-

Welcome to the Darwinex Forums, these forums are member-run and managed by CavaliereVerde. Member-run forum rules may differ from the site guidelines.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Alternatives to Darwinex

- Thread starter Viro Major

- Start date

- Watchers 32

CavaliereVerde

Senior member

- Messages

- 2,806

- Likes

- 2,745

@Viro Major

Probably you wanted to continue this kind of discussion... 😉

->https://community.darwinex.com/t/last-final-will-a-more-balanced-darwinex/5744

I agree that Darwinex is not the best as pure broker.

Darwinex is still a forex metatrader broker, 100% CFDs

Dukascopy has much more to offer, lot of cool stuff for traders, it is much older and has a very good reputation.

Unfortunatelly Dukascopy has nothing to offer for wannabe money managers.

Probably you wanted to continue this kind of discussion... 😉

->https://community.darwinex.com/t/last-final-will-a-more-balanced-darwinex/5744

I agree that Darwinex is not the best as pure broker.

Darwinex is still a forex metatrader broker, 100% CFDs

Dukascopy has much more to offer, lot of cool stuff for traders, it is much older and has a very good reputation.

Unfortunatelly Dukascopy has nothing to offer for wannabe money managers.

Gargamel

Active member

- Messages

- 244

- Likes

- 474

As I said:I don't know what you want.We are not any more at official forum.They don't want to hear anything from users.They know everything 🙄. Even when there was an official forum they ignored it mostly.Your wishes and proposals are like talking to a wall.Try calling them or send an e-mail and report back how it went 😆.their service which I wish they would expand.

I am here because of some good people so we can brainstorm how to make best use of what is.Discussing about what should be is even more hopeless than it was at the old forum.

This thread will be useful as a post box for alternatives.If one day somebody finds better stuff,we can take our business over there and that is end of story.

By the way,those crooks at google couldn't resist the title of this thread and this forum was temporary for one day on the first page of search results for 'Past month' and fifth page in category 'Past year'. But today they already rectified the mistake.😉

V

Viro Major

Originating from Austria, not Switzerland but targeting the german speaking countries mostly.There is another german company specialising in stocks which obtains a lot higher AuM levels and federates professional traders under its wing. I forgot the name sorry so can’t reference it

Welcome to wikifolio.com | wikifolio.com

Invest in the best wikifolio certificates or publish your own trading idea. Register now and benefit from the best!

Amounts not uncommon (many at 10M+ AuM)

Gargamel

Active member

- Messages

- 244

- Likes

- 474

I looked into Wikifolio a while back and now I have taken another look.It is basically germanic 'Alpari PAMM' jungle.

The setup for investors is a bit iffy,given the German credibility in corporate/financial matters lately and lack of investor's compensation guarantees(at least I didn't find any comparable to UK and Darwinex) and claims of hedging( it could be a bucket shop operation). Anyway it is not available outside Germany,I guess you have to open an account in Germany to invest in wikifolios...

For traders it is an Alpari-style jungle.Traders are pushing as hard as possible to get noticed (plenty of +100% per year,more than 120 investable wikifolios at the moment), with predictable outcome.But new lucky survivors are rising every year to replace unlucky ones on the top of the rankings and provide Holy Grails to investors.

I see no Risk moderation.

Investors are chasing high performers,as usual 😆 .Only 9 traders with conservative metrics have above 1 Mil. AuM.But later I have found only 6-7(15 max.) credible conservative traders . Out of those 9 invested, majority(6) are lucky or have rich friends and not really conservative with credible track-record.

They have a Management fee like Darwinex.Performance fees are liberalized and left to traders to decide(5-30%).A good feature for investors is that Performance fee is on Yearly HWM,which is understandable given the platform is oriented toward Equity trading/investing.

There are more then 25k wikifolios...8400 are investible at the moment and 6-7(estimate) are conservative as I said earlier.

The setup for investors is a bit iffy,given the German credibility in corporate/financial matters lately and lack of investor's compensation guarantees(at least I didn't find any comparable to UK and Darwinex) and claims of hedging( it could be a bucket shop operation). Anyway it is not available outside Germany,I guess you have to open an account in Germany to invest in wikifolios...

For traders it is an Alpari-style jungle.Traders are pushing as hard as possible to get noticed (plenty of +100% per year,more than 120 investable wikifolios at the moment), with predictable outcome.But new lucky survivors are rising every year to replace unlucky ones on the top of the rankings and provide Holy Grails to investors.

I see no Risk moderation.

