isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

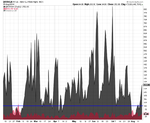

NYSE Percentage of Stocks above their 150 day Moving Averages $NYA150R

The medium term NYSE Percentage of Stocks above their 150 day Moving Averages chart ($NYA150R) broke down yesterday with a triple bottom sell signal on the P&F chart, and so is now on Bear Confirmed status.

The medium term NYSE Percentage of Stocks above their 150 day Moving Averages chart ($NYA150R) broke down yesterday with a triple bottom sell signal on the P&F chart, and so is now on Bear Confirmed status.