You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

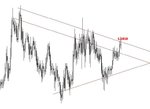

EURGBP : Week close at 0.6969.

This cross pair is still in a descending triangle, and I am expecting for nice move once its out of it. Maybe I will be entering short even inside the triangle. Target for this position is at least 0.6770. This week we saw another failure to break upside, and now its going down. The market is defiantly trying to take maximum about of this pattern, and this week is a proof for that. I had a short position last week for possible downside break, but the trade was closed at entry level. Now I will be taking another position for very same possible break. Indications are for this break to come soon, but we will have to see if this really is the case.

This cross pair is still in a descending triangle, and I am expecting for nice move once its out of it. Maybe I will be entering short even inside the triangle. Target for this position is at least 0.6770. This week we saw another failure to break upside, and now its going down. The market is defiantly trying to take maximum about of this pattern, and this week is a proof for that. I had a short position last week for possible downside break, but the trade was closed at entry level. Now I will be taking another position for very same possible break. Indications are for this break to come soon, but we will have to see if this really is the case.

Attachments

EURJPY: I mentioned last week that short position may be an option, but we got upside move in the beginning of the week, followed by seloff on Friday after bearish candle on Thursday. Now short position on this pair seems to be a good possibility, and I will be looking for sell opportunity if things will not change in the beginning of the week. Of course, possible target area is mid-low 126s, but I am looking for more aggressive move towards 124.50/80 and maybe eventually 121 figure to come. Sell is defiantly considered in the beginning of the week. Keep yourself updated.

That is it for now, not as much as usually, but situation is mixed on most of the majors USD crosses, and taken that Friday is the reason for this picture, I will have to look at the beginning of the week at least to decide what I do next.

I wish to all to have a profitable week to come,

Best Regards,

Rezo Shmertz

That is it for now, not as much as usually, but situation is mixed on most of the majors USD crosses, and taken that Friday is the reason for this picture, I will have to look at the beginning of the week at least to decide what I do next.

I wish to all to have a profitable week to come,

Best Regards,

Rezo Shmertz

Attachments

Newtron Bomb

Guest Author

- Messages

- 1,602

- Likes

- 87

rezo

Lovely analysis really nice to see the long term view.

Clear and simple once again the fx market showing that if the TA doesnt stand out it isnt there 😉

Lovely analysis really nice to see the long term view.

Clear and simple once again the fx market showing that if the TA doesnt stand out it isnt there 😉

Hi Newtron Bomb, thanx.

Well, here you go - another good example of Friday trap. I stick to my plan of waiting 2-3 days for situation to become clear. Despite what is going today, I prefer waiting. There is enough room for move (see the table). If I get to grab part of it, its good enough...if not - I will wait again. No rush. I thought eurjpy or eurgbp would become a confirmed sell today, but at the moment those are not confirmed also. For now nothing for me - no trades, but I am watching the market.

For all those trading out there - Best Luck and best Trades!

Regards,

Rezo.

Well, here you go - another good example of Friday trap. I stick to my plan of waiting 2-3 days for situation to become clear. Despite what is going today, I prefer waiting. There is enough room for move (see the table). If I get to grab part of it, its good enough...if not - I will wait again. No rush. I thought eurjpy or eurgbp would become a confirmed sell today, but at the moment those are not confirmed also. For now nothing for me - no trades, but I am watching the market.

For all those trading out there - Best Luck and best Trades!

Regards,

Rezo.

Ok, Monday closed. here is what I got:

The only possible trade for the coming sessions is long on USDJPY. The trend down is very strong, but technically the picture is looking for some upside move. Estimated target is 112.05 - just around the Sep 22 gap. Stop is appx 50 pips - will determine exactly later (maybe little more, maybe less). Prefered scenario is if the price declined to buy cheaper. Maybe around 110.50s will be a good entry. But taken target is 112.05, stop lets say 60 pips, then 120 target is good enough -> So any price below 110.85 will be good to enter AFTER I finally decide. And no entry will be considered above 110.85...

For now, only initial confirmation for long position is in place. Will be looking for good entry signal now. Lets see how it goes. For now this is it,

Take care,

Rezo.

The only possible trade for the coming sessions is long on USDJPY. The trend down is very strong, but technically the picture is looking for some upside move. Estimated target is 112.05 - just around the Sep 22 gap. Stop is appx 50 pips - will determine exactly later (maybe little more, maybe less). Prefered scenario is if the price declined to buy cheaper. Maybe around 110.50s will be a good entry. But taken target is 112.05, stop lets say 60 pips, then 120 target is good enough -> So any price below 110.85 will be good to enter AFTER I finally decide. And no entry will be considered above 110.85...

For now, only initial confirmation for long position is in place. Will be looking for good entry signal now. Lets see how it goes. For now this is it,

Take care,

Rezo.

Hi everybody,

Well, usdjpy is around 110 50, and I am considering to buy the pair despite other majors looking bullish against US dollar. I have all the terms for entering the trade, and unless those terms change, I will enter once I have a confirmed entry.

