Stock indices futures are known for their volatility, however trading index options may be a more manageable alternative for the average trader.

Highly leveraged futures contracts are available in all of the major indices. Perhaps the most popular being the Dow, Nasdaq and S&P 500. Similar to mutual funds, trading indices offer stock traders instant diversity. Traders can profit from an increase or decrease in the overall equity market as opposed to trying to pick individual stocks.

However, the volatility and leverage involved with stock index futures prove to be unmanageable for many traders. For this reason, traders may find that options are the ideal instrument for index trading.

Range Trading

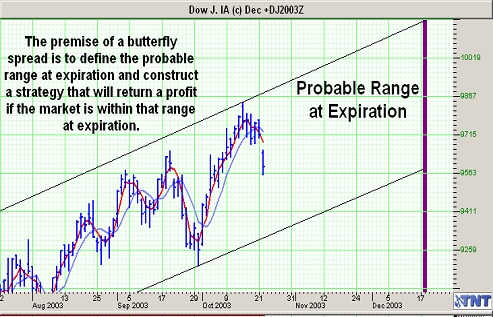

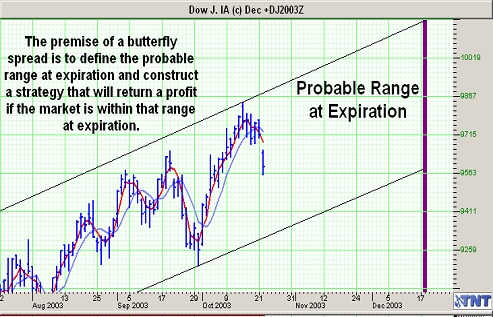

Because the stock market can be unpredictable at times, it is often appropriate to use range trade strategies such as the option butterfly in order to increase the odds of success.

It is not uncommon for stock indices to trade in a defined range. This can be true in bull, bear or stagnant market conditions making butterfly strategies ideal.

Option Butterfly trades are affordable and conservative. However, for those that are willing to accept additional risk in hopes of higher yields may find that futures, as opposed to options, better meets their goals.

A butterfly consists is a limited risk trade that provides a large "profit playground" with little out of pocket expense. The option spread can be constructed using either calls or puts. A Butterfly consists of two long options and two short options with three equidistant strike prices.

Swing Trading

Because the stock market often experiences short-lived trends, perhaps the most efficient way to trade them is through swing trading.

Swing traders don't attempt to predict the duration of a trend, or to hold a bullish or bearish bias. The premise of this trading style is that one can capitalize on both trending and retracement phases of a market.

The vital assumption is that all upward price action must eventually result in a period of correction.

To successfully swing trade stock market indices, it is necessary to have a relatively quick trigger for entry and exit.

Moving average crossovers are often the optimal method of timing entry and exit. This is because; a crossover is capable of marking the end of one trend and the beginning of another.

If this trading style seems almost too good to be true - your intuitions are correct. By looking at a chart, a trader would almost never lose if he/she accepted moving average crossover signals to enter and exit a trade.

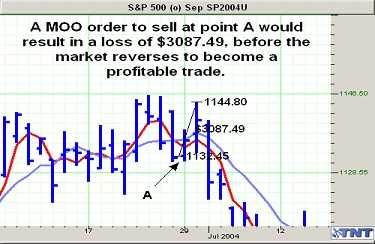

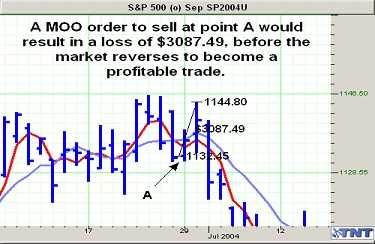

The problem is that most traders are not sufficiently capitalized to hold positions that will eventually become profitable. Let's take a closer look at another trade example?

Mini contracts are available, but even a mini would have produced a $617.49 loss before a market reversal. Many traders are unable or unwilling to absorb such losses, even if they are relatively confident that the trade will end up in positive territory.

Traders can compensate a Moving Average Crossover system by placing appropriate stops and using a trend-confirming indicator such as MACD or Stochastics.

Trading on Moving Average Crossovers alone will result in false signals. Filtering signals with a confirmation indicator will alleviate some of this.

A rule of thumb for stop placement in swing trading is at the relative high or low of the previous two trading sessions. If the relative high or low is not beyond your entry, use the high or low of the next feasible day.

Stops should be trailed. Each day that the market goes in your favor the stop should be placed just above the high or low of the previous day.

Highly leveraged futures contracts are available in all of the major indices. Perhaps the most popular being the Dow, Nasdaq and S&P 500. Similar to mutual funds, trading indices offer stock traders instant diversity. Traders can profit from an increase or decrease in the overall equity market as opposed to trying to pick individual stocks.

However, the volatility and leverage involved with stock index futures prove to be unmanageable for many traders. For this reason, traders may find that options are the ideal instrument for index trading.

Range Trading

Because the stock market can be unpredictable at times, it is often appropriate to use range trade strategies such as the option butterfly in order to increase the odds of success.

It is not uncommon for stock indices to trade in a defined range. This can be true in bull, bear or stagnant market conditions making butterfly strategies ideal.

Option Butterfly trades are affordable and conservative. However, for those that are willing to accept additional risk in hopes of higher yields may find that futures, as opposed to options, better meets their goals.

A butterfly consists is a limited risk trade that provides a large "profit playground" with little out of pocket expense. The option spread can be constructed using either calls or puts. A Butterfly consists of two long options and two short options with three equidistant strike prices.

Swing Trading

Because the stock market often experiences short-lived trends, perhaps the most efficient way to trade them is through swing trading.

Swing traders don't attempt to predict the duration of a trend, or to hold a bullish or bearish bias. The premise of this trading style is that one can capitalize on both trending and retracement phases of a market.

The vital assumption is that all upward price action must eventually result in a period of correction.

To successfully swing trade stock market indices, it is necessary to have a relatively quick trigger for entry and exit.

Moving average crossovers are often the optimal method of timing entry and exit. This is because; a crossover is capable of marking the end of one trend and the beginning of another.

If this trading style seems almost too good to be true - your intuitions are correct. By looking at a chart, a trader would almost never lose if he/she accepted moving average crossover signals to enter and exit a trade.

The problem is that most traders are not sufficiently capitalized to hold positions that will eventually become profitable. Let's take a closer look at another trade example?

Mini contracts are available, but even a mini would have produced a $617.49 loss before a market reversal. Many traders are unable or unwilling to absorb such losses, even if they are relatively confident that the trade will end up in positive territory.

Traders can compensate a Moving Average Crossover system by placing appropriate stops and using a trend-confirming indicator such as MACD or Stochastics.

Trading on Moving Average Crossovers alone will result in false signals. Filtering signals with a confirmation indicator will alleviate some of this.

A rule of thumb for stop placement in swing trading is at the relative high or low of the previous two trading sessions. If the relative high or low is not beyond your entry, use the high or low of the next feasible day.

Stops should be trailed. Each day that the market goes in your favor the stop should be placed just above the high or low of the previous day.

Last edited by a moderator: