Hellena Trade

Well-known member

- Messages

- 272

- Likes

- 48

#GBPUSD

🔔(UPDATE) GBP/USD (4H): SHORT to min wave "4" area 1.30100.

➖➖➖➖➖➖➖➖➖

➡️Consolidation of the flat price has been delayed, but I am not in a hurry to cancel the forecast. I believe that by the end of the week we will see a breakout of the conditional flat boundaries (1.32143 and 1.30846).

Of course, to a greater extent I count on overcoming the level of 1.30846 after which trades will be set to breakeven.

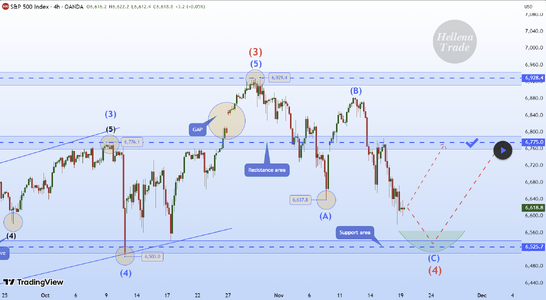

#SPX500

5️⃣ SPX500 (4H): LONG to resistance area of 6775.

➖➖➖➖➖➖➖➖➖

➡️Dear colleagues, according to the last forecast the price is at the support level, but as it turned out, the correction in wave “4” is a bit more complicated than I thought.

Wave “4” consists of three waves “ABC” and should be over soon. The upward movement is still in priority, but I will target the not so distant resistance area of 6775.

Once it is reached, we will think about how to reach higher levels.

#GOLD

🔔(UPDATE)🥇 GOLD (4H): LONG to resistance area of 4382.

➖➖➖➖➖➖➖➖➖

➡️Colleagues, I know you have a lot of questions about overcoming the cost of the support area.

But I've always said that it's just an area, so there can be errors.

At this point, I expect the upward movement to resume despite the fact that there are some changes in the wave pattern for waves “12345”, where wave “4” has gone a bit further than expected.

If the price updates the local low of 3925 - the forecast will be canceled or revised.

🔔(UPDATE) GBP/USD (4H): SHORT to min wave "4" area 1.30100.

➖➖➖➖➖➖➖➖➖

➡️Consolidation of the flat price has been delayed, but I am not in a hurry to cancel the forecast. I believe that by the end of the week we will see a breakout of the conditional flat boundaries (1.32143 and 1.30846).

Of course, to a greater extent I count on overcoming the level of 1.30846 after which trades will be set to breakeven.

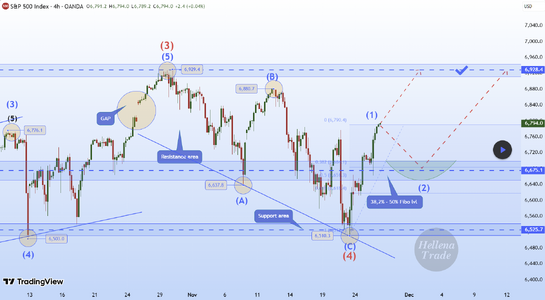

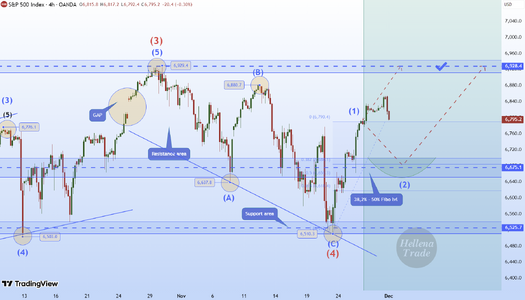

#SPX500

5️⃣ SPX500 (4H): LONG to resistance area of 6775.

➖➖➖➖➖➖➖➖➖

➡️Dear colleagues, according to the last forecast the price is at the support level, but as it turned out, the correction in wave “4” is a bit more complicated than I thought.

Wave “4” consists of three waves “ABC” and should be over soon. The upward movement is still in priority, but I will target the not so distant resistance area of 6775.

Once it is reached, we will think about how to reach higher levels.

#GOLD

🔔(UPDATE)🥇 GOLD (4H): LONG to resistance area of 4382.

➖➖➖➖➖➖➖➖➖

➡️Colleagues, I know you have a lot of questions about overcoming the cost of the support area.

But I've always said that it's just an area, so there can be errors.

At this point, I expect the upward movement to resume despite the fact that there are some changes in the wave pattern for waves “12345”, where wave “4” has gone a bit further than expected.

If the price updates the local low of 3925 - the forecast will be canceled or revised.