As we start the New Year, we look back on 2010 and find that Commodities outpaced any other asset class with a 15% return based on a basket of Commodities. Compare this to Stocks 13%, Bonds 5%, and Dollar-based trades of 2%. Why is this? For starters, we are in a secular bull market for Commodities that started in approximately 2004. Commodity markets typically trend for 16 – 18 years during these cycles. We are in the infant stages of this bull market.

Commodity markets are true supply and demand markets. Some sectors are:

Think of these sectors and how every day of our lives we come into contact with the majority of them. Compare this to a product a company makes like an iPod. Do we really need an iPod to survive? Absolutely not! With the world population expanding by almost 80 million people per year, we are seeing more demand put on the supply of Commodities than ever before.

The world supply of natural resource Commodities that once were closer to the surface of the earth are now becoming fewer and fewer. Today miners (metals) and drillers (energy) must go deeper into the earth to extract some of these resources. This translates into higher cost for the producers who then pass the increases on to you and me, the consumers.

If there was ever a perfect storm for an asset class it is now:

For many investors, Commodity Futures do not fit their personalities for investments. This is understandable due to the leverage and sometimes volatile nature of these markets. Without investing in the Commodity Futures themselves, investors have a multitude of ways to diversify their portfolios.

Here is a list of some of the different ways:

This article will focus on the Stocks related to these Commodities and how to find them. I will briefly discuss these other alternative investments before going on to Stock investing. From our list above, we can see that Options can be used to trade Commodities, or used as protection. ETFs are widely available and easily accessible from all Stock accounts. The Forex market is perfect for investing in currencies of countries that are leaders of natural resources. Australian and Canadian currencies are dominated by Commodity exports from these two countries. Mutual Funds offer a longer term investment outlook. The cash Commodites themselves can be purchased and stored, such as buying and holding Gold or Silver. Real Estate investors should look to purchase properties in countries or states that are dominated by natural resources (farming, mining, etc).

This leaves us with the question of how do we know if it is time to buy Commodity Stocks?

