Introduction

The Holy Grail is quite possibly the most famous piece of Christian mythology. Almost every archaeologist, historian, Christian and capitalist would love to find it, and many dedicate their lives towards its pursuit. It is said that those who drink from The Grail will be blessed with eternal life, whether that is spiritual or physical is open for debate (unless you have read "The Da Vinci Code" where the last thing you would do is drink from it!). Perhaps that explains why Indiana Jones may appear in a fourth film despite his increasing age.

When we talk about the Market Holy Grail we don't mean a cup that promises ever lasting life, more a cup that you can dip into the markets and pull out a never ending supply of money. But wait a minute, this sounds too good to be true? Or does it? Warren Buffett and George Soros have made billions from their investments in financial markets, maybe they found The Grail. The Internet is teaming with market "gurus" who offer to teach the secrets of The Grail for a princely sum of around $250 a month. So why do so many traders retire frustrated, mentally exhausted and a few thousand dollars worse off, never having found what looks so readily available to them?

The reason why traders? attempts are often futile is because they spend their time and money looking in the wrong place. By saying they are looking in the wrong place implies that there is a right place and we are not dealing with a myth. So where is it? Fear not intrepid explorer, we will show you where to look. If you concentrate hard enough you might even see the treasure map hidden within our words.

What the Market Holy Grail Is Not

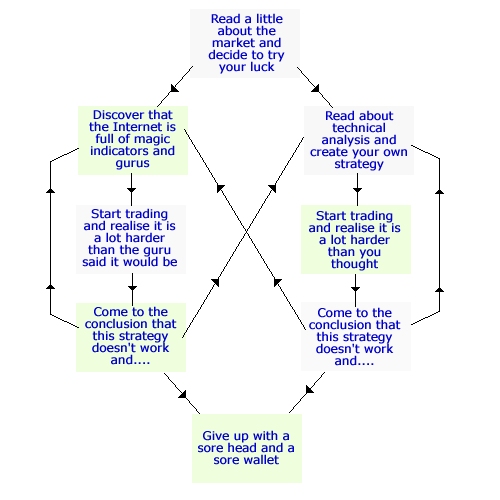

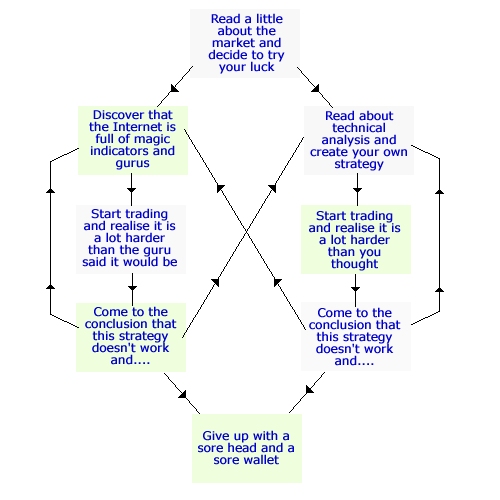

The majority of first time traders will go through a process like this, or something very similar:

Confusing isn't it? That is because, as you probably already know, learning to trade is a very confusing business. It often seems like the more you learn the more confused you become. The more confused you become the more you think you should learn and so on. If you are unable to get a combination of indicators to work surely someone has a combination you can buy. Alas, no matter how hard you try, following either of these two paths never seems to work. That is because the Market Holy Grail is not an indicator, strategy, method or charting package.

So What is it?

If it is not something that you will find on your charts then it is not something that you will be able to understand after one night's study. Just as many people dedicate an enormous amount of energy towards researching the Christian myth of the Grail, you will have to do the same when pursuing the market incarnation. That is a very important point; being a successful trader isn't easy, nobody ever said it would be. That is why the rewards for becoming consistently profitable are so high. There is no doubt that most, if not all, combinations of indicators work. However that does not mean that they work all of the time but they do work well in specific conditions. The success of every indicator-based strategy is dependent on your ability to read the conditions of the market and apply what you have learned. It is also down to the internal thought process that occurs every time you come to place a trade. So what is the magic factor? The answer is: you.

