“The greatest enemy of knowledge is not ignorance; it is the illusion of knowledge”. Stephen Hawking.

The participants of financial markets are possessed by a need for rational interpretations of reality which they are doomed to contemplate without a chance to change a thing. Something similar happened at the dawn of mankind when fear and weakness in the face of nature found consolation in a Supreme Devine Force suitable for «explaining» anything.

The major problem of rational interpretation of the events happening in the financial markets consists not in its uselessness but in serious material losses it entails. Today we will attempt to reveal the pitfalls laid by rational interpretations using oil futures as an example.

In the summer of 2014 both WTI and Brent grades of crude oil started a free fall causing a global change in the development of world economies. Suffice it to say that as a result of the dramatic oil price depreciation Russian Currency Rouble lost half of its value within several months.

Sanctions and — to a greater extent — counter sanctions sped up the involution of the Russian economy heavily dependent on exportation of raw materials, and pretty soon the Brent price became almost an exclusive booster for the local stock market. Oil goes down — Rouble goes down — both Russian market indices — MCX (valued in local currency) and RTS (valued in USD) — go down too. One could trade this dependency fool-proof.

It might look strange that a single factor, even such important as oil, could supersede in the eyes of the stock market the entire diversity of economic, social and political reality of a big country. However psychologically the explanation for this phenomenon is pretty obvious. If the Russian stock market would have been guided by the real economy drowned in gloomy predictions, the value of RTS index would be 90 points instead of 900 as of today.

Stock exchange is a living organism and similar to a human being it can’t survive in a fully negative environment. No wonder the financial markets constantly catch at a straw trying to justify their positive motion.

In January 2016 the Russian stock market found such straw in the same oil which suddenly stopped its overwhelming collapse (in 19 months Brent lowered from $105 to $27) and switched to an even dizzier ascent winning back more than 30% of its losses in just 5 months.

Since oil has become a sole motive for fluctuations of the Russian stock market traders and investors instantaneously turned into oil-and-gas experts dexterous at giving rational interpretations for each and every move of The Feeding Mom («Matushka Kormilitsa» — Russian traders slang for the oil).

In January 2016 all grounds for rationale suddenly washed away. It was easy to give logical explanations to the drop in oil prices since it occurred simultaneously with a dramatic increase both in production and reserves. However, the switch into rally happened when the growth of production and reserves accelerated even further due to the removal of sanctions against exports of Iranian oil and the inability of OPEC countries and Russia to negotiate at least a freeze of production at current levels. Hundreds of tankers queued at big harbours in wait of unloading only completed the gloomy picture.

When the rational logic comes to grief there is always conspiracy theory ready to extend a helping hand. «The oil had to drop initially because there were overstock and overproduction, — assert newly-fledged experts, — but today it must rise because the insiders know a horrible secret: no matter how much you boost the production the demand for oil will inevitably exceed all bids in the nearest future!»

Alternative conspiratorial rationale: the insiders acquired some secret information about oncoming geopolitical upheavals (a war?) which will result in the oil prices equal to that of gold!

Finally, there is always an old ruse at hand borrowed from the legacy of formal fallacies: in our case — ignoratio elenchi or irrelevant conclusion: it’s of no concern that the crude oil production keeps on growing and the warehouses burst since there is a chronic shortage of its fractions — gasoline, kerosene, HFO etc. — and it justifies further price increases.

All these clumsy attempts to rationalise trend changes in oil futures are pure crystal gazing because the market movements are not the reflections of reality but a product of our mythological perception multiplied by fine manipulation techniques.

The markets are originally endowed with a centrifugal force which tears the behaviour of securities from their formal raison d’etre i.e. business activity of their issuers in the real world. This alienation became the further the stronger and in the mid 90s it reached its apogee when the financial markets started to live their own independent lives.

The reason for this complete alienation of the markets from the real world lies far from any conspiracy theory and is pretty obvious: the further the economy develops the trickier become its backbone connections.