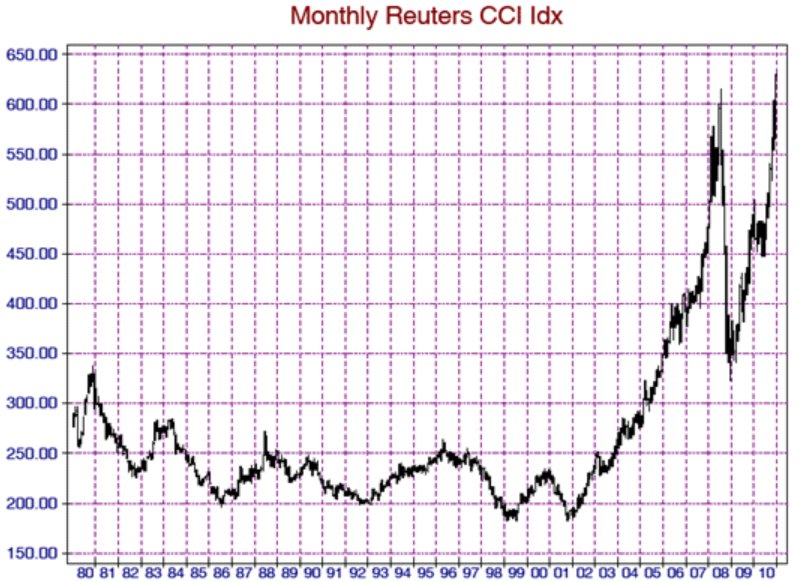

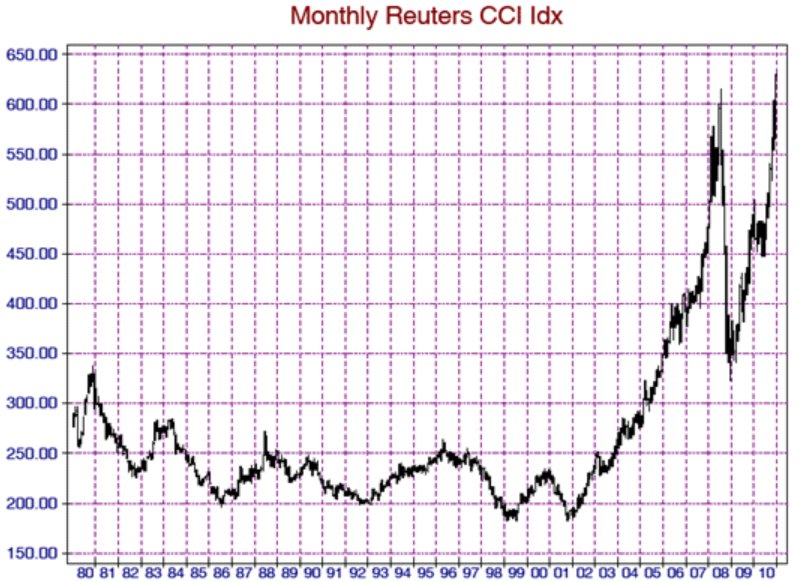

One of the first things you can do is view a chart of an index that contains a basket of Commodities and identify if the index is trending up. There are many popular Commodity indexes to look at. Figure 1 is the Commodity Research Bureau index (CRB index).

Figure 1

These indexes are very similar to Stock indexes such as the S&P 500, Nadaq, Dow and Russell 2000 except they are constructed with Commodities instead of Stocks. The CRB index has been around since approximately 1956.

Once we identify that the Commodity markets, overall, are in a bull market, we need to identify which Commodities are performing the best. For this, you can start with a website called www.finviz.com/futures.ashx . This page will take you to a heat map of the Commodity markets and a performance chart. Click on the performance tab and you will see a list of Commodities and how they have performed. Looking at the monthly, quarterly and yearly results should reveal some markets that are consistently outperforming their peers. We would like to find a Commodity that is in the top percentile of a couple of time frames, if possible. This will confirm a strong trend. This becomes, in essence, a Commodity Screener, narrowing down our candidates for further research.

Now we have a handful of Commodities that are performing well and to add confirmation, we should look at a daily chart of the Commodity itself to verify the uptrend and any potential major support or resistance levels nearby.

The next task is to find Stock market sectors associated with our trending Commodity. A good website for identifying this is http://markets.financialcontent.com/mi.charlotte/sectors. Once here, we can identify sectors such as:

For this example, I will use Lumber as our Commodity we wish to research. Please remember that this is not advice to buy or sell Lumber or related stocks we will discuss. This is for educational purposes only.

Looking under the Industrial Goods sector tab, we find a list of sectors and the one related to Lumber appears to be "Lumber and Wood Production." Once inside this page, we find a chart with historical data that we can use to confirm the overall direction of this sector. We also find a list of sector components (Stocks). Some of these are producers, or processors, of the Commodity, while others could be companies that construct wood items such as kitchen cabinets, furniture, etc.

I clicked on Deltic Timber Corporation where I find a stock chart over the last year with a beautiful uptrend that follows the same path as the Lumber market. Along with the name of this Stock, there is a listing of related companies that you can do even more research on.

Armed with this information we can start our analysis and be invested long before the herd. Rarely will you find non-professional investors studying the Commodity markets as a Stock screener. This is the edge that will help propel you ahead of the competition.

A word of warning about investing in Commodity-related stocks. As with any trade or investment, we always do our analysis of the market first before investing with our money. I mentioned earlier some paper assets (Stocks) are not trustworthy after all the manipulation and corruption by corporations during the financial crisis of 2008. Therefore, we must be diligent in analyzing Stocks.

With the infancy of this secular bull market in Commodities, you will have plenty of time to study these markets and related sectors to take advantage of the opportunities ahead. All of this in the comfort of your own equity trading account.

"The problem in my life and other people's lives is not the absence of knowing what to do, but the absence of doing it." Peter Drucker

Commodity markets are true supply and demand markets. Some sectors are:

- Energy

- Metals

- Grains

- Food

- Livestock

Think of these sectors and how every day of our lives we come into contact with the majority of them. Compare this to a product a company makes like an iPod. Do we really need an iPod to survive? Absolutely not! With the world population expanding by almost 80 million people per year, we are seeing more demand put on the supply of Commodities than ever before.

The world supply of natural resource Commodities that once were closer to the surface of the earth are now becoming fewer and fewer. Today miners (metals) and drillers (energy) must go deeper into the earth to extract some of these resources. This translates into higher cost for the producers who then pass the increases on to you and me, the consumers.

If there was ever a perfect storm for an asset class it is now:

- With China and India rapidly growing and demanding more natural resources, this will continue to deplete the world's supply of natural resources.

- Many investors are finding safety in hard assets (Commodities). They do not trust paper assets anymore and want something tangible to invest in.

