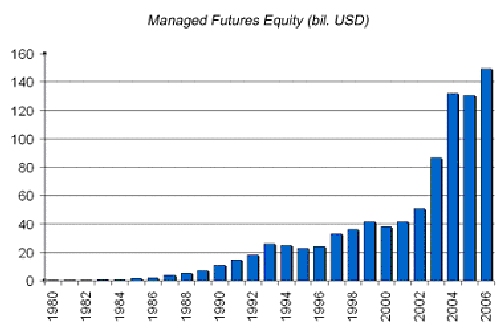

The total amount of assets under management in managed futures is today estimated to be in excess of $200 billion. Investors can choose from about 1000 programs, whose risk characteristics can extremely vary. It is therefore very important to fully understand the strategy each underlying manager is pursuing. We can not think of strategies on a stand-alone basis as a lot of managers employ them in combination, for example one main and several complementary strategies.

Technical approach

Here traders use technical analysis. It means that they monitor chart patterns and expect that they will repeat themselves in the future. The most common technical indicators usually include moving averages and strategies developed on the idea of a...

Of all the facets of trading, the first that a new trader must learn before he can engage the markets with any degree of confidence is the identification of low risk entries on a price chart. Notice that not just any entry will do, only those offering the biggest reward for the least amount of loss potential.

If you've ever read about or had the chance to chat with any successful trader, you will find one common thread: They all (without exception) have an edge based on low risk entries.

What defines a low risk entry? I define it as the following: The price level where a trader can expose the least amount of capital to prove whether his edge will work. I tell students to look for these areas by identifying "the line in the sand" or...

Producing a high probability trade forecast is not easy. Just as difficult is determining the best trading strategy and vehicles to capitalize on the forecast. Read on to learn some of my favorites trading strategies.

Let's say you've done your homework. You've identified a pivot point, a futures market direction and have projected a time frame for the move. The only thing missing is the price amplitude. In other words, how big or small will the price move be?

Generally, the magnitude of the move will always be the unknown. With TimeLine forecasts we will always have an idea of the direction and time frame, but it is up to real world commodity market forces to decide how far the move will carry.

The way to handle price uncertainty is...

Remember that hit movie "Lost in Translation," in which a clueless Bill Murray wanders dumbstruck through the foreign and thoroughly baffling world of modern-day Tokyo? That's the look that comes over many forex traders when they try to get their head around the Internal Revenue Code as it relates to foreign exchange trading.

Forex is the world's largest and most liquid market, with a daily currency dollar volume of more than $1.4 trillion. Once primarily traded by banks and other financial institutions, forex opened to individual traders in the mid-1980s and became widely popular when trading exploded in the nineties. Forex can be lucrative indeed for traders who know how to capitalize on the rise and fall of various currencies...

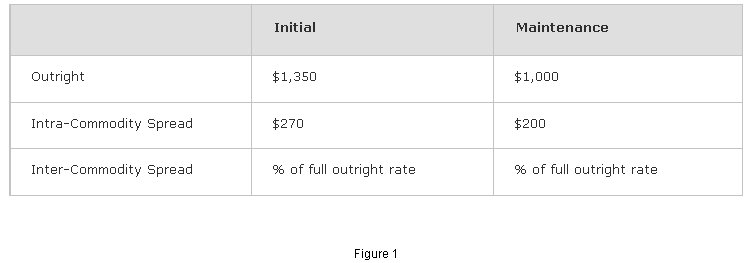

As we come into the growing season for many of our agricultural Commodities, there will be numerous opportunities to trade the volatility created by weather, crop estimates and other fundamentals. I mention the agricultural markets because they offer some of the finest opportunities. However, other markets can be spread, also.

For example, here are just a few:

Ten Year Treasury Note / Thirty Year Treasury Bond

Live Cattle / Lean Hogs

Euro FX / Aussie Dollar

Gold / Silver

Spreading offers the Futures trader an opportunity to trade these markets with less capital than on outright Futures position, while being hedged at the same time. This hedge does not mean you cannot lose money, it simply implies you are long one Futures...

Ever wonder what makes a winning trader consistent? In my opinion that consistency is due to the trader having his own "edge" over other traders. This "edge" is what each trader must find for himself. Often traders focus on their results so much that they forget that every other trader in the world is doing the same thing: Trying to profit from price action alone. Trading this way can make you money, but what if you had an added edge to your strategy? In Commodity Futures, we have something called Open Interest that just may provide that advantage.

What is This Open Interest?

Open Interest is the total number of outstanding contracts that are held by market participants at the end of the day.

Contracts that are held overnight have...

This week I would like to discuss Spread Trading in Commodities. I will write future articles on this topic as it would be near impossible to cover all aspects of this method of trading in one article. This article will be an introductory lesson on Spread Trading in Commodities.

Welcome to Spread Trading

Spread - The purchase of one Futures contract against the sale of another Futures contract of the same or related Commodity.