At a given moment the influences of the real world over financial markets become so multifaceted that they simply fail further rational accounting. Externally this condition looks like a cause-and-effect entropy, complete chaos which is impossible to explain logically.

In a situation where the price changes in the market are determined by a vector compounded of myriad reasons the majority of which are publicly unknown, any attempt to give a rational explanation to these changes looks ridiculous.

Market movements are the products not of individual motivations but of the mob psychology. This main motivation of this mass consciousness constitutes mythological thinking based on imaginary, emotional, irrational and the priority of bright images.

In our example with crude oil prices the attempts to rationalise their erratic movements are conditioned by unconscious thanatophobia, fear of death, associated with sharp drops in petroleum prices. In the collective subconsciousness of market participants there is a strong notion of an economic collapse inevitable in case of oil prices falling below $ 10.

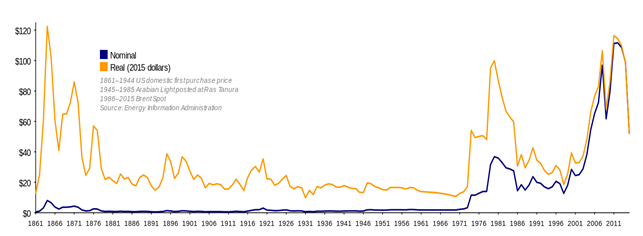

Well, let’s look at the following chart:

This is the history of oil prices traded at organised markets for the last 150 years. If we compare the price spikes with significant historical events, we will see that some of these events caused overwhelming rises (e.g. World War I, Energy Crisis of the 70s, Recovery after 2008 derivatives meltdown), others, contrariwise, led to collapses (Iraqi invasion of Kuwait in 1990), but most of the time oil prices just ignored social and political shocks (all the way through The Great Depression, World War II, Caribbean Crisis and Vietnam War).

Our inability to predict rises and falls of oil prices based on certain historical events is nonetheless compensated by another correlation implied by the chart. Any time a sharp move in oil prices occurs, the mass consciousness of market participants records a collective safety risk, arouses anxiety and causes strong reaction directed at returning things to normal.

Since the end of 90s the status quo of the oil market was associated with a constant rise in prices. That’s why the flash-like collapse caused by financial crisis of 2008 was quickly compensated by an even more impressive rise.

On the subconscious level the market always tries to bring the situation to normal. The only variable here is the notion of normal which changes in time and place. Today this normal envisions the oil prices at $100 and growing. Why? Because the concept of growth is the core of all modern paradigms of social development. Growing is normal, anything else is anomalous.

This propensity to the normal has no rational explanation that’s why appealing to the tankers queued at harbours, production levels, unsuccessful OPEC meetings or Cushing storage hub is meaningless. The driving force behind today’s oil flight from $27 to $52 is hidden in mythological perception of reality which in its turn demands the return to normal.

This is why it seems to us that the oil prices grow out of the blue. The same very reason supports our readiness to accept any rational explanation, even conspiratorial as soon as it sounds logical.

How long will the return to normal in oil prices take? It’s impossible to predict because we don’t know what will prevail — the evidence of negative factors (overproduction, overstock etc.) or thanatophobia of the trading crowd. We also cannot exclude the forthcoming of a black swan in shape of anything. e.g. afore-cited war.

One thing is clear: if nothing extraordinary happens and the present dynamics in oil production and consumption remains intact, the oil will continue its return to normal — $100 and higher — even without OPEC countries reaching any agreement on production cuts.

I’d like to draw a practical conclusion to this text which could be useful in trading and investing. It’s pretty obvious: since the mythological and irrational nature of the market’s psychology precludes us from predicting price fluctuations, we can achieve success in two other venues: parsing the reality in order to discover its current concept of normal and conforming our moves with the existing trends and not with their (inexistent) rational interpretations.