- A dominant force for many Commodities is the weather. Many of us know about the extreme weather patterns over the last couple of years. Just recently, Australia suffered severe flooding that shut down mines by filling them with water and damaged thousands of acres of Wheat, and to an extent, their Sugar crop will be down drastically this year.

For many investors, Commodity Futures do not fit their personalities for investments. This is understandable due to the leverage and sometimes volatile nature of these markets. Without investing in the Commodity Futures themselves, investors have a multitude of ways to diversify their portfolios.

Here is a list of some of the different ways:

- Stocks

- Options

- Exchange Traded Funds (ETFs)

- Forex

- Mutual Funds

- Cash Commodities

- Real Estate

This article will focus on the Stocks related to these Commodities and how to find them. I will briefly discuss these other alternative investments before going on to Stock investing. From our list above, we can see that Options can be used to trade Commodities, or used as protection. ETFs are widely available and easily accessible from all Stock accounts. The Forex market is perfect for investing in currencies of countries that are leaders of natural resources. Australian and Canadian currencies are dominated by Commodity exports from these two countries. Mutual Funds offer a longer term investment outlook. The cash Commodites themselves can be purchased and stored, such as buying and holding Gold or Silver. Real Estate investors should look to purchase properties in countries or states that are dominated by natural resources (farming, mining, etc).

This leaves us with the question of how do we know if it is time to buy Commodity Stocks?

One of the first things you can do is view a chart of an index that contains a basket of Commodities and identify if the index is trending up. There are many popular Commodity indexes to look at. Figure 1 is the Commodity Research Bureau index (CRB index).

Figure 1

These indexes are very similar to Stock indexes such as the S&P 500, Nadaq, Dow and Russell 2000 except they are constructed with Commodities instead of Stocks. The CRB index has been around since approximately 1956.

Once we identify that the Commodity markets, overall, are in a bull market, we need to identify which Commodities are performing the best. For this, you can start with a website called www.finviz.com/futures.ashx . This page will take you to a heat map of the Commodity markets and a performance chart. Click on the performance tab and you will see a list of Commodities and how they have performed. Looking at the monthly, quarterly and yearly results should reveal some markets that are consistently outperforming their peers. We would like to find a Commodity that is in the top percentile of a couple of time frames, if possible. This will confirm a strong trend. This becomes, in essence, a Commodity Screener, narrowing down our candidates for further research.

Now we have a handful of Commodities that are performing well and to add confirmation, we should look at a daily chart of the Commodity itself to verify the uptrend and any potential major support or resistance levels nearby.

The next task is to find Stock market sectors associated with our trending Commodity. A good website for identifying this is http://markets.financialcontent.com/mi.charlotte/sectors. Once here, we can identify sectors such as:

- Basic Materials

- Conglomerates

- Financial

- Healthcare

- Industrial Goods

- Services

- Technology

- Utilities

For this example, I will use Lumber as our Commodity we wish to research. Please remember that this is not advice to buy or sell Lumber or related stocks we will discuss. This is for educational purposes only.

Looking under the Industrial Goods sector tab, we find a list of sectors and the one related to Lumber appears to be "Lumber and Wood Production." Once inside this page, we find a chart with historical data that we can use to confirm the overall direction of this sector. We also find a list of sector components (Stocks). Some of these are producers, or processors, of the Commodity, while others could be companies that construct wood items such as kitchen cabinets, furniture, etc.

I clicked on Deltic Timber Corporation where I find a stock chart over the last year with a beautiful uptrend that follows the same path as the Lumber market. Along with the name of this Stock, there is a listing of related companies that you can do even more research on.

Armed with this information we can start our analysis and be invested long before the herd. Rarely will you find non-professional investors studying the Commodity markets as a Stock screener. This is the edge that will help propel you ahead of the competition.

A word of warning about investing in Commodity-related stocks. As with any trade or investment, we always do our analysis of the market first before investing with our money. I mentioned earlier some paper assets (Stocks) are not trustworthy after all the manipulation and corruption by corporations during the financial crisis of 2008. Therefore, we must be diligent in analyzing Stocks.

With the infancy of this secular bull market in Commodities, you will have plenty of time to study these markets and related sectors to take advantage of the opportunities ahead. All of this in the comfort of your own equity trading account.

"The problem in my life and other people's lives is not the absence of knowing what to do, but the absence of doing it." Peter Drucker

Last edited by a moderator: