You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Have you ever just jumped into a trade without understanding the trading environment, meaning whether the market was trending, range bound or close to a major turning point (higher time frame supply or demand) only to have the trade stop out? Of course you have…we’ve all experienced that disappointment in our journey of discovery through this world of market speculation.

To prevent this from happening too often, traders must develop a systematic approach that takes into account the environmental condition on every trade. The objective is to guide a trader into a better decision making process.

Trading Risk, Reward and Probability

The three main factors one must focus on as a trader are risk, reward and probability. In my experience as...

Many traders look to technical indicators for clues as to where price action will be moving in the future. There are many problems associated with this approach. First and foremost, technical indicators lag current price. The indicators are created from data that is compiled from where price has been at some point in the past, the rate at which it is changing, and perhaps use volume as an additional filter. Technical indicators are simply a mathematical way of analyzing and representing price action and offering a different perspective of what price is doing. A trader should never rely exclusively on an indicator for a buy or sell signal. However, when used in conjunction with price behavior analysis, a trader can gain confidence for...

Advantages of a Forex Trading Career

There are several advantages that a career as a forex trader, also known as a foreign exchange trader, offers and these include:

Low Costs

Forex trading can have very low costs (brokerage and commissions). There are no commissions in a real sense–most forex brokers make profits from the spreads between forex currencies. One does not have to worry about including separate brokerage charges, eliminating an overhead. Compare that to equity or other securities trading where the brokerage structure varies widely and a trader must take such fees into account.

Suits Varying Trading Styles

The forex markets run all day, enabling trades at one’s convenience, which is very advantageous to short-term traders...

Whether you're a seasoned trader or new to the forex market, the myths about forex trading are always swirling around you. These myths can potentially affect anyone, no matter how long they have been trading. By knowing some of the major myths, traders can avoid unnecessary frustrations. While there are potentially many trading myths, we'll look at 10 that come up often and affect every stage of development – from why people get involved in forex to developing strategies.

1) Get Rich Quick

Advertising has rapidly expanded the retail market in forex. This has brought many people into the arena who are on a quest to get rich quick (or with little effort). This, unfortunately is very rare indeed. Trading takes patience and there is no...

The World Trade Organization (WTO) was established on January 1, 1995. The aim was to enhance global trade and economic openness, but it has been a source of controversy ever since. The WTO therefore sits as a force for trade during a time when globalization has led many to favor protectionism instead. While many economists believe that free markets and open trade raises all ships, many others point to evidence that unregulated free trade can be harmful to some smaller or developing nations, or to smaller or developing industries within nations.

Politics and Trade

The birth of the WTO was more of a continuation than a truly new creation. Its predecessor, the General Agreement on Tariffs and Trade (GATT), shared its lineage with Bretton...

The average person experiences the value of currency as fairly stable from day to day. The price of a cup of coffee every morning is around $1.50, the fixed-interest car payment and mortgage are the same every month, and for a salaried worker, even the paychecks are identical. The fact that the value of currency is constantly fluctuating in relation to other currencies only seems to matter for most people when planning a foreign trip or making an internet purchase from a foreign website. This limited view, however, is mistaken.

The indirect impact of exchange rates and their fluctuations extends much more broadly and deeper in ways that affect several of the most important aspects of our economic lives—like how long it takes to get a...

Every foreign exchange trader will use Fibonacci retracements at some point in their trading career. Some will use it just some of the time, while others will apply it regularly. But no matter how often you use this tool, what's most important is you use it correctly every time.

Improperly applying technical analysis methods will lead to disastrous results, such as bad entry points and mounting losses on currency positions. Here we'll examine how not to apply Fibonacci retracements to the foreign exchange markets. Get to know these common mistakes and chances are you'll be able to avoid making them and suffering the consequences in your trading.

Don't Mix Reference Points

When fitting Fibonacci retracements to price action, it's...

Is there anything more frustrating than taking a breakout trade to have it fade back into its previous range and stop you out?

What if you could learn to take advantage of these so called ‘fakeouts’ with a clear, simple trading system that has a great risk to reward ratio?

Here is a strategy I have been using to successfully take advantage of false breakouts that occur on a regular basis throughout different currency pairs. I’ll take you through a trade I took recently so you understand this strategy in 5 simple steps.

Step one: Identify support and resistance

I am a strong believer that support and resistance levels should be obvious. I am interested in levels everyone else is aware of and looking at. An exercise I often suggest is...

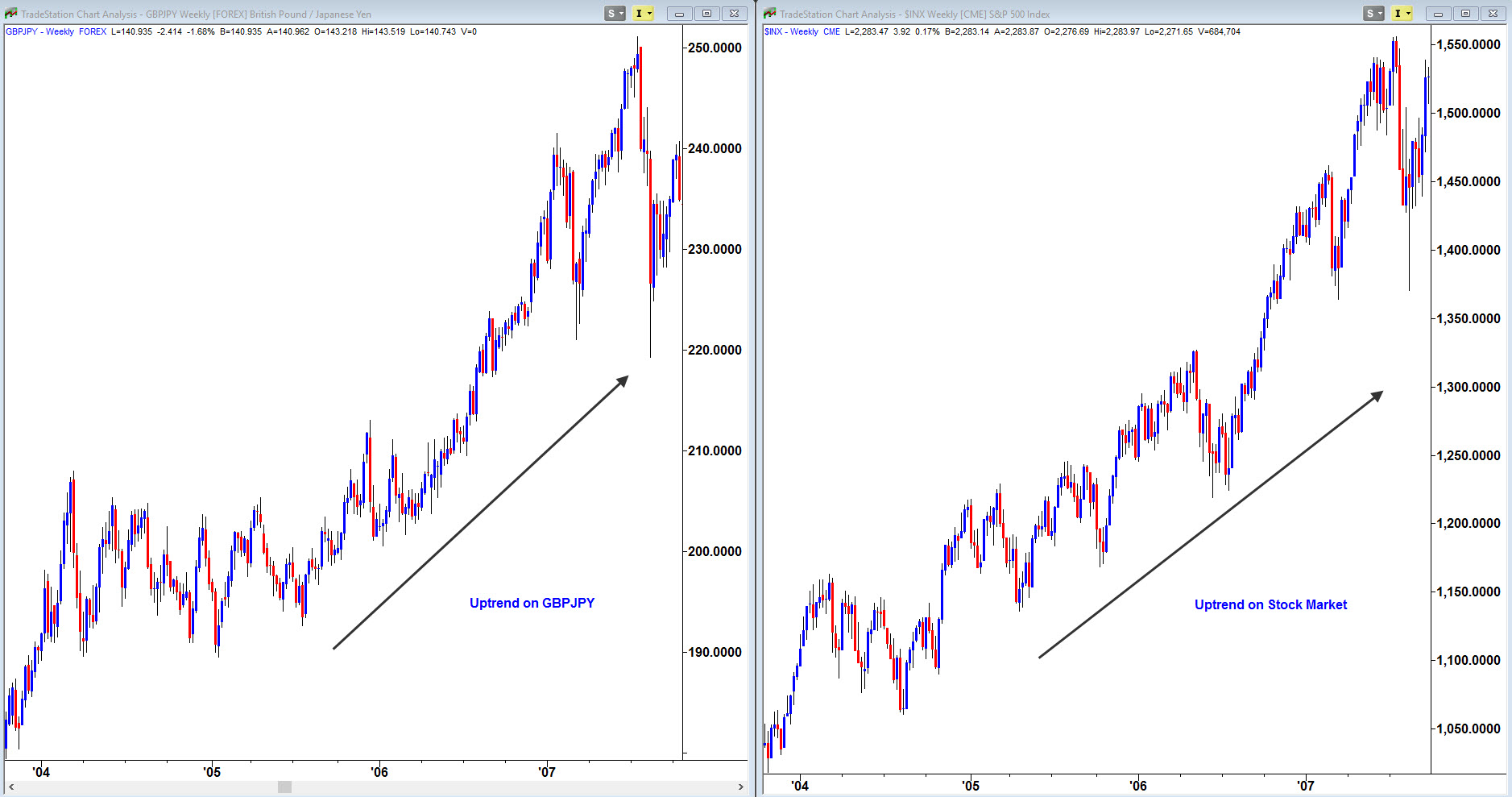

This article will show you how to use a smaller economy’s currency to help you decide what to do with a larger economy’s currency.

Just like in the stock and futures markets, there are always things that seem to lead the way of the larger markets. For example, very often a few of the FAANG stocks (Facebook, Apple, Amazon, Netflix, Google/Alphabet) will lead the S&P 500 and Nasdaq higher or lower, or even just watching the Nasdaq in futures will often lead the S&P futures market. In Forex, oftentimes a smaller currency pair will lead the direction of a larger pair.

Now, when I say smaller vs. larger currency pair, what I’m really referring to is the respective size of the economy, or Gross Domestic Product (GDP). Looking at the last...

