isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Moving Average Breadth Charts - status change

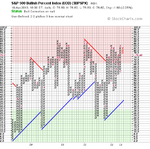

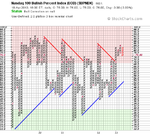

The short term NYSE Percentage of Stocks above their 50 Day Moving Averages chart broke down strongly today to move back to "Bear Confirmed" status. The S&P 500 Percentage of Stocks above their 50 Day Moving Averages chart also moved moved to Bear Confirmed.

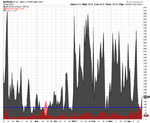

But most notable for me personally in today's big sell off was that the "head coach" - the long term NYSE Bullish Percent Index got within .05 of reversing to a column of Os for the first time since the 20th December. And so there's a good chance of that happening tomorrow if the sell off intensifies.

The short term NYSE Percentage of Stocks above their 50 Day Moving Averages chart broke down strongly today to move back to "Bear Confirmed" status. The S&P 500 Percentage of Stocks above their 50 Day Moving Averages chart also moved moved to Bear Confirmed.

But most notable for me personally in today's big sell off was that the "head coach" - the long term NYSE Bullish Percent Index got within .05 of reversing to a column of Os for the first time since the 20th December. And so there's a good chance of that happening tomorrow if the sell off intensifies.