Preperation for 5-10-2016

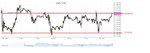

I initially only drew the outer lines. I do not want to draw too many lines but I really felt the additional line at 2144.20 was necessary here. However that means I can't trade that narrow range, and I can only trade the bottom range if Maximum Range Breakout (MRB) + range is more than 5 points. So be it.

I initially only drew the outer lines. I do not want to draw too many lines but I really felt the additional line at 2144.20 was necessary here. However that means I can't trade that narrow range, and I can only trade the bottom range if Maximum Range Breakout (MRB) + range is more than 5 points. So be it.