Preperation 27-10-2016

Long S&P500

Net P/L +3.40 points

Amount 1 Contracts

Opening Rate 2132.3

Close Rate 2135.7

Open Time 10/27/2016 11:05 AM

Close Time 10/27/2016 12:34 PM

Stop loss: below the 2130.70 point

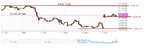

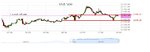

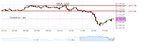

Entry and exit 5m chart:

Reason of closure: adjusted trailing stop loss got hit at ~ + 1.5 R

Comments

Pretty much same reason of entry as last trade. Big rally down, hit support and stayed there for a while so took a long position. However, having defined 2133.94 as a daily resistence level it was probably not so wise to open at 2132.3 but thats up for discussion. That being said if I was counting on price to go up to 2140.70 which is a level of 26-10-2016 I should not have tightened my SL and let that profit run more. I was too late since I wasnt watching but then I atleast should have let it run but my logic was that it had passed the 2133.94 level already. But it went through it convincingly which meant that it was heading for 2140.70 instead..

Interesting trade..

Long S&P500

Net P/L +3.40 points

Amount 1 Contracts

Opening Rate 2132.3

Close Rate 2135.7

Open Time 10/27/2016 11:05 AM

Close Time 10/27/2016 12:34 PM

Stop loss: below the 2130.70 point

Entry and exit 5m chart:

Reason of closure: adjusted trailing stop loss got hit at ~ + 1.5 R

Comments

Pretty much same reason of entry as last trade. Big rally down, hit support and stayed there for a while so took a long position. However, having defined 2133.94 as a daily resistence level it was probably not so wise to open at 2132.3 but thats up for discussion. That being said if I was counting on price to go up to 2140.70 which is a level of 26-10-2016 I should not have tightened my SL and let that profit run more. I was too late since I wasnt watching but then I atleast should have let it run but my logic was that it had passed the 2133.94 level already. But it went through it convincingly which meant that it was heading for 2140.70 instead..

Interesting trade..