In the futures market, the transition from an expiring futures contract to a new futures contract is called a rollover. Since futures are derivatives contracts that control an underlying asset they, like many contracts, have a start and finish date. Because there is a shelf life to futures markets, traders must close their existing positions in the contracts that are close to expiring. If they elect to continue trading that asset, before the contract expires they will rollover their position (close the expiring position and open a new position) which will trade until the next cycle of expiration, usually several months into the future.

Timing of Futures Contract Expirations

To someone new to trading futures, futures contract expirations and, more importantly, knowing when to rollover could be confusing. That’s because all types of futures contracts do not expire in the same months or at the same time during the month.

Financials

Every quarter (March, June, September and December) the futures contracts that track interest rates, currencies, and the stock index futures come to the end of their contract life and expire. This necessitates the need for traders engaged in these markets to exit these contracts and, if desired, roll them over to the next quarterly month. However, the contracts don’t all expire on the same day, so the Futures Rollover event is happening throughout the month across most futures contracts. Futures traders must pay attention to the expiration date and futures rollover deadline for the contract they are trading.

Non-financials

The fact that financials all carry quarterly expiration makes it is easier for traders to remember when to rollover. In contrast, all of the traditional commodities such as oil, gold, wheat and the like, rollover more frequently because many producers use these contracts as a way to hedge against their cash crops and businesses use them to hedge against rising costs of buying the underlying commodities. Since these futures contract expiration dates vary, it is even more important for traders to pay attention to the futures rollover deadlines affecting their positions.

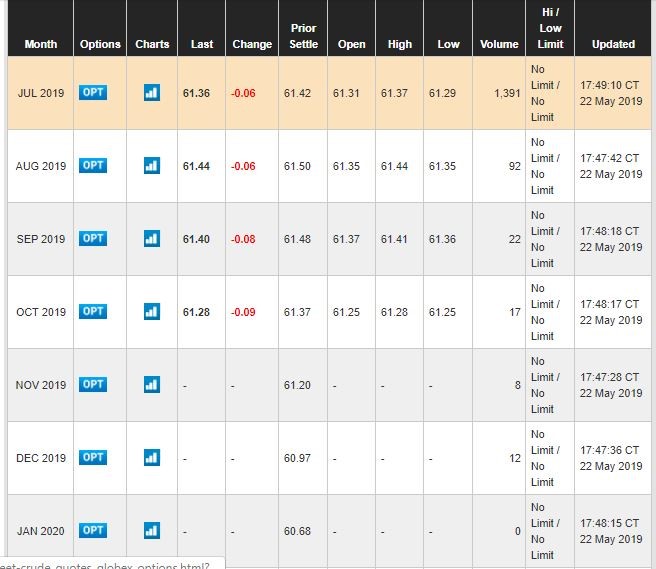

As an example, below is a calendar of all the pertinent dates for Crude Oil. In it, we see that Crude has a contract for every month of the year. This is unique for the energy complex as it is used by many businesses to hedge a possible increase in the price of Crude oil.

What Happens If a Futures Contract Doesn’t Rollover or Close Before Expiration?

One of two things can result from failure to rollover or close, meaning that a trader may find themself still in a position on the day the futures contract expires: forced liquidation and slippage.

If a trader holds on to an expiring contract after the first notice date (the date in which a trader may be required to accept delivery) it could cause all sorts of headaches for the broker, not to mention the trader concerned. To minimize the headaches the broker may force liquidate the position and will likely do so without regard to price which could result in losses. Also, the broker will likely deem the trader negligent for missing the rollover date and suspend the account for a given period.

Losses are especially likely since liquidity in the expiring contract starts to dry up immediately after rollover day. As liquidity dries up, spreads become wider which could lead to trades becoming more prone to slippage.

Futures Contract Settlement Date

The most important date for traders is the settlement date, which is the last day the contract will trade and, therefore, the last day to close out or rollover a futures contract. A trader will have to rollover the expiring futures contract on or before the settlement date which occurs just before the contract expiration date.

The CME maintains a futures expiration calendar (click here to view) and an explanation for all the terms. The products are grouped by sector. To get to the calendar, simply find the specific futures contract and click on the product name link which will take you to the contract specifications page in which you will see the calendar tab.

Take note that futures rollover day differs depending on the type of futures contract being traded. In other words, the number of days before expiration when a trader needs to exit one contract for another varies. Below is a list of the sectors and days prior to expiration when rollover occurs:

- Equity indexes – 7 days

- Currencies – 3 days

- Interest Rates – 14 days

- Metals – 20 days

- Grains – 10 days

- Energy – 3 days

With this information, you simply check the product calendar at the beginning of every month and prepare to make the switch (close out the expiring month) from one contract and open (or rollover) a contract from the next month which will have increased volume. This is done according to the rollover days I’ve spelled out above. It’s as simple as that and just an extra, albeit necessary, step when you’re trading Futures contracts.

Gabe Velazquez can be contacted on this link: Gabe Velazquez