Another pair to watch is the eurgbp - its still in the triangle, and at the moment is trying to break upside. I thought it was going to be a sell, but as it looks at the moment, we may get a break upside with a target of recent highs (7180 - 7220). That is a pretty good target, and I will consider entry for the upside move today-tomorrow. It is knocking on the upper boarder of the triangle once again now, so lets watch what will happen. I will post once I decide.

Good Trading

Well, usdjpy is around 110 50, and I am considering to buy the pair despite other majors looking bullish against US dollar. I have all the terms for entering the trade, and unless those terms change, I will enter once I have a confirmed entry.

Another pair to watch is the eurgbp - its still in the triangle, and at the moment is trying to break upside. I thought it was going to be a sell, but as it looks at the moment, we may get a break upside with a target of recent highs (7180 - 7220). That is a pretty good target, and I will consider entry for the upside move today-tomorrow. It is knocking on the upper boarder of the triangle once again now, so lets watch what will happen. I will post once I decide.

Good Trading

Attachments

EURGBP currently @7050, I think we are seeing a break upside, but lets see the day close and then look for good entry. If it fails to close above the triangle border, it will be sign that we may still reverse downside.

Looks like a good trade for 7180 at least if confirmed.

Looks like a good trade for 7180 at least if confirmed.

Great breakthrough on EURGBP (now@7085). As I said, I will wait for day close and then start seeking for long entry. @ the moment, close anywhere above 7025 is a close above triangle, so I think this is not a question anymore. Lets hope I get a good entry before it reaches the expected target of 7180-7220 🙂

As for USDJPY - looks like an intervention just started, but I am not looking to buy because of the intervention - lets look for at least another 15- 60 mins...may still be a buy here..although selling pressure is much stronger than I thought it would be...need to be careful

As for USDJPY - looks like an intervention just started, but I am not looking to buy because of the intervention - lets look for at least another 15- 60 mins...may still be a buy here..although selling pressure is much stronger than I thought it would be...need to be careful

In addition to EURGBP and USDJPY I am looking at:

short USDCHF for 1.2880

long EURUSD for 1.1910

All these trades are possible in near 24h, except for long usdjpy - I may stop looking at it as a possible buy - trend is very strong, and retracement, even if occurs, may be very weak. In brief, it may be dangerous to long this pair.

Still watching the market.

Good Luck Everyone!

short USDCHF for 1.2880

long EURUSD for 1.1910

All these trades are possible in near 24h, except for long usdjpy - I may stop looking at it as a possible buy - trend is very strong, and retracement, even if occurs, may be very weak. In brief, it may be dangerous to long this pair.

Still watching the market.

Good Luck Everyone!

Ok, going to take long position on usdjpy at around 109.50 with stop at 108.90 and target 112.05. I still do ont put an order, prefer live entry, but thats the leves I will be looking to enter. This plan is active till end of a day, i.e. for another 5 hours to come. I may enter lower or higher, depending how it goes.

Had my eye on USDCHF since last week. Was going to short it back then, but I think now it still is not to late. Target is same - 1.2870. Will be looking to long the Euro as well for retest of 1.19 levels. Target will be set @1.1905. Usdjpy scenario will be canceled with this hour close as posted earlier. Other trades on watch:

long audusd

long eurgbp

short usdcad

good luck!

long audusd

long eurgbp

short usdcad

good luck!

Will buy euro, swissy and most probably canadian as well - sell USD on all:

long euro for 1.1930, that will be done if I get a good entry. stop is about 70 pips, maybe more, so I may pass this one because of poor r:r ratio

short usdchf for 1.2870 - this one looks good

short usdcad for target 1.3080

at the moment swissy trade looks best, but as you know I will open maximum of 3 trades at the time; as an alternative, there are 2 more pairs on watch:

long audusd for 7155

long eurgbp for 7180 - 7220

Good trading 🙂

long euro for 1.1930, that will be done if I get a good entry. stop is about 70 pips, maybe more, so I may pass this one because of poor r:r ratio

short usdchf for 1.2870 - this one looks good

short usdcad for target 1.3080

at the moment swissy trade looks best, but as you know I will open maximum of 3 trades at the time; as an alternative, there are 2 more pairs on watch:

long audusd for 7155

long eurgbp for 7180 - 7220

Good trading 🙂

there is a little triangle currently on Euro/$ short charts, and I think it should break down to trigger 1.1750 (market needs some retracment) - maybe it will be the best time to enter long. This may bring retracement on swissy as well...

Watching market. I think today may be the trading day

Watching market. I think today may be the trading day

Attachments

Last edited:

This is in no way reco to short for 11750 level - no. The trend upside is very strong, and even though correction is expected, I dont trade corrections. I mentioned the correction as possibility. For me, even trading triangle break against the trend in this situation is considered as dangerous trade (although triangle is a good formation to trade).