Sergei Golubitskiy can be contacted at EXANTE

The participants of financial markets are possessed by a need for rational interpretations of reality which they are doomed to contemplate without a chance to change a thing. Something similar happened at the dawn of mankind when fear and weakness in the face of nature found consolation in a Supreme Devine Force suitable for «explaining» anything.

The major problem of rational interpretation of the events happening in the financial markets consists not in its uselessness but in serious material losses it entails. Today we will attempt to reveal the pitfalls laid by rational interpretations using oil futures as an example.

In the summer of 2014 both WTI and Brent grades of crude oil started a free fall causing a global change in the development of world economies. Suffice it to say that as a result of the dramatic oil price depreciation Russian Currency Rouble lost half of its value within several months.

Sanctions and — to a greater extent — counter sanctions sped up the involution of the Russian economy heavily dependent on exportation of raw materials, and pretty soon the Brent price became almost an exclusive booster for the local stock market. Oil goes down — Rouble goes down — both Russian market indices — MCX (valued in local currency) and RTS (valued in USD) — go down too. One could trade this dependency fool-proof.

It might look strange that a single factor, even such important as oil, could supersede in the eyes of the stock market the entire diversity of economic, social and political reality of a big country. However psychologically the explanation for this phenomenon is pretty obvious. If the Russian stock market would have been guided by the real economy drowned in gloomy predictions, the value of RTS index would be 90 points instead of 900 as of today.

Stock exchange is a living organism and similar to a human being it can’t survive in a fully negative environment. No wonder the financial markets constantly catch at a straw trying to justify their positive motion.

In January 2016 the Russian stock market found such straw in the same oil which suddenly stopped its overwhelming collapse (in 19 months Brent lowered from $105 to $27) and switched to an even dizzier ascent winning back more than 30% of its losses in just 5 months.

Since oil has become a sole motive for fluctuations of the Russian stock market traders and investors instantaneously turned into oil-and-gas experts dexterous at giving rational interpretations for each and every move of The Feeding Mom («Matushka Kormilitsa» — Russian traders slang for the oil).

In January 2016 all grounds for rationale suddenly washed away. It was easy to give logical explanations to the drop in oil prices since it occurred simultaneously with a dramatic increase both in production and reserves. However, the switch into rally happened when the growth of production and reserves accelerated even further due to the removal of sanctions against exports of Iranian oil and the inability of OPEC countries and Russia to negotiate at least a freeze of production at current levels. Hundreds of tankers queued at big harbours in wait of unloading only completed the gloomy picture.

When the rational logic comes to grief there is always conspiracy theory ready to extend a helping hand. «The oil had to drop initially because there were overstock and overproduction, — assert newly-fledged experts, — but today it must rise because the insiders know a horrible secret: no matter how much you boost the production the demand for oil will inevitably exceed all bids in the nearest future!»

Alternative conspiratorial rationale: the insiders acquired some secret information about oncoming geopolitical upheavals (a war?) which will result in the oil prices equal to that of gold!

Finally, there is always an old ruse at hand borrowed from the legacy of formal fallacies: in our case — ignoratio elenchi or irrelevant conclusion: it’s of no concern that the crude oil production keeps on growing and the warehouses burst since there is a chronic shortage of its fractions — gasoline, kerosene, HFO etc. — and it justifies further price increases.

All these clumsy attempts to rationalise trend changes in oil futures are pure crystal gazing because the market movements are not the reflections of reality but a product of our mythological perception multiplied by fine manipulation techniques.

The markets are originally endowed with a centrifugal force which tears the behaviour of securities from their formal raison d’etre i.e. business activity of their issuers in the real world. This alienation became the further the stronger and in the mid 90s it reached its apogee when the financial markets started to live their own independent lives.

The reason for this complete alienation of the markets from the real world lies far from any conspiracy theory and is pretty obvious: the further the economy develops the trickier become its backbone connections.