Hello

traders! This week, my Lesson will show how to use multiple time frames to

trade the Forex market. In the grand scheme of this core strategy, we recommend

using three time frames to help make your investing and trading decisions,

whether you are trading stocks, Forex, Options or futures. The first time

frame, or largest time frame, is to determine where we are in the ‘big

picture’, essentially showing us where the biggest institutions are trading.

The next time frame down shows us the direction/trend between these

institutional levels. And the third or smallest time frame show us smaller

supply and demand zones so we can join the trend in between those the larger

time frame levels. Pretty easy, huh? Let’s get into a bit more...

The currency price of one country becomes stronger or weaker against another country's currency on a daily basis, but what exactly does that mean for those who don't trade in the forex market? Currency exchange rates affect travel, exports, imports and the economy. In this article, we'll discuss the nature of currency exchange and its broader impact on people and the economy.

For the sake of this article, we will be using the relationship between the Euro and the U.S. dollar as our primary example. More specifically, we will be discussing what happens to the economies of the U.S. and Europe if the Euro trades markedly higher against the U.S. dollar. Although the Euro has recently lost ground against the U.S. dollar (1 USD = 0.89 EUR)...

A struggle many traders tend to have, and one that makes it hard to be a good trader, is overthinking. Whenever I teach, right off the bat I ask my students one simple question: Have you ever been emotional about money at some point in your life? Without doubt, every hand in the room is raised. Obviously, I already knew the answer; but I ask the question because most of us never think about this simple dynamic and its impact on our trading goals.

From a young age we have been taught that it is good to be right in work and in play, like our grades at school, during sports and in day to day business. The problem is, you take this attitude to the market and you will inevitably fail. You can be right nine times out of ten, take just one...

Over the last 15 years that I have been trading, I have made efforts to fully understand multiple asset classes as I believe this is the best way for anyone to ensure maximum diversity, minimum risk and, of course, better profits across their investment portfolio. While I have always been very active in FX trading, it has always been options trading which sparked the most interest for me due to its multiple layers of complexity and strategy. With so many contracts, expiry dates and a whole host of strategies ranging from iron condors and strangles to vertical spreads, options are truly unique and allow us to make money from markets moving up, down and sideways, too. They can be used for position protection and stop losses as well, with...

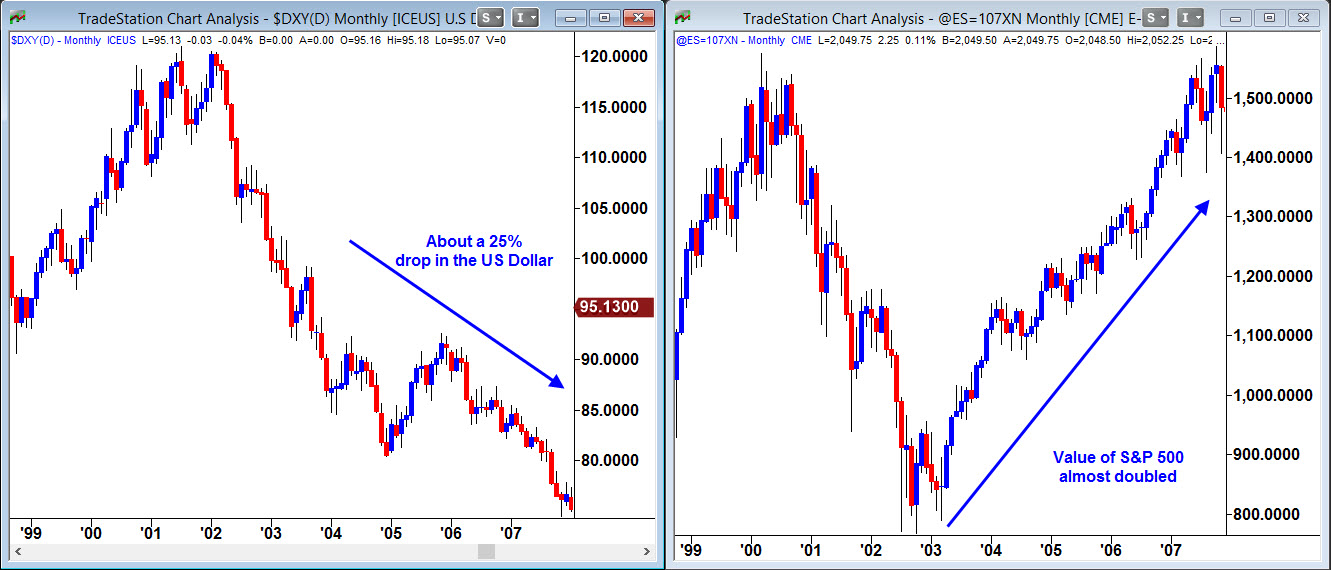

One of the more interesting and helpful tools we have as traders is to use the correlation of the dollar index ($DXY) with our US dollar currency pairs. However, since non USD currencies don’t have their own index, we’ll have to make one. Let’s dive in!

First of all, the dollar index is basically showing the strength or weakness of the US dollar vs. a basket of currencies. Kind of like the S&P 500 is used to measure the direction (strength or weakness) of the average stock, we can use the dollar index in the same way for US dollar currency pair trades. Currently, the dollar index is vs. the basket of: EUR, JPY, GBP, CAD, SEK, and the CHF. The weighting will vary slightly over time, but right now the EUR is approximately 57%, the Yen...

Finding a good entry, stop and target is fundamentally the most important aspect of trading and investing in any market, not just Forex. I have found over my years of teaching that when I introduce people to core strategies, they rarely ever want to use any of the other tools along with it because price will tell you all you need to know, if you learn to read it objectively. It will provide you with the clearest picture of the market and allow you to set stop losses, targets and entries without emotion and with controlled discipline. If you can learn to listen to what a price chart is really telling you rather than getting yourself caught up in unprofitable guesswork, you are, without doubt, on the right path to consistency in your...

Over the last few weeks there I have noticed much confusion in the air regarding the state of the current financial markets and with so much political and economical news in the air, it’s far from surprising to hear the questions coming.

Anyone with a little experience in the world of currency trading is familiar with the impact that Central Bank Interest rates have on currency prices, and we are told to pay as much attention to this as possible so as to keep informed on all factors shaping exchange rates across the board. When reading about anything to do with FX and interest rates, you will find commentary on one aspect called the Carry Trade which is something I have been getting many questions about lately. It is a very important...

Following a move to the USA, it led me to thinking more about the world of Forex Markets and how it has such a huge impact on all of our lives as a result of its movement, yet so few of us are even aware of just how important this impact really is.

Whether we like it or not, when we live in a particular country and are earning and saving as much of that nation’s currency as we can, we are effectively long that currency. If you live in Great Britain, then basically you are long GBP. If you live in Japan, you are long the Yen. And, if you live in the USA, you are long the dollar and you have a passive interest in the value of the dollar going up. Think about it like this: if you bought a stock and owned it for the long term, you are long...

The Ichimoku Kinko Hyo or equilibrium chart isolates higher probability trades in the forex market. It is new to the mainstream, but has been rising incrementally in popularity among novice and experienced traders. More known for its applications in the futures and equities forums, the Ichimoku displays a clearer picture because it shows more data points, which provide a more reliable price action. The application offers multiple tests and combines three indicators into one chart, allowing the trader to make the most informed decision. Learn how the Ichimoku works and how to add it to your own trading routine.

Getting to Know Ichimoku

Before a trader can trade effectively on the chart, a basic understanding of the components that make...

The global forex market boasts over $4 trillion in average daily trading volume, making it the largest financial market in the world. Forex's popularity entices traders of all levels, from greenhorns just learning about the financial markets to well-seasoned professionals. Because it is so easy to trade forex - with round-the-clock sessions, access to significant leverage and relatively low costs - it is also very easy to lose money trading forex. This article will take a look at 10 ways that traders can avoid losing money in the competitive forex market.

1) Do Your Homework – Learn Before You Burn

Just because forex is easy to get into doesn't mean that due diligence can be avoided. Learning about forex is integral to a trader's...

The colossal size of the global foreign exchange (“forex”) market dwarfs that of any other, with an estimated daily turnover of $5.35 trillion, according to the Bank for International Settlements’ triennial survey of 2013. Speculative trading dominates commercial transactions in the forex market, as the constant fluctuation (to use an oxymoron) of currency rates makes it an ideal venue for institutional players with deep pockets – such as large banks and hedge funds – to generate profits through speculative currency trading. While the very size of the forex market should preclude the possibility of anyone rigging or artificially fixing currency rates, a growing scandal suggests otherwise.

The Root Of The Problem: The Currency “Fix”

The...

Looking for the right Forex broker has been a task that many of us have loved and hated. Sometimes we find the right one pretty much straight away but at other times we struggle so much that we simply want to give up. The problem is that there is so many different Forex brokers out there such as ECN, STP, futures, options and so on. The sheer volume of them available for every sector can become the obstacle in actually finding one. Despite all this however, there is only one type of Forex broker that we should all look for – a business partner.

Business partners tend to have each other’s interests at heart and they both agree on the final outcome of the project, whatever it may be. The final outcome is usually related to profit and the...

Hello traders! This week I will try to explain a bit about relative strength between individual currencies, help you choose which pair to trade, and suggest a couple of rules for your trading plan.

In the classes that I teach, obviously the topic of charts comes up, along with which currency is getting stronger vs. another when looking at the chart. An easy (and somewhat politically incorrect) way of remembering how the charts work is to think about a teeter totter or see-saw from our childhood playgrounds. When looking at that teeter totter from the side, if the right side is pointing up, the kid on the left side of the teeter totter is fatter than the kid on the right side. In the currency market, the base (currency on the left) is...

What is order flow trading? In order to define order flow trading one would first need to delineate exactly the type of trading one is discussing. There is quite a bit of dialogue about order flow trading and misperceptions abound as to the most efficacious manner in which to use this trading method.

Some describe order flow trading as directional trading, i.e., you are betting that prices will either move up or down. If you believe a currency pair will go up, you will execute a buy order, going long. If you believe a currency pair will fall, you can sell it, shorting the trade.

Order Flow-Transaction Flow

Order flow can also be referred to as transaction flow. Transaction flow takes place when someone believes the price of a...

Forex trading is one of the most challenging ventures a person could probably undertake in their life. Going to the gym and building muscle won’t help you, nor will going to university and getting a fancy degree. This job requires psychological features of strength, which most new traders do not have, and sadly may never get.

Successful trading basically comes down to how disciplined you are. You might have the best strategy in the world but if your head isn’t in the right place, you will end up just being another statistic.

Most traders are disappointed with the unlimited money making potential of the market against their own performance, and are acting out of emotions like desperation, greed or fear to try and close the gap. Here...

The forex market is the largest and most accessible financial market in the world, but although there are many forex investors, few are truly successful ones. Many traders fail for the same reasons that investors fail in other asset classes. In addition, the extreme amount of leverage - the use of borrowed capital to increase the potential return of investments - provided by the market, and the relatively small amounts of margin required when trading currencies, deny traders the opportunity to make numerous low-risk mistakes. Factors specific to trading currencies can cause some traders to expect greater investment returns than the market can consistently offer, or to take more risk than they would when trading in other markets.

Forex...

When you start as an analyst in a retail FX shop and your background has largely been fundamental analysis you can quickly find yourself being ostracised, worse even ridiculed for your “old fashioned” view of the market.

Yep, you’ve guessed it, I’m writing from personal experience. But soon after moving into the retail world, I devoured tombs on technical analysis, progressing to inter-market analysis and then pretty fancy technical strategies. This ended up being the perfect complement to my fundamental background. While some traders are technical purists, I am not. I take the best bits from both to navigate the choppy waters of the markets.

With both my institutional and retail FX experience, I still come to the same conclusion...

This is one of the most frustrating situations for a trader. You think you understand the economic back-drop and you have a brilliant case for why a currency or a stock should move in a particular direction and then they move exactly the opposite way.

The summer rally is a prime example. Who would have thought that the markets would be poised to rally if Spain was to request a bailout? Now that the ECB has put in place its bond-buying OMT programme the markets have decided that a Spanish bailout is a risk positive event even though Spain has the fourth largest economy in the currency block, its growth is in free-fall and the Eurozone’s creditors have no firm grasp how large Madrid’s liabilities will be. Likewise, public policy...

Hello traders! I’d like to discuss a common misconception that new traders have – that professional traders sit and stare at their computer all day, making dozens of trades during their trading day. In addition, I’ll suggest a progression of trades you can add to your trading plan to help keep you from over trading.

During the classes that I teach, the question often comes up as to how many trades I take during a day or a week. Many new students are surprised when I give my answer of “between zero and three trades a day.” Their surprise is especially evident when discussing the forex market because it is open 24 hours a day, from Sunday afternoon to Friday afternoon! With all that time to find trades, why don’t we trade dozens of times...

The spot forex market is said to trade at over $1 trillion a day. Combine that with currency options and futures contracts, and the amounts could literally be another couple of trillion traded on any given day.

Historically Speaking

In its 2009 report, the Foreign Exchange Committee at the Bank of International Settlements estimated the total numbers of forex related transactions to be $3.2 trillion. With this type of money floating around an unregulated spot market that trades over the counter with no accountability, forex scams can only increase with the lure of earning fortunes in limited amounts of time. Many of the old popular scams have ceased, due to serious enforcement actions by the Commodity Futures Trading Commission (CFTC)...