Investors are chasing high performers,as usual 😆 .Only 9 traders with conservative metrics have above 1 Mil. AuM.But later I have found only 6-7(15 max.) credible conservative traders . Out of those 9 invested, majority(6) are lucky or have rich friends and not really conservative with credible track-record.

They have a Management fee like Darwinex.Performance fees are liberalized and left to traders to decide(5-30%).A good feature for investors is that Performance fee is on Yearly HWM,which is understandable given the platform is oriented toward Equity trading/investing.

There are more then 25k wikifolios...8400 are investible at the moment and 6-7(estimate) are conservative as I said earlier.

Last edited:

Gargamel

Active member

- Messages

- 244

- Likes

- 474

Addition to previous post:

1)Traders must invest in wikifolio at least 5k € or CHF to get label 'Real money' for their wikifolio (547 wikifolios with that label at the moment)

2)Traders don' get all Performance fee they earned during a year,but only a portion of it.Depending on amount of investments in their wikifolio.After more than 125k is invested in their wikifolio,they get 50% of Performance fee and that is Max. 😢.So even if trader demands 30% fee from investors,he can get only 15 % .And than there is a 19% German VAT tax applied🤣.

3) They have also a category of wikifolio managers who are specialized in investments in other wikifolios.Those Portfolio Managers get fixed 10% of performance fees in successful wikifolios contained in portfolio-so part of 'stolen' performance fees from traders can go to Portfolio managers.

4)part of 'stolen fees' from traders is apparently used to cover transaction costs of investors in wikifolio and to prevent Divergence from trader's results in his account,if I understand the scheme correctly

1)Traders must invest in wikifolio at least 5k € or CHF to get label 'Real money' for their wikifolio (547 wikifolios with that label at the moment)

2)Traders don' get all Performance fee they earned during a year,but only a portion of it.Depending on amount of investments in their wikifolio.After more than 125k is invested in their wikifolio,they get 50% of Performance fee and that is Max. 😢.So even if trader demands 30% fee from investors,he can get only 15 % .And than there is a 19% German VAT tax applied🤣.

3) They have also a category of wikifolio managers who are specialized in investments in other wikifolios.Those Portfolio Managers get fixed 10% of performance fees in successful wikifolios contained in portfolio-so part of 'stolen' performance fees from traders can go to Portfolio managers.

4)part of 'stolen fees' from traders is apparently used to cover transaction costs of investors in wikifolio and to prevent Divergence from trader's results in his account,if I understand the scheme correctly

Last edited:

CavaliereVerde

Senior member

- Messages

- 2,806

- Likes

- 2,745

So if we suppose a max performance fee of 30% the trader gets a max of 15%.

It is not more convenient than Darwinex and it is more an alternative to eToro, stockpicking without a serious desktop trading platform and no automated trading.

It is not more convenient than Darwinex and it is more an alternative to eToro, stockpicking without a serious desktop trading platform and no automated trading.

Gargamel

Active member

- Messages

- 244

- Likes

- 474

Well,as I added 4) in my post part of 'stolen fees' finances prevention of Divergence.That is important so investors get what they see and not like at THA darwin where they feel cheated because of divergence.So if we suppose a max performance fee of 30% the trader gets a max of 15%.

It is not more convenient than Darwinex and it is more an alternative to eToro, stockpicking without a serious desktop trading platform and no automated trading.

But this whole set-up is another incentive for traders to push for max. Return to compensate for low % of fees.If normal fee there is around 12% and trader gets 6% at best and VAT eats away another 1%,they are very interested to produce 50 -100% Return per year or more.Very bad environment.

Last edited:

V

Viro Major

Talking about taxes, this morning, it looks like Darwinex made a move to become compliant.And than there is a 19% German VAT tax applied🤣

Why wouldn’t you pay taxes even on performance fees collected ? I mean, it’s a service provided to Darwinex. In a way, it’s actual work

On the Topic of Wikifolio, there are a few things that haven't been mentioned. Mainly the Risk side.

So let me get to it. I'm german and live in Germany. I first tried out Wikifolio way back in 2015, because it was

a very cool "concept" something new and exciting. Gargamel has been so kind to give a little overview.

Plattform:

Wikifolio has it's own interface which is rather simplistic, Traders do not trade with their own Capital, it's

basically demo Money! In order to get the "real Money" Badge a trader has to invest 5k and send wikifolio

their Brokerage statement of the Investment in said wikifolio. This process, back then, had to be repeated every

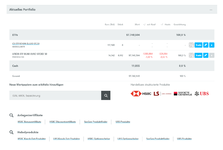

3 Months. Now I won't go any further. So back to the Plattform, as you can see from my Screenshot, a trader can

only buy structured products from HSBC, L&S (will get in to that later) and Socgen. I don't have to tell any of you

what the implications are of such "products". Wikifolio more often than not, has major difficulties with high Vol. days.

