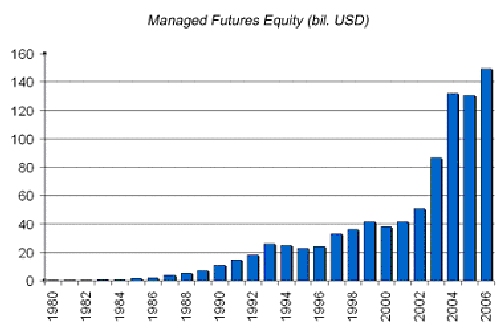

The total amount of assets under management in managed futures is today estimated to be in excess of $200 billion. Investors can choose from about 1000 programs, whose risk characteristics can extremely vary. It is therefore very important to fully understand the strategy each underlying manager is pursuing. We can not think of strategies on a stand-alone basis as a lot of managers employ them in combination, for example one main and several complementary strategies.

Technical approach

Here traders use technical analysis. It means that they monitor chart patterns and expect that they will repeat themselves in the future. The most common technical indicators usually include moving averages and strategies developed on the idea of a break through a specific price barrier. Moving averages were also used as the main method by the first managed futures fund, Futures Inc., founded in 1949 by Richard Donchian.

Fundamental approach

Traders do not follow historical data or price ranges where the market is located, instead they react upon the fundamental situation on the market. CTAs trade upon news, inventory levels, weather forecasts (which affect the crop), i.e. they focus on the situation between supply and demand. A fundamental approach is not typically used as the main strategy.

Systematic approach

Systematic managers use advanced mathematic and statistic methods in order to develop fully automated programs, which then generate trading signals and eventually transmit orders for execution. As a result of advances in technology this approach is naturally adopted more and more often.

The biggest company using a systematic approach is none other then AHL - the flagship program of the giant Man Group, a company that manages hedge funds, selects external managers for their funds of hedge funds, and is also the biggest futures broker. AHL took its name from the initials of its founders (Adam, Harding and Lueck). However, they left the company after the acquisition of Man Group to found Winton Capital and Aspect

Capital. Today, these companies (together with AHL) are managing about $30 billion.

Discretionary approach

A discretionary approach is the opposite to a systematic one. That means that managers take decisions over each trade individually. They are more specialized in a few selected markets.

Trend following

This strategy has the longest history and continues to be implemented most often. As indicated by the headline, positions are opened in the current market direction. Naturally, these traders need "trending" markets, i.e. those with long and uninterrupted trends without major corrections that might end the position.

An example of a trend-following trader could be John W. Henry. Using a combination with systematic approach, he managed to achieve very good results and later even bought Boston's baseball team, the Red Sox. However, due to the absence of trending markets in the last three years the manager promoted to the Hall of Fame of futures trading suffered negative results of up to tens of percents annually.

Countertrend strategy

Traders who adopt this less-common strategy try to anticipate the price top/bottom and initiate a position against the current trend.

Option strategies

There are many strategies within the framework of option trading, but CTAs usually use option writing and here option spread trading only. Spread trading means they write (sell) options with the strike price over and under the current market price. They try to position themselves neutrally in order to profit from the situation when the market stays within the specified range over the specified period. The second (more conservative) strategy is the credit spread, where an option with nearer strike price is sold and an option with further strike price is bought. Such option specialists of course do not like trending markets.

The risk in option strategies varies substantially and therefore has given rise to a risk terminology in other strategies as well. Those are so-called "short option" and "long option" strategies. The risk in short option strategies could be hidden for a long time. It is possible to achieve very good returns for some period, but during an unexpected event a significant loss may occur, such as the one suffered by Victor Niederhoffer. His programs between 1993-1996 achieved solid stable returns and reached top positions in terms of traditional risk/return statistics. But after his short option positions on S&P 500 were hit in October 1997, he was forced to liquidate his funds.

Forex

Currency strategies are sometimes presented as a stand along category. Another time they are for their same risk/return characteristics included among managed futures strategies.

Currency traders usually specialize in their market segment only and therefore are able to offer so-called passive strategies as well, which investors use to hedge their currency exposure. That is why forex managers have sometimes much more assets under management then managers in other strategies. An example can be FX Concepts, an American company managing about $12 billion, or London's Record Currency Management managing as much as about $53 billion.

Short term / medium term / long term strategies

Under short term strategies we understand everything from intra-second trading (exclusively within a systematic approach) to holding a position for several days. The trading frequency is very high so it is important to monitor and analyze the impact of commissions and slippage.

An example of intra-second trading is RSJ Invest, a Czech company trading with the help of mathematical models of such a high volume that its activity counts for about 4% of total volume on London's exchange Euronext.liffe.

Medium term positions are held from several days to several months. Option trades are a good example of this, with their length of about two months.

Long term strategies do not focus on hot news or the current market behaviour. Instead they monitor seasonal events and long term market tendencies. An example could be strategies developed on the basis of a fundamental analysis or spread trading of contracts with different months of delivery.

Sector specialists vs. diversified portfolio

In this case strategies are not necessary different, but there are specialist traders (focusing at "their" market only) or global players, who create highly diversified positions. Systematic CTAs are generally more diversified.

Due to high demand from investors a lot of strategies are currently emerging that focus on energies, metals and agriculture commodities. However, those are bank products rather than individual manager strategies or investment strategies of smaller firms.

Funds of funds

Funds of funds, better known as CPOs (commodity pool operators), specialize in the selection of best traders, from which they then create a diversified fund. The advantages are lower minimum investment and access to closed funds, the disadvantage extra fees for their activity.

Technical approach

Here traders use technical analysis. It means that they monitor chart patterns and expect that they will repeat themselves in the future. The most common technical indicators usually include moving averages and strategies developed on the idea of a break through a specific price barrier. Moving averages were also used as the main method by the first managed futures fund, Futures Inc., founded in 1949 by Richard Donchian.

Fundamental approach

Traders do not follow historical data or price ranges where the market is located, instead they react upon the fundamental situation on the market. CTAs trade upon news, inventory levels, weather forecasts (which affect the crop), i.e. they focus on the situation between supply and demand. A fundamental approach is not typically used as the main strategy.

Systematic approach

Systematic managers use advanced mathematic and statistic methods in order to develop fully automated programs, which then generate trading signals and eventually transmit orders for execution. As a result of advances in technology this approach is naturally adopted more and more often.

The biggest company using a systematic approach is none other then AHL - the flagship program of the giant Man Group, a company that manages hedge funds, selects external managers for their funds of hedge funds, and is also the biggest futures broker. AHL took its name from the initials of its founders (Adam, Harding and Lueck). However, they left the company after the acquisition of Man Group to found Winton Capital and Aspect

Capital. Today, these companies (together with AHL) are managing about $30 billion.

Discretionary approach

A discretionary approach is the opposite to a systematic one. That means that managers take decisions over each trade individually. They are more specialized in a few selected markets.

Trend following

This strategy has the longest history and continues to be implemented most often. As indicated by the headline, positions are opened in the current market direction. Naturally, these traders need "trending" markets, i.e. those with long and uninterrupted trends without major corrections that might end the position.

An example of a trend-following trader could be John W. Henry. Using a combination with systematic approach, he managed to achieve very good results and later even bought Boston's baseball team, the Red Sox. However, due to the absence of trending markets in the last three years the manager promoted to the Hall of Fame of futures trading suffered negative results of up to tens of percents annually.

Countertrend strategy

Traders who adopt this less-common strategy try to anticipate the price top/bottom and initiate a position against the current trend.

Option strategies

There are many strategies within the framework of option trading, but CTAs usually use option writing and here option spread trading only. Spread trading means they write (sell) options with the strike price over and under the current market price. They try to position themselves neutrally in order to profit from the situation when the market stays within the specified range over the specified period. The second (more conservative) strategy is the credit spread, where an option with nearer strike price is sold and an option with further strike price is bought. Such option specialists of course do not like trending markets.

The risk in option strategies varies substantially and therefore has given rise to a risk terminology in other strategies as well. Those are so-called "short option" and "long option" strategies. The risk in short option strategies could be hidden for a long time. It is possible to achieve very good returns for some period, but during an unexpected event a significant loss may occur, such as the one suffered by Victor Niederhoffer. His programs between 1993-1996 achieved solid stable returns and reached top positions in terms of traditional risk/return statistics. But after his short option positions on S&P 500 were hit in October 1997, he was forced to liquidate his funds.

Forex

Currency strategies are sometimes presented as a stand along category. Another time they are for their same risk/return characteristics included among managed futures strategies.

Currency traders usually specialize in their market segment only and therefore are able to offer so-called passive strategies as well, which investors use to hedge their currency exposure. That is why forex managers have sometimes much more assets under management then managers in other strategies. An example can be FX Concepts, an American company managing about $12 billion, or London's Record Currency Management managing as much as about $53 billion.

Short term / medium term / long term strategies

Under short term strategies we understand everything from intra-second trading (exclusively within a systematic approach) to holding a position for several days. The trading frequency is very high so it is important to monitor and analyze the impact of commissions and slippage.

An example of intra-second trading is RSJ Invest, a Czech company trading with the help of mathematical models of such a high volume that its activity counts for about 4% of total volume on London's exchange Euronext.liffe.

Medium term positions are held from several days to several months. Option trades are a good example of this, with their length of about two months.

Long term strategies do not focus on hot news or the current market behaviour. Instead they monitor seasonal events and long term market tendencies. An example could be strategies developed on the basis of a fundamental analysis or spread trading of contracts with different months of delivery.

Sector specialists vs. diversified portfolio

In this case strategies are not necessary different, but there are specialist traders (focusing at "their" market only) or global players, who create highly diversified positions. Systematic CTAs are generally more diversified.

Due to high demand from investors a lot of strategies are currently emerging that focus on energies, metals and agriculture commodities. However, those are bank products rather than individual manager strategies or investment strategies of smaller firms.

Funds of funds

Funds of funds, better known as CPOs (commodity pool operators), specialize in the selection of best traders, from which they then create a diversified fund. The advantages are lower minimum investment and access to closed funds, the disadvantage extra fees for their activity.

Last edited by a moderator: