Hellena Trade

Well-known member

- Messages

- 272

- Likes

- 48

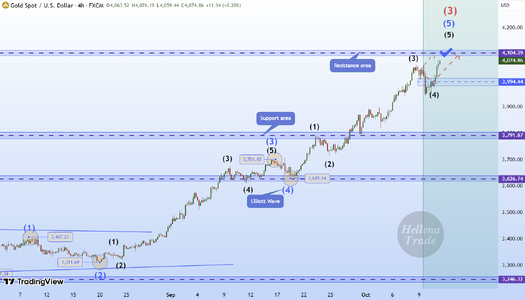

#GOLD

🔔(UPDATE)🥇 GOLD (4H): LONG to support area of 3950.

➖➖➖➖➖➖➖➖➖

➡️The recent confident bounce from the support area is quite telling in terms of the bulls' mood to renew the local highs again.

I think that wave “5” is developing, completing the impulse. After updating the level of 3895.22, I will advise that trades should be set trades to breakeven.

🔔(UPDATE)🥇 GOLD (4H): LONG to support area of 3950.

➖➖➖➖➖➖➖➖➖

➡️The recent confident bounce from the support area is quite telling in terms of the bulls' mood to renew the local highs again.

I think that wave “5” is developing, completing the impulse. After updating the level of 3895.22, I will advise that trades should be set trades to breakeven.