You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Most investors desire diversification. It only makes sense not to put all your eggs in one basket.

One of the boons of the age of exchange-traded funds (ETFs) is that it’s now easy to diversify among many asset classes within a regular stock brokerage account. Besides funds based on combinations of stock, there are ETFs that follow the prices of bonds, real estate, precious metals, foreign currencies and more.

One category that should be of interest to all investors is the energy market. We all know that the price of oil and gas fluctuates. These may eventually be replaced by renewable energy sources, but for the foreseeable future they will be a vital part of the global economy. Like all commodities, an investment in oil provides a...

“The greatest enemy of knowledge is not ignorance; it is the illusion of knowledge”. Stephen Hawking.

The participants of financial markets are possessed by a need for rational interpretations of reality which they are doomed to contemplate without a chance to change a thing. Something similar happened at the dawn of mankind when fear and weakness in the face of nature found consolation in a Supreme Devine Force suitable for «explaining» anything.

The major problem of rational interpretation of the events happening in the financial markets consists not in its uselessness but in serious material losses it entails. Today we will attempt to reveal the pitfalls laid by rational interpretations using oil futures as an example.

In the...

For the hard-asset enthusiast, the gold-silver ratio is part of common parlance, but for the average investor, this arcane metric is anything but well-known. This is unfortunate because there's great profit potential using a number of well-established strategies that rely on this ratio.

In a nutshell, the gold-silver ratio represents the number of silver ounces it takes to buy a single ounce of gold. It sounds simple, but this ratio is more useful than you might think. Read on to find out how you can benefit from this ratio.

How the Ratio Works

When gold trades at $500 per ounce and silver at $5, traders refer to a gold-silver ratio of 100. Today the ratio floats, as gold and silver are valued daily by market forces, but this wasn't...

From gold exchange-traded funds (ETFs) to gold stocks to buying physical gold, investors now have several different options when it comes to investing in the royal metal. But what exactly is the purpose of gold? And why should investors even bother investing in the gold market? Indeed, these two questions have divided gold investors for the last several decades. One school of thought argues that gold is simply a barbaric relic that no longer holds the monitory qualities of the past. In a modern economic environment, where paper currency is the money of choice, gold's only benefit is the fact that it is a material that is used in jewelry.

On the other end of the spectrum is a school of thought that asserts gold is an asset with various...

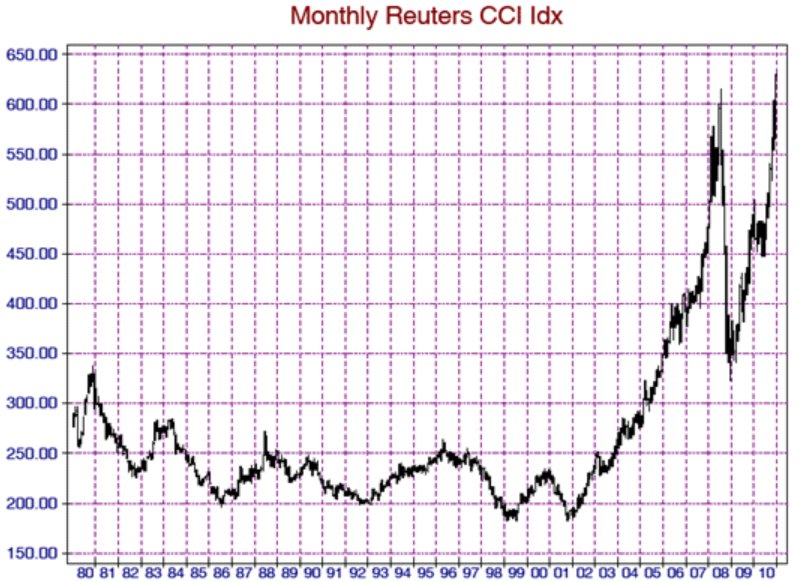

As we start the New Year, we look back on 2010 and find that Commodities outpaced any other asset class with a 15% return based on a basket of Commodities. Compare this to Stocks 13%, Bonds 5%, and Dollar-based trades of 2%. Why is this? For starters, we are in a secular bull market for Commodities that started in approximately 2004. Commodity markets typically trend for 16 – 18 years during these cycles. We are in the infant stages of this bull market.

Commodity markets are true supply and demand markets. Some sectors are:

Energy

Metals

Grains

Food

Livestock

Think of these sectors and how every day of our lives we come into contact with the majority of them. Compare this to a product a company makes like an iPod. Do we really...

There is always "year one" for every commodity futures trader. I had mine and made every mistake a trader can make and more. Here's my story of how I stumbled into the lion's den, got gored a few times and even made some money. My hope is that beginners will read this and avoid some of the more obvious stuff. Here's to all new traders!

It all started in the spring of 1979. I was 28 years old. I was in the office of my new retail electronics company. I was going over some paperwork and got a call from a young and excited broker from Boston Commodities, or some name like that. He must have had the list of new businesses and was cold calling the small business owners.

I had no idea, but at the time sugar was in a major bull market...

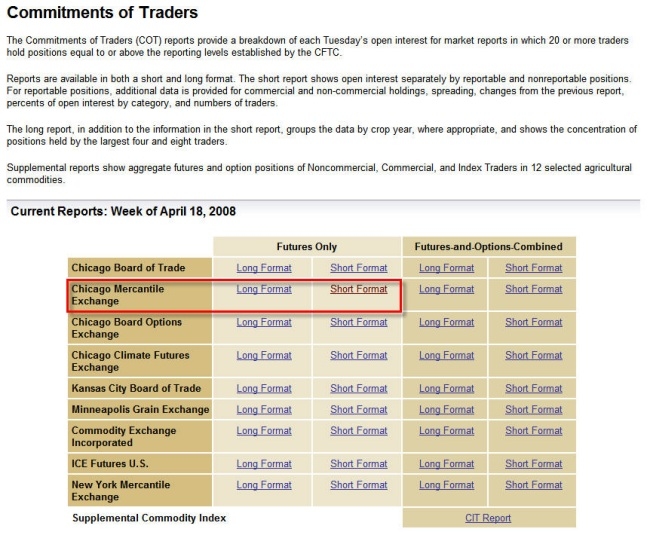

The Disaggregated COT Report

The first Commitments of Traders ("COT") report was published back in 1962 and antecedents of the report can be traced all the way back to 1924. Since its inception, the COT report has gone through numerous changes and improvements over the years. The Commodity Futures Trading Commission ("CFTC"), an independent US agency created by congress in 1974 to regulate the US commodity futures and options markets, is responsible for maintaining the COT report and publishes the data on its website (www.cftc.gov). The CFTC also provides several decades of historical COT data on their website.

The COT report provides a breakdown of the buying and selling that takes place in the futures markets each week. By...

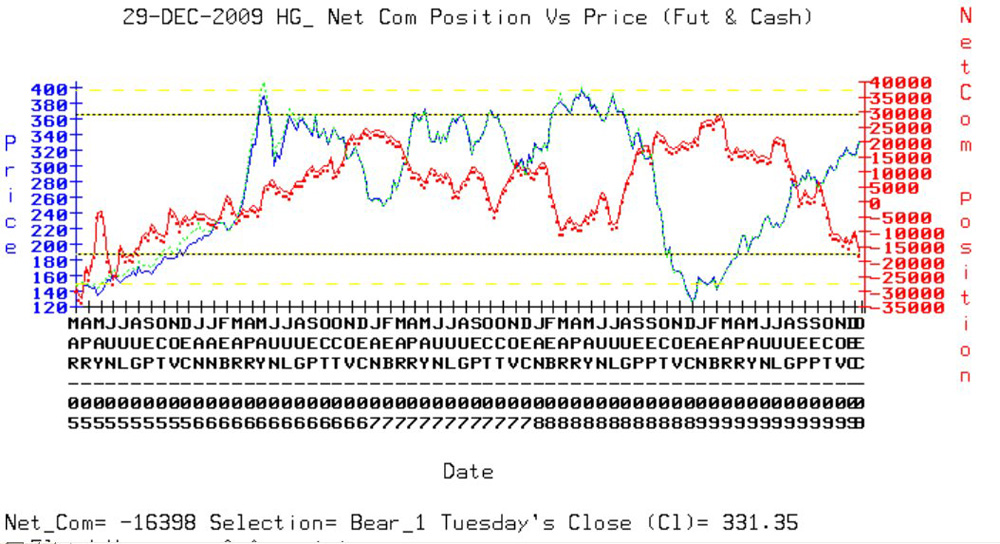

A month ago we reviewed gold and our conclusion was that the fifth attack on the $1,000/oz level in two years was highly likely to lead to a decisive upside breakout. We looked and saw that a suspected massive short position in gold was likely to lead to an explosive rally, as shorts were forced to cover. We analyzed the weekly chart (below) as well as a daily chart to come up with our target of $1,300 - $1,500/oz.

Keep in mind that targets can be dangerous if we hold to them with an iron fist. The key fact is that gold is in uptrend. A target is merely a device to help formulate a trading plan in the direction of that trend.

Last month we recommended trading gold futures and stocks from the long side and offered several tactical...

To get a computerized system edge, you need to figure out the basic human trading weaknesses and include them in your software. Anyone can buy a trading system these days, but it will have little value unless it is unique and different from the crowd. Here's some easy-to-understand ideas I use that add in the human fears!

These days it's very easy to put together a computerized commodity trading system. The average software program will literally write and optimize itself. You can buy a "black box" that will give you wonderful claimed performance. But what does that tell you? If anyone can do it, then it's of little value and uniqueness in the market and will become a loser over time. To get an edge, you need to figure out the human...

Many traders are seeking out assistance in their trading decisions from decision support tools we call technical indicators. While these are helpful, they are only to be used as support for our decision to buy where demand outstrips supply or to sell when supply overwhelms demand. We see this supply/demand imbalance on our charts as support and resistance. However, there is another useful data set that is independent of price that will give us clues as to the possible future of the markets. This data can be found in the Commitment of Traders report.

The Commitment of Traders (commonly referred to as the COT) report has been published by the Commodity Futures Trading Commission since 1962 and provides information on the open...

Much has been written about the current bull market in gold and how it compares to previous moves, in particular during the 1970s when the metal soared to at the time unimaginable heights.

On this basis it is worth looking at the background to the value story on gold, and this may shed some light on why its bull market may have significantly further to go for CFD traders in coming years.

The Gold Standard

The UK, which at the time was the world's dominant economic powerhouse, adopted a gold standard in the early 19th century. Other currencies then looked to have gold backing, and towards the end of the century, various European countries joined the standard, though some chose for a time use a joint gold and silver standard.

The...

A brief look at the three commodities that are said to drive inflation - silver, sugar and soybeans.

In the commodity markets, many inter market relationships exsist. Crude Oil, Gasoline, and Heating Oil are an example, the same for the bean complex with Beans, Bean Oil, and Bean Meal all being obviously related. The reason for the relationship is simple and easy to understand. They are all comprised of a common ingredient the.... Mother Commodity

However history has shown that there is many inter market relationships that are not as obvious. The reason for the relationship may not be as clear and, like many legends, could be subject to interpretation. They also are not necessarily as tight or as in sync as the aforementioned...

A look at why we might not yet have seen the top of the oil price rise.

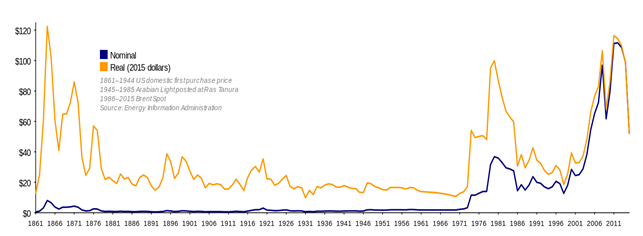

The above quote came from one of our companies earliest reports, published on 16 January 2001. The simple equation of supply and demand was the basis for our bullish view and remains so today. Demand is increasing every year, while supply is constrained by a lack of past investment, as well as the absence of any sizable new discoveries.

Five years on from our bullish prognosis, energy prices remain at the forefront of financial headlines. While oil has displayed significant volatility during the ascent to all-time highs above US$70 a barrel, we remain resolutely bullish about the direction of prices over the longer term.

The case for a high oil price is as...

Two of my favorite trading subjects are cycles and seasonality. In this feature, I'll discuss seasonality in agricultural markets.

I want to start out by emphasizing that seasonality or cycles, by themselves, do not make good trading systems. However, they are great "tools" to add to your "Trading Toolbox."

Seasonality in agricultural markets is a function of supply and demand factors that occur at about the same time every year. For agricultural markets, supply stimuli can be caused by harvest, planting, weather patterns and transportation logistics. Demand stimuli can result from feed demand, seasonal consumption and export patterns.

Livestock futures, too, have seasonal tendencies. Hog and cattle seasonals tend to be caused by...