What Does This Mean?

Wait a minute; we can't be serious, can we? Well let us think about it for a while. Think back to the last time you tried to trade a "Holy Grail" system or a system you researched and back tested yourself. If it failed how many of the following weaknesses hindered your efforts:

Inexperience: No matter how many times you read that trading manual nothing can prepare you for live trade. As all of your indicators begin to line up you get confused, miss signals and react too quickly or too late. After your first hectic day you realise that your strategy was OK and you can attribute your loss to your lack of experience.

Greed: Buying a strategy almost inevitably comes with a statement telling you how you can make a boatload of money with relatively little work. When designing your own strategy you will automatically look for the highest winning ratio rather than best risk/ reward. This will lead to classic over trading (if you are destined to win why not increase your earnings by trading more), inability to cut losses (your strategy predicts market direction so all you have to do is wait and this loss will turn into a profit) and believing the market will move further in your direction than it actually does (setting a target that gives you as much profit as you want rather than as much profit as the market can give you).

Fear: After being burned a few times by the greed and inexperienced stage you will have probably changed strategies at least once. After all it isn't your fault it must just be a dodgy strategy. Now it is time to hit the books and find another combination of indicators to use. The more you learn the more indicators you can find that help you make money. Or if you prefer to buy another "Grail" system it must be more complicated like something the professionals use. Unfortunately all of the extra knowledge, indicators and complication leave you almost paralysed when it comes to entering a trade. Coupled with the losses you incurred during your "greed phase" entering a trade becomes scary. That moment of doubt where you question your indicators or the market's recent behaviour causes you to miss your entry and forget about the trade altogether. As you know only too well this trade was the best of the day or possibly even the whole week!

Another common mistake associated with fear is late entry. All of the characteristics of complete failure to enter are there but rather than miss the trade completely you enter late. This completely destroys your risk reward and an unsuccessful trade costs you much more than it would if you had entered at the correct time.

Just when you thought fear could only influence your entries it turns around and has a bite at your exits too. Exiting too early can cause you to take an unnecessary loss. Picture the trade: you enter correctly and the market moves a little way in your direction. All of a sudden the market turns around hard and your position starts to represent a loss. Rather than sticking to your stop loss (your defined risk) you exit early and think that you have saves yourself some financial pain. Just as you exit or just before your stop loss is triggered the market turns on its heels and ends up reaching your initial target.

Scenario two causes you to take your profit too early. The market approaches your target and goes through a natural correction. As you see the market eat into your profit you decide enough is enough and you get out while you are still in the black. Of course the market resumes its initial direction and hits your original target.

Fear will cause you to develop a lack of faith in your chosen method. Depending on how many times this has happened before you will either go back to the drawing board with your method or lose faith in your ability to trade at all. You start to believe that surely nobody makes money from trading.

This is the point at which many traders have what they call the "aha moment". All of a sudden it becomes clear that successful trading isn't down to the system at all it is down to the person using the system. This is the moment when each trader realises where the Grail can be found.

Finding The Grail:

Do we need a system at all?

If the secret to the market Holy Grail lies within each trader then what is the point of a system at all? Simply put a system represents a reason to enter the market. If you don't have a system then you have no reason to enter the market at all.

The Basis of a System:

Every system should be comprised of the following:

Trading science: Whether you use technical indicators or fundamental analysis this is your science. It doesn't have to be complicated; in fact simple is often much more effective. This will generate your buy or sell signal.

Money Management: Arguably more important than your signal is how to manage the resultant trade. You have to set strictly governed rules that determine how much of your trading capital you will risk per trade. Part of money management is your risk: reward ratio. If you have a risk: reward ratio of 1:4 then a profit factor of 0.5 (50%) you will be banking a very handsome profit indeed!

Discipline: If you don't have the discipline to stick to your trading science or your money management then your system may as well never have existed. Being disciplined will help eradicate late entries and early exits. In short it is the most important factor in every system.

It is very hard to apply discipline to something you have no confidence in. Therefore we recommend starting from scratch with a new strategy, something simple. This does not mean you should fork out hundreds of Dollars on a new system. Our Scalping For Forex ebook outlines a proven, simple approach that is an ideal tool to help you on your path to the Market Grail.

There is No Substitute For Experience No matter which strategy you use to help build your discipline and money management there is no substitute for experience of the market you are involved with. This experience includes knowledge of price action, chart patterns and momentum cycles to name but a few. For example, if you are trading using a momentum breakout strategy there is no point in trading during a slow, choppy market. This is something that you can only learn from experience of price action and you shouldn't hope to grasp it over night. Once again, trading isn't easy and it certainly is not a get rich quick scheme.

The Holy Grail is quite possibly the most famous piece of Christian mythology. Almost every archaeologist, historian, Christian and capitalist would love to find it, and many dedicate their lives towards its pursuit. It is said that those who drink from The Grail will be blessed with eternal life, whether that is spiritual or physical is open for debate (unless you have read "The Da Vinci Code" where the last thing you would do is drink from it!). Perhaps that explains why Indiana Jones may appear in a fourth film despite his increasing age.

When we talk about the Market Holy Grail we don't mean a cup that promises ever lasting life, more a cup that you can dip into the markets and pull out a never ending supply of money. But wait a minute, this sounds too good to be true? Or does it? Warren Buffett and George Soros have made billions from their investments in financial markets, maybe they found The Grail. The Internet is teaming with market "gurus" who offer to teach the secrets of The Grail for a princely sum of around $250 a month. So why do so many traders retire frustrated, mentally exhausted and a few thousand dollars worse off, never having found what looks so readily available to them?

The reason why traders? attempts are often futile is because they spend their time and money looking in the wrong place. By saying they are looking in the wrong place implies that there is a right place and we are not dealing with a myth. So where is it? Fear not intrepid explorer, we will show you where to look. If you concentrate hard enough you might even see the treasure map hidden within our words.

What the Market Holy Grail Is Not

The majority of first time traders will go through a process like this, or something very similar:

- Read a little about the market and decide to try you luck.

- Discover that the Internet is full of magic indicators and gurus.

- Start trading and realise that it is a lot harder than the gurus said it would be.

- Come to the conclusion that this strategy doesn't work and try again or...

- Give up with a sore head and a sore wallet.

Confusing isn't it? That is because, as you probably already know, learning to trade is a very confusing business. It often seems like the more you learn the more confused you become. The more confused you become the more you think you should learn and so on. If you are unable to get a combination of indicators to work surely someone has a combination you can buy. Alas, no matter how hard you try, following either of these two paths never seems to work. That is because the Market Holy Grail is not an indicator, strategy, method or charting package.

So What is it?

If it is not something that you will find on your charts then it is not something that you will be able to understand after one night's study. Just as many people dedicate an enormous amount of energy towards researching the Christian myth of the Grail, you will have to do the same when pursuing the market incarnation. That is a very important point; being a successful trader isn't easy, nobody ever said it would be. That is why the rewards for becoming consistently profitable are so high. There is no doubt that most, if not all, combinations of indicators work. However that does not mean that they work all of the time but they do work well in specific conditions. The success of every indicator-based strategy is dependent on your ability to read the conditions of the market and apply what you have learned. It is also down to the internal thought process that occurs every time you come to place a trade. So what is the magic factor? The answer is: you.

What Does This Mean?

Wait a minute; we can't be serious, can we? Well let us think about it for a while. Think back to the last time you tried to trade a "Holy Grail" system or a system you researched and back tested yourself. If it failed how many of the following weaknesses hindered your efforts:

Inexperience: No matter how many times you read that trading manual nothing can prepare you for live trade. As all of your indicators begin to line up you get confused, miss signals and react too quickly or too late. After your first hectic day you realise that your strategy was OK and you can attribute your loss to your lack of experience.