Orders can't be submitted, plattfrom is not accesable, Spreads are insane and so on. So all in all from a trading stand point I give it a 3 out of 10.

Regulatory:

This is probably the main issue with investing in Wikifolio. Lang & Schwarz (L&S) is basically their "Market Maker", they handle nearly everything from IPO, CP Managment, Regulatory issues etc. The main Issue I personally have with Wikifolio,

due to the fact that Wikifolios can be bought on exchanges (Stuttgart or L&S) and have an ISIN it sort of gives of the vibe

of a tangible asset class (very often these wikiofolios are premiered in Handelsblatt). But it is not, the buyer of said wikfolio. as with all derivatives has a title against L&S. So if L&S where to go Bankrupt (which is not unlikely) an Investor loses his Investment.

Summary:

I've always said, the basic concept (IPO's, real exchange, PIB's and KiDs) of wikifolio is good, but not refined. It works well for them and the potential glory hunters. Revenue split is a hassle, but overall the negatives (from a trading standpoint) outway the positives. In its current form it is by no way an alternative. If I had the time and financial backing I would create something similar, more accesible, easy on the eye but with "real" products (Futures, Options, Stocks, Forex), proper Risk Management, no phoney trackrecord farming, Demo accounts and so on. But that is easier said than done. As of now I have alot of ideas but lack the Industry background.

So let me get to it. I'm german and live in Germany. I first tried out Wikifolio way back in 2015, because it was

a very cool "concept" something new and exciting. Gargamel has been so kind to give a little overview.

Plattform:

Wikifolio has it's own interface which is rather simplistic, Traders do not trade with their own Capital, it's

basically demo Money! In order to get the "real Money" Badge a trader has to invest 5k and send wikifolio

their Brokerage statement of the Investment in said wikifolio. This process, back then, had to be repeated every

3 Months. Now I won't go any further. So back to the Plattform, as you can see from my Screenshot, a trader can

only buy structured products from HSBC, L&S (will get in to that later) and Socgen. I don't have to tell any of you

what the implications are of such "products". Wikifolio more often than not, has major difficulties with high Vol. days.

Orders can't be submitted, plattfrom is not accesable, Spreads are insane and so on. So all in all from a trading stand point I give it a 3 out of 10.

Regulatory:

This is probably the main issue with investing in Wikifolio. Lang & Schwarz (L&S) is basically their "Market Maker", they handle nearly everything from IPO, CP Managment, Regulatory issues etc. The main Issue I personally have with Wikifolio,

due to the fact that Wikifolios can be bought on exchanges (Stuttgart or L&S) and have an ISIN it sort of gives of the vibe

of a tangible asset class (very often these wikiofolios are premiered in Handelsblatt). But it is not, the buyer of said wikfolio. as with all derivatives has a title against L&S. So if L&S where to go Bankrupt (which is not unlikely) an Investor loses his Investment.

Summary:

I've always said, the basic concept (IPO's, real exchange, PIB's and KiDs) of wikifolio is good, but not refined. It works well for them and the potential glory hunters. Revenue split is a hassle, but overall the negatives (from a trading standpoint) outway the positives. In its current form it is by no way an alternative. If I had the time and financial backing I would create something similar, more accesible, easy on the eye but with "real" products (Futures, Options, Stocks, Forex), proper Risk Management, no phoney trackrecord farming, Demo accounts and so on. But that is easier said than done. As of now I have alot of ideas but lack the Industry background.

Attachments

V

Viro Major

Explore | AMP Futures

CavaliereVerde

Senior member

- Messages

- 2,806

- Likes

- 2,745

I was very impressed by the lenght of the trackrecords, than I noticed that the majority are backtests.

High returns are also in the backtested part.

Only the last 3-4 years yellow-green part is significant.

High returns are also in the backtested part.

Only the last 3-4 years yellow-green part is significant.

V

Viro Major

It’s iSystems white labeled. Only automated strategies. Manual traders are excluded (which by definition would not provide backtests)

Gargamel

Active member

- Messages

- 244

- Likes

- 474

Last week I took a closer look at new eToro set-up:since 2015 new Popular Investor (trader) programme with incentives to act responsibly and with look at long-term success for trader and copiers(investors) and since August 2020 normalized trading conditions for FX (before it was really silly-spread on E/U 3 pips for example).eToro offers nothing to traders:

-bad trading conditions,bad reputation and unstable prospects for AuM,

It is still a jungle with only minor Risk management-traders that breach very generous Risk level 7 are stopped from being copied,while in eToro Portfolio programme they are much more severe and 5% DD is enough to be dropped out of portfolio.

Basically the system is geared towards psychological incentives to behave responsibly-like Ayondo platform tried and failed,while Darwinex invested into Risk-management algos to protect investors.

eToro stands a chance to actually succeed as Retail investment platform because they have secured big AuM for traders with their aggressive marketing campaigns and thus incentive is there to behave properly,BUT majority of that AuM is Dumb money.That means to get noticed trader must chase max.% and must be very active or all time in the market.That brings predictable cycle of rapid popularity of some traders when they get discovered by crowd and then slow or fast dissipation of AuM when trader doesn't live up to unrealistic expectations and ridiculously short attention span of such investors.

I did find a few conservative traders with solid following,so there is a hope for long-term success.But majority of stars are very risky stock-pickers and crypto traders.

Very interesting feature is that investors don't pay any performance fees and that makes great incentive to push that 'Copy' button.They pay only trading spreads like chosen trader.That means company is paying Popular Investor rewards out of its pocket.For 'Red star' traders it is fixed monthly sum of 400-800 USD,while 'green and black star' traders get 1,5-2,5% (yearly)of AuM invested in them on yearly average AuM or something like that.That means there is no incentive to push for max.Return.But,Catch 22 is trader must push for max. Return to get noticed in the first place.Than he must continue to perform on high level or Dumb money goes looking for next Holy Grail...

The 'blue star' traders- novices accepted into programme and vast majority of other users don't get anything for being copied 😉 .

Another twist is 'skin in the game' feature:blue star traders need at least 1k trading capital,red star traders 5k,green star traders 25k and black star traders 50k trading capital.If that is not met trader cannot progress into higher tier and thus his max.AuM and rewards are limited to his tier.The serious AuM starts with 'green star' tier: above 500k,but trader needs to post 25 k in his trading account to become eligible and get some noticeable income from his activity.For poor traders it is a bit too much.But I like the idea in general.Trader and copiers are trading with same risk!

Also scalping is not allowed and can get trader banned altogether.Algo traders are not welcome.Trading platform is only one(no MT4/5) and made for stock pickers and swing fx traders.No migrations of trackrecords allowed.Broker is bucket shop.

Traders that are accepted into Popular Investor programme(starting as blue star and getting no rewards) must post their photo for everyone to see and their real name and country of residence.

There are at the moment 45 traders with more than 1 Mil.AuM.

For illustration purposes I borrowed a table made by one eToro user in Autumn 2019 about Elite Investors(green and black star traders at that time). That is significant because today eToro in its marketing materials is pointing out 29% average yearly profit in 2019 for 50 most invested traders.

How it works😀umb money is making those green and black star traders continuously by posting AuM to them and ruining them(they lose their star status) by withdrawing AuM for whatever reason. So there are always half of elite traders on their way out for daring to go into DD that lasts a while or even stagnating for several months in a row.And there is half of fresh Holy Grail traders with abnormal recent gains,But while first group was invested for a while,second group just got invested and thus those elevated Returns were not pocketed by majority of copiers.The only entity making money consistently is broker of course.

ATH stands for all time high.Yellow traders went bankrupt or retired during previous 12 months.In left column traders in red are those with more than 12 months since ATH.Exactly half of them😉.Green are those at ATH .

In right column we can see how far were traders in % from their ATH.

Basically 'red star' traders are eToro equivalent of Darwinia.They get 400-800 USD monthly while they are still in that tier.No other rewards.But they must trade with at least 5k capital and maintain above 50k AuM and at least 10 active copiers on average.

Peculiarities : everything is in USD although broker and customers are in EU.

UK customers are under UK regulatory regime and everybody else under Cyprus regime.

There is 1 Mil. deposit insurance for customers of both branches.Most represented country for customers and Elite traders is UK,while there is not much activity in this forum about eToro.

Company claims 14-15 mil. registered customers but there are less than 800K public, verified accounts,many of them inactive.They are getting more and more customers from Middle East and SE Asia.Big growth potential.Also now with normalized Fx trading conditions they might get much more customers from Eastern Europe than now is the case.