Spread Trading has been referred to as "Hedge Trading". Remember that Hedging is the method Commercial traders use to help reduce price risk volatility. They may own the physical Commodity and short a Futures contract against it or they may need the Commodity at a later date and buy the Futures contract until...

Being the trader/trainer in the Extended Learning Track (XLT) Futures and Forex classes, I get this question all the time. Due to the ongoing evolution of these two markets, the answer is not as simple as you may think. In this piece, I will discuss what these markets are, identify the advantages and disadvantages of each of these two markets, and discuss how we deal with these markets in the XLT.

To begin with, both of these markets are where global currency values (exchange rates) are determined. These are fantastic markets as they are always moving and the moves and trends are larger than you will find in any other set of markets. The "spot" market is the cash market which means the current value (exchange rate) of where the...

One of the most frustrating aspects of trading commodities is getting comfortable with how each contract is quoted, what the point value or multiplier of each contract is and most importantly how to calculate the profit, loss and risk of a trade. Each commodity futures contract is standardized but in comparison to those with differing underlying assets they are often worlds apart. This can be extremely overwhelming for a new trader; I hope that the following explanations shorten your learning curve and give you the information that you need to begin your journey in the challenging yet lucrative trading arena known as options and futures.

Unfortunately, until recently there hadn't been much in the way of uniformity in commodities. With...

Before Putting Your Money on the Line - You Should Know the Basics

If you are like most people, you work hard for your money and the last thing you want to do is see it evaporate in your trading account. Throughout my journey in the markets, I have yet to find a fool proof way to guarantee profitable trading, but what I am certain of is that you owe it to yourself to fully understand the products and markets that you intend to trade before risking a single dollar. What you will learn from this article is merely a stepping stone but without fully understanding the basics you may never lay the foundation necessary to become a successful trader.

When most people think of commodities they imagine fields of grain or bars of gold...

Finding your very own unique commodity trading edge is a worthwhile goal. Without one you are lost in the masses, struggling to push your head above the sea of expenses. Trading edges do exist, though for short periods of time. Psychological edges are more permanent. You need many. Here's how to find yours.

First let's talk about a good market for day trading. Next, we'll talk about finding a trading "edge."

The S&P 500 Index futures contract market may be the best futures game around for day-trading. It's liquid and the swings are usually large enough every day to make it worthwhile. The electronic e-mini futures market (the mini S&P 500) is lightning fast for executions that rival or even exceed the floor-trader advantage. However...

Ever wondered about Futures Spread Trading? In this article the author looks at the basics and the best way to trade them.

How professional traders optimize profits

Futures spread trading is probably the most profitable, yet safest way to trade futures. Almost every professional trader uses spreads to optimize his profits. Trading spreads offers many advantages which make it the perfect trading instrument, especially for beginners and traders with small accounts (less than $10,000).

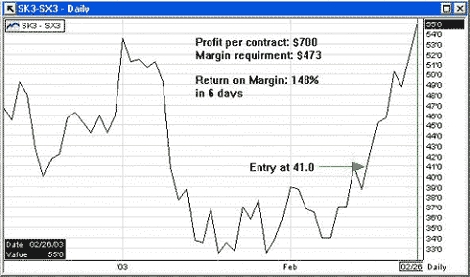

The following example of a Soybean-Spread shows the advantages of futures spread trading:

Example: Long May Soybeans (SK3) and Short November Soybeans (SX3)

Four Advantages of Futures Spread Trading

Advantage 1: Easy to trade

Do you see how nicely this...

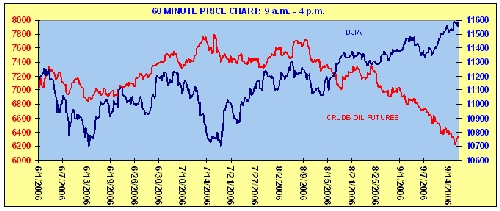

Is there a correlation between Crude Oil Futures and the Dow? And can this correlation be quantified?

In my August 30, 2006 market summary, I wrote how "we would be foolish not to avail ourselves of the inverse pricing relationship between crude-oil and the Dow Jones Industrial Average." Since then, the price of crude has fallen $6.35 and the Dow is 227 points to the upside.

But, now that the distance between these two indicators appears to be excessive, will this wide discrepancy begin to shrink?

In August, energy prices were approaching $80 a barrel, the major equity indices were flat, but as the continuous NYMEX light sweet crude-oil futures contract (CL #F) was sputtering, the markets began spurting upwards. If you compare the...

As a new trader, you are probably impatient to get to the study of charts and evaluation of various trading strategies. Surely, winning involves predicting future market direction using sophisticated technical analysis to identify the best entry and exit points for our trades? So why delay discussion of all that stuff for a look at a bit of mundane statistics?

The reason is simple. If you regard the trading game as some kind of super intelligence test where you are pitching your skills against the rest of the world, you are unlikely to play the game with the right attitude and expectations. On the other hand, if you see trading as a numbers game, then you are more likely to approach it correctly.

So, if it is a numbers game (which it...