Hellena Trade

Well-known member

- Messages

- 272

- Likes

- 48

#EURUSD

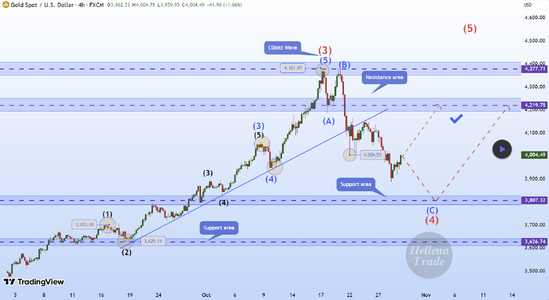

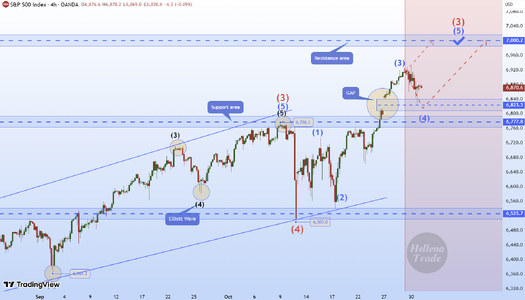

EUR/USD (4H): SHORT to the support area 1.15419.

➖➖➖➖➖➖➖➖➖

➡️The situation is quite interesting. I would not like to recommend selling, but judging by the waves, the price should update the minimum of 1.15419 and complete the wave "C" of higher order near the level of 1.15000.

Then the triangle (ABCDE) will continue to develop. And as much as I don't want to, I will insist that the price will continue the downward movement at least to the support area of 1.15419.

📣Fundamental context

The dollar continues to be under pressure - markets are increasingly laying expectations of a soon Fed rate cut due to signs of a slowdown in the US economy. At the same time, the euro is receiving moderate support due to stability in the eurozone and investors' interest in alternative assets outside the dollar.

In fact, this may lead to some sideways movement, which will be expressed in the triangle (ABCDE).

EUR/USD (4H): SHORT to the support area 1.15419.

➖➖➖➖➖➖➖➖➖

➡️The situation is quite interesting. I would not like to recommend selling, but judging by the waves, the price should update the minimum of 1.15419 and complete the wave "C" of higher order near the level of 1.15000.

Then the triangle (ABCDE) will continue to develop. And as much as I don't want to, I will insist that the price will continue the downward movement at least to the support area of 1.15419.

📣Fundamental context

The dollar continues to be under pressure - markets are increasingly laying expectations of a soon Fed rate cut due to signs of a slowdown in the US economy. At the same time, the euro is receiving moderate support due to stability in the eurozone and investors' interest in alternative assets outside the dollar.

In fact, this may lead to some sideways movement, which will be expressed in the triangle (ABCDE).