Greed: Buying a strategy almost inevitably comes with a statement telling you how you can make a boatload of money with relatively little work. When designing your own strategy you will automatically look for the highest winning ratio rather than best risk/ reward. This will lead to classic over trading (if you are destined to win why not increase your earnings by trading more), inability to cut losses (your strategy predicts market direction so all you have to do is wait and this loss will turn into a profit) and believing the market will move further in your direction than it actually does (setting a target that gives you as much profit as you want rather than as much profit as the market can give you).

Fear: After being burned a few times by the greed and inexperienced stage you will have probably changed strategies at least once. After all it isn't your fault it must just be a dodgy strategy. Now it is time to hit the books and find another combination of indicators to use. The more you learn the more indicators you can find that help you make money. Or if you prefer to buy another "Grail" system it must be more complicated like something the professionals use. Unfortunately all of the extra knowledge, indicators and complication leave you almost paralysed when it comes to entering a trade. Coupled with the losses you incurred during your "greed phase" entering a trade becomes scary. That moment of doubt where you question your indicators or the market's recent behaviour causes you to miss your entry and forget about the trade altogether. As you know only too well this trade was the best of the day or possibly even the whole week!

Another common mistake associated with fear is late entry. All of the characteristics of complete failure to enter are there but rather than miss the trade completely you enter late. This completely destroys your risk reward and an unsuccessful trade costs you much more than it would if you had entered at the correct time.

Just when you thought fear could only influence your entries it turns around and has a bite at your exits too. Exiting too early can cause you to take an unnecessary loss. Picture the trade: you enter correctly and the market moves a little way in your direction. All of a sudden the market turns around hard and your position starts to represent a loss. Rather than sticking to your stop loss (your defined risk) you exit early and think that you have saves yourself some financial pain. Just as you exit or just before your stop loss is triggered the market turns on its heels and ends up reaching your initial target.

Scenario two causes you to take your profit too early. The market approaches your target and goes through a natural correction. As you see the market eat into your profit you decide enough is enough and you get out while you are still in the black. Of course the market resumes its initial direction and hits your original target.

Fear will cause you to develop a lack of faith in your chosen method. Depending on how many times this has happened before you will either go back to the drawing board with your method or lose faith in your ability to trade at all. You start to believe that surely nobody makes money from trading.

This is the point at which many traders have what they call the "aha moment". All of a sudden it becomes clear that successful trading isn't down to the system at all it is down to the person using the system. This is the moment when each trader realises where the Grail can be found.

Finding The Grail:

Do we need a system at all?

If the secret to the market Holy Grail lies within each trader then what is the point of a system at all? Simply put a system represents a reason to enter the market. If you don't have a system then you have no reason to enter the market at all.

The Basis of a System:

Every system should be comprised of the following:

Trading science: Whether you use technical indicators or fundamental analysis this is your science. It doesn't have to be complicated; in fact simple is often much more effective. This will generate your buy or sell signal.

Money Management: Arguably more important than your signal is how to manage the resultant trade. You have to set strictly governed rules that determine how much of your trading capital you will risk per trade. Part of money management is your risk: reward ratio. If you have a risk: reward ratio of 1:4 then a profit factor of 0.5 (50%) you will be banking a very handsome profit indeed!

Discipline: If you don't have the discipline to stick to your trading science or your money management then your system may as well never have existed. Being disciplined will help eradicate late entries and early exits. In short it is the most important factor in every system.

It is very hard to apply discipline to something you have no confidence in. Therefore we recommend starting from scratch with a new strategy, something simple. This does not mean you should fork out hundreds of Dollars on a new system. Our Scalping For Forex ebook outlines a proven, simple approach that is an ideal tool to help you on your path to the Market Grail.

There is No Substitute For Experience No matter which strategy you use to help build your discipline and money management there is no substitute for experience of the market you are involved with. This experience includes knowledge of price action, chart patterns and momentum cycles to name but a few. For example, if you are trading using a momentum breakout strategy there is no point in trading during a slow, choppy market. This is something that you can only learn from experience of price action and you shouldn't hope to grasp it over night. Once again, trading isn't easy and it certainly is not a get rich quick scheme.

Last edited by a moderator: