isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

UK FTSE 350 Sectors

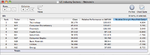

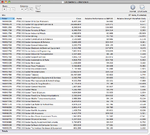

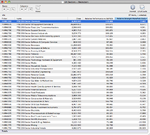

Attached is the updated UK FTSE 350 sector charts and relative strength lists. Using the Mansfield RS as the gauge of strength, NMX1350 Chemicals comes out on top. But I've also included the FTSE 350 sector matrix which shows the peer relationships and how each sector is doing relative to the other sectors. It's ranked by the strongest to the weakest, so NMX2750 Industrial Engineering is the current strongest sector, but it weakened against 6 sectors on Friday and it's combination score is significantly weaker than the other top 5 sectors, so NMX1350 Chemicals again looks to be the strongest sector based on it's combination score of short and long term signals.

Attached is the updated UK FTSE 350 sector charts and relative strength lists. Using the Mansfield RS as the gauge of strength, NMX1350 Chemicals comes out on top. But I've also included the FTSE 350 sector matrix which shows the peer relationships and how each sector is doing relative to the other sectors. It's ranked by the strongest to the weakest, so NMX2750 Industrial Engineering is the current strongest sector, but it weakened against 6 sectors on Friday and it's combination score is significantly weaker than the other top 5 sectors, so NMX1350 Chemicals again looks to be the strongest sector based on it's combination score of short and long term signals.

Attachments

-

UK_Sectors_list_30_3_12.png83.7 KB · Views: 432

UK_Sectors_list_30_3_12.png83.7 KB · Views: 432 -

UK_Sectors_1_30_3_12.png105.3 KB · Views: 336

UK_Sectors_1_30_3_12.png105.3 KB · Views: 336 -

UK_Sectors_2_30_3_12.png105.2 KB · Views: 315

UK_Sectors_2_30_3_12.png105.2 KB · Views: 315 -

UK_Sectors_3_30_3_12.png107.1 KB · Views: 384

UK_Sectors_3_30_3_12.png107.1 KB · Views: 384 -

UK_Sectors_4_30_3_12.png103.9 KB · Views: 364

UK_Sectors_4_30_3_12.png103.9 KB · Views: 364 -

UK_Sectors_RS_list_39_3_12.png83.8 KB · Views: 315

UK_Sectors_RS_list_39_3_12.png83.8 KB · Views: 315 -

FTSE350-Sectors-M_30-3-12.png142.1 KB · Views: 761

FTSE350-Sectors-M_30-3-12.png142.1 KB · Views: 761