CavaliereVerde

Senior member

- Messages

- 2,806

- Likes

- 2,745

It is a bit like 200k users of this forum... 🤣Company claims 14-15 mil. registered customers but there are less than 800K public,

Many investors have a private profile and by the way even 800k is an impressive number.

eToro makes much more sense for a copier/investor than for a trader.

Gargamel

Active member

- Messages

- 244

- Likes

- 474

Addendum:there are 1309 Popular Investors(PI) in programme.

5 black stars with more than 10 Mil.AuM

42 green stars with 500K-10 Mil. AuM

around 200 red stars with 50-500k AuM

other 1000 PI's don't get any rewards for being copied.

Green star traders must sign an exclusivity contract with company or their payments are blocked.

Black star traders must be financial professionals or accumulate 3 years track-record in the programme.

Company staff is monitoring via weekly video-calls the mental state of green/black star traders to make sure they are OK.They also have Personal account managers and various perks.

5 black stars with more than 10 Mil.AuM

42 green stars with 500K-10 Mil. AuM

around 200 red stars with 50-500k AuM

other 1000 PI's don't get any rewards for being copied.

Green star traders must sign an exclusivity contract with company or their payments are blocked.

Black star traders must be financial professionals or accumulate 3 years track-record in the programme.

Company staff is monitoring via weekly video-calls the mental state of green/black star traders to make sure they are OK.They also have Personal account managers and various perks.

V

Viro Major

This is a trading (not social) company that understands perfectly well what people want ! Finally....

I’ve spent more time diving into all the services ran by Dukascopy, which is an exhaustive list and really takes some time because their numerous websites (trading, bank and crypto) are very dense in offers.

Honestly, I believe it’s the company I saw who understands the most their client base, wishes and needs. I’m very surprised at how quick they release features that are spot on up to showing accurate expertise and talks to broad or niche audiences the same. Uktimately, it’s a perfect partner and right now I have no complaints.

So now, I have many accounts with them (still 0 with Darwinex but soon enough in January)

* 5 trading ones, including 1 which has a XAU base currency for transparent investment also when flat, and 2 USD ones which accept Bitcoin and Ethereum deposits and withdrawals (so practical)

* their managed fund account

* the binary one which I don’t care too much about if at all, but the interface is very neat again and the best I’ve seen in that field

* one swiss multi-currency bank account, where the card is tied to and will also serve to touch financial rewards for participating at 2 of their cryptocurrency programs. Acquiring DUK+ coins soon which will pay up to 70% in DUK+ per year or about 15-30% in EUR. But my aim is to join the liquidity rebate pool program and touch a share of 1% of the commissions generated by the broker at the global level. The interests touched will be lower at about 10%-15% (for now) but fluctuating over time based on adoption, but I believe in the long run it might pay of as the smartest move

Their management interfaces are so slick, clean and clear, I’m amazed how they planned everything ! The leadership just knows what they do and how to nest stuff

There is just too much good stuff to dig out about this broker. Can’t explain it all

Last edited by a moderator:

V

Viro Major

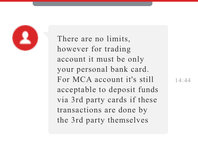

Something rare, Dukascopy doesn’t require to respect the close loop policy : funds deposited by card can be withdrawn by wire transfer... and vice-versa. That can save on fees since wire transfer withdrawals are a fixed fee but card deposits accommodate for speed

You can even deposit using 3rd party payment methods to the bank account before transfering to trading account. Talk about unseen convenience...

More than a gimmick, the card permits to save on withdrawal fees and has high limits (9k EUR per day to 50k per month). Online payments are free and ATM withdrawals are 1% (for reference, Darwinex in and out by card = -1.2% due to close loop policy). Most importantly, the spending is available straight away without transfer wait

Lastly, no stupid limits applied on any funding methods!

Please stop for a while the focus on quant analysis and release a real broker

You can even deposit using 3rd party payment methods to the bank account before transfering to trading account. Talk about unseen convenience...

More than a gimmick, the card permits to save on withdrawal fees and has high limits (9k EUR per day to 50k per month). Online payments are free and ATM withdrawals are 1% (for reference, Darwinex in and out by card = -1.2% due to close loop policy). Most importantly, the spending is available straight away without transfer wait

Lastly, no stupid limits applied on any funding methods!

Please stop for a while the focus on quant analysis and release a real broker

Last edited by a moderator:

TLN

Well-known member

- Messages

- 259

- Likes

- 411

Yes. This is also my concern.Lastly, no stupid limits applied on any funding methods

Why Darwinex creates a stupid rule like max 10k$ for Card. Max 5k$ for Skrill.

Very inconvenience for some like me.