At a given moment the influences of the real world over financial markets become so multifaceted that they simply fail further rational accounting. Externally this condition looks like a cause-and-effect entropy, complete chaos which is impossible to explain logically.

In a situation where the price changes in the market are determined by a vector compounded of myriad reasons the majority of which are publicly unknown, any attempt to give a rational explanation to these changes looks ridiculous.

Market movements are the products not of individual motivations but of the mob psychology. This main motivation of this mass consciousness constitutes mythological thinking based on imaginary, emotional, irrational and the priority of bright images.

In our example with crude oil prices the attempts to rationalise their erratic movements are conditioned by unconscious thanatophobia, fear of death, associated with sharp drops in petroleum prices. In the collective subconsciousness of market participants there is a strong notion of an economic collapse inevitable in case of oil prices falling below $ 10.

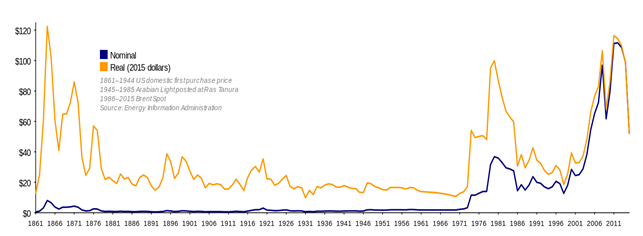

Well, let’s look at the following chart:

This is the history of oil prices traded at organised markets for the last 150 years. If we compare the price spikes with significant historical events, we will see that some of these events caused overwhelming rises (e.g. World War I, Energy Crisis of the 70s, Recovery after 2008 derivatives meltdown), others, contrariwise, led to collapses (Iraqi invasion of Kuwait in 1990), but most of the time oil prices just ignored social and political shocks (all the way through The Great Depression, World War II, Caribbean Crisis and Vietnam War).

Our inability to predict rises and falls of oil prices based on certain historical events is nonetheless compensated by another correlation implied by the chart. Any time a sharp move in oil prices occurs, the mass consciousness of market participants records a collective safety risk, arouses anxiety and causes strong reaction directed at returning things to normal.

Since the end of 90s the status quo of the oil market was associated with a constant rise in prices. That’s why the flash-like collapse caused by financial crisis of 2008 was quickly compensated by an even more impressive rise.

On the subconscious level the market always tries to bring the situation to normal. The only variable here is the notion of normal which changes in time and place. Today this normal envisions the oil prices at $100 and growing. Why? Because the concept of growth is the core of all modern paradigms of social development. Growing is normal, anything else is anomalous.

This propensity to the normal has no rational explanation that’s why appealing to the tankers queued at harbours, production levels, unsuccessful OPEC meetings or Cushing storage hub is meaningless. The driving force behind today’s oil flight from $27 to $52 is hidden in mythological perception of reality which in its turn demands the return to normal.

This is why it seems to us that the oil prices grow out of the blue. The same very reason supports our readiness to accept any rational explanation, even conspiratorial as soon as it sounds logical.

How long will the return to normal in oil prices take? It’s impossible to predict because we don’t know what will prevail — the evidence of negative factors (overproduction, overstock etc.) or thanatophobia of the trading crowd. We also cannot exclude the forthcoming of a black swan in shape of anything. e.g. afore-cited war.

One thing is clear: if nothing extraordinary happens and the present dynamics in oil production and consumption remains intact, the oil will continue its return to normal — $100 and higher — even without OPEC countries reaching any agreement on production cuts.

I’d like to draw a practical conclusion to this text which could be useful in trading and investing. It’s pretty obvious: since the mythological and irrational nature of the market’s psychology precludes us from predicting price fluctuations, we can achieve success in two other venues: parsing the reality in order to discover its current concept of normal and conforming our moves with the existing trends and not with their (inexistent) rational interpretations.

Sergei Golubitskiy can be contacted at EXANTE

Last edited by a moderator: