A study by Alan Saunders of ShareHunter.com on the successful share selection techniques promulgated by Stan Weinstein in his best selling book "Secrets for Profiting in Bull and Bear Markets"

Most trading systems that I come across are given to using too much jargon or gobbledegook and are complicated - unnecessarily so in my opinion. And that is why I appreciated - and now benefit from - the brilliant simplicity of Weinstein's "Stage Analysis" approach to the buying and selling of shares.

There is nothing new in using technical analysis (TA) to identify shares for investment yet the truth is that TA is considered by many private investors as akin to black magic. But it need not be confusing or complicated and can, of itself, identify real potential winning shares.

All of the "fundamental" information about a company, its products, its market share, its dividend policy, its management and, when relevant, its takeover or merger potential is factored into the share price and, therefore, it is already in the chart waiting to be deciphered. And that is where the straight forward simplicity of Weinstein's "Stage Analysis" technical approach can help us all.

If you can read what the chart is telling you (and that is not difficult as this article intends to show you) then you have no need of sourcing your share buys from newspapers, hours of study of the "fundamentals" or from tipsters but rather from the information that the chart is giving you. And that comes from the simple TA provided by Weinstein which identifies those dynamic shares which are in a "breakout" mode.

Weinstein has given us the gift of simplifying TA down to a few basic truths. He created a set of rules which, when followed, allows for the identification of top performing shares that are likely to produce explosive profits irrespective of whether the market is in a "bull" or "bear" phase. This makes for share trading which is not just profitable and predictable but which also is a lot more enjoyable.

I am going to outline three of Weinstein's master techniques which, when applied consistently, simultaneously and conservatively and when used in conjunction with sensible money management and exit-stop procedures (the subject of a later article) will develop your recognition abilities and hone your trading skills so that you can make profits - and potentially large profits - year after year.

First of all, let us agree on some of the basic terms used in technical analysis "

Let me also add that Stage Analysis, dynamic though it is, is not for the adrenalin junkies who trade intra-day. Weinstein emphasizes how important it is not to overtrade and always to allow sufficient room for a share to "breath? normally and so his system is based on weekly prices. My own experience is that it is far more profitable to trade shares based on their weekly price history than trading shares based on daily prices (where the volatility is comparatively greater and trend changes more numerous). That is why the ShareHunterSelect service is also based on weekly prices.

Let us begin with the first of Weinstein's analytical trio "

1. STAGE ANALYSIS

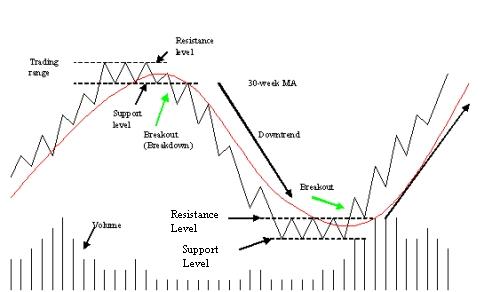

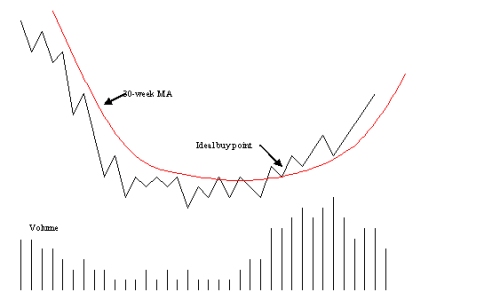

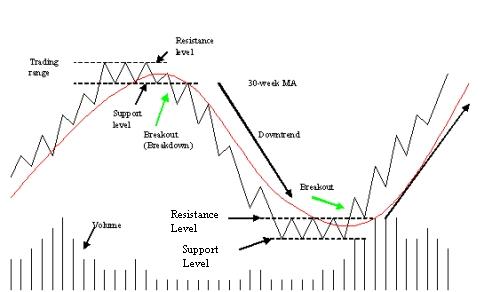

It is said that a picture is worth a thousand words - well, Weinstein rephrases that to "a chart is worth a thousand earnings forecasts?! Look at the picture below - there is no need for any words; the chart says it all - at a glance. And that's it - your ability to "read" a chart and decide which share is going to make you pots of money, starts right here with this diagram?

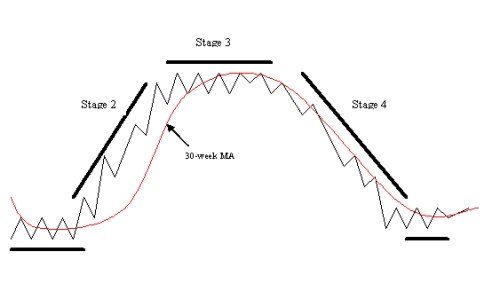

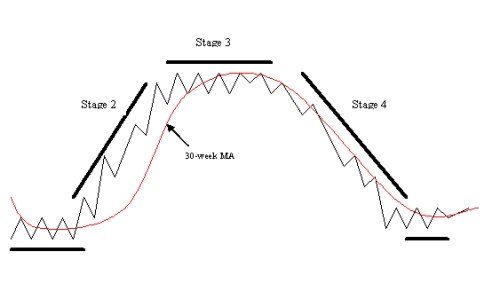

Let's look at each of these 4 Stages in turn :

Stage 1: The Basing Area (or Accumulation):

After a share has been declining for many months it will eventually lose its downward momentum and start to trend sideways. What's actually happening is that whereas sellers were in preponderance, the buyers and sellers are starting to move into equilibrium. Volume will usually lessen as a base (stage 1) forms.

How it appears on the chart is that the 30-week moving average (MA) loses its downward slope and starts to flatten out. In addition, intermittent rallies and declines will toss the share above and below the MA. This basing action can go on for months, if not years in some cases.

There are two main dangers here - impatient investors will move in to catch the low price - but there is little value by so doing as your money can be tied up, going nowhere, for months or years. Even worse, premature investors can lose patience and end up selling out after months of inaction just before the big move up starts.

Stage 2: The Advancing Phase (or Uptrend)

This is the ideal time to buy a share - when it is finally swinging out of its Stage 1 base into this more dynamic stage. Such a price breakout above the top of the resistance zone and of the 30-week MA should be accompanied by increased volume (the buyers, usually the professionals, are buying the share).

The Chart will show the 30-week MA starting to curve upwards (slightly after the breakout) and this is followed by the classic uptrend picture of consecutively higher highs and higher lows as more buying takes place and others take their profits (too soon!). This is important as there will always be downside corrections mixed in with the rises. This is the market place in action - two steps forward and one back - but, so long as it is all happening above the share's rising 30-week MA there is no need to worry (or to exit the trade) as all is in order.

Over several months of this bullish action more and more investors are becoming aware of the share and jumping on the wagon. Eventually the share will start to sag closer to its MA and the angle of ascent of the MA will start to slow down; the share is over-extended and definitely no longer a buy (but it is a "hold" for you who bought it at the start of its Stage 2 rise).

Stage 3: The Top Area (or Distribution Phase)

Eventually, all good things come to an end and, in the stock market, this is takes the form of a Stage 3 top as the share loses its upward momentum and starts to trade sideways.

What's going on under the surface is that buyers and sellers are again more or less of equal strength.

Volume is often quite heavy and the moves, up and down, can be quite "choppy". The heavy volume is caused by new (and late!) buyers who are excited by the impression that the share's bull run is likely to continue (and the "buy now" stories and tips) being met in equal measure by the "canny" investors who bought in at the start of the Stage 2 rise and who are now heading for the exit.

The chart shows all of this in the form of the 30-week MA losing its upward momentum and starting to flatten out. And, whereas those declines in Stage 2 all held above the MA, in Stage 3 the share price will straddle the MA - above and below it.

ShareHunter investors will often take half their profits at this stage, leaving the other half either to enjoy a renewed, late run or until the latest exit-stop price is hit.

Whatever else, this is most definitely not the time to even think about buying the share as Stage 3 is usually followed by a Stage 4!

Stage 4: The Decline (or Downtrend)

This is the stage when the factors that sustained a share's rising price give way to fatigue and pressures caused by fearful sellers (not to mention the modern phenomenon of Hedge fund shorting).

It shows up on the chart in the form of the share price breaking down below the bottom edge of the neutral trading range that formed in Stage 3 with the 30-week MA turning downwards and the share price moving, and staying, below it.

Be aware that the "fundamentals" of the share may still look in good shape; the conventional thinking is likely to be that the share is just "undergoing a correction". This is wrong, the "correction" took place in Stage 3 and the upside potential in Stage 4 is very small indeed while the downside risk is considerable. (At ShareHunter we use Stage 4 to highlight our prospects for shorting shares).

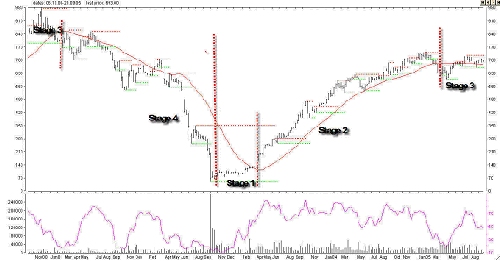

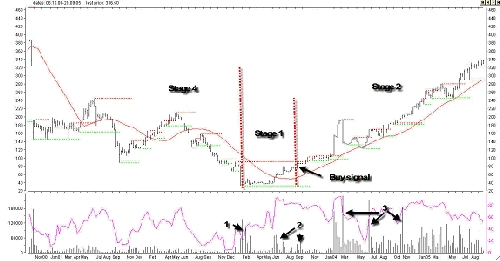

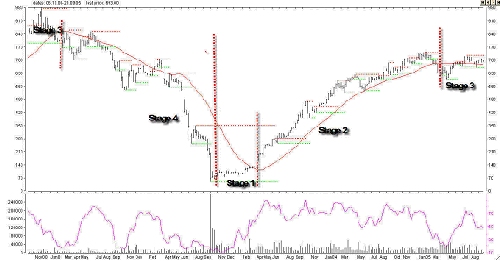

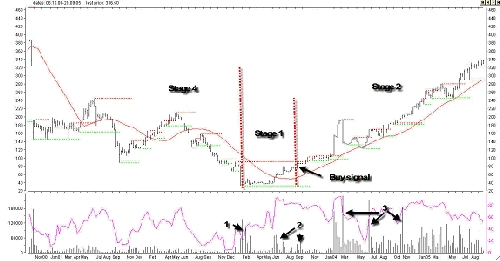

Here is a chart of W.S.Atkins (atk) where all 4 stages can be easily identified -

There are two very significant advantages for an investor in using this simple Stage Analysis. The first is, of course, the ability to identify the right time to buy (or short-sell) the share ("timing is everything") and the second is the ability to avoid ever again buying a share that is in a Stage 4 decline. That alone can save a lot of pain and '000s of pounds; and the third is the ability to identify the right time to short the share for maximum profit.

A large number of private investors create a lot of heartache for themselves by closing out their winners far too early and for small profits - yet they will often hold on, in some form of "macho" demonstration, to their losers and racking up ever increasing losses. Examine your own experience; how many times have you held a share that you should have sold at 700p only to watch it drop to 500p, then 300p and then 100p? And then worse still - oh calamity - to have bought more at 500p and again at 300p because "if it was good value at 700p it must be even better value at these prices".

And then you dump out (at 70p or so in the above chart) at a large loss just as the Stage 1 in that share is about to start!

Does any of that sound familiar? Well with Stage Analysis you need never again suffer this sort of nightmare. Stage Analysis lets you take charge and adopt a path to consistent trading profits - in both bull and bear markets.

2. VOLUME -

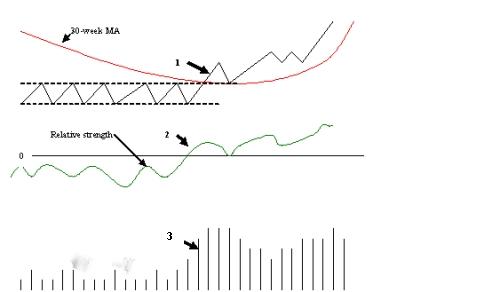

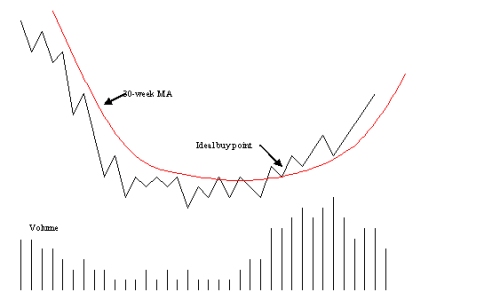

Once you have identified a Stage 2 breakout the next most important factor to concentrate on is volume. If you use this tool properly then you will be well on the way to separating the so-so buys from the potentially explosive big winners.

Volume is a gauge of how powerful the buyers (or sellers!) are and, when read in conjunction with what is happening to the share price, is a powerful indicator in its own right. Shares can fall under their own weight (there does not have to be an increase in volume) but for a share price to advance it takes a lot of buying power. Try pushing a boulder uphill; it takes a large expenditure of energy to move it up the hill but let it go and it can build up plenty of downside momentum on its own !

The rule is very simple: Never trust a breakout that isn't accompanied by a significant increase in volume.

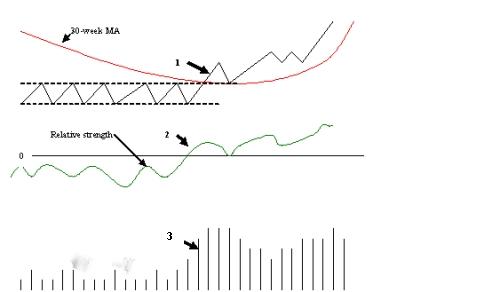

The diagram below shows exactly how a healthy volume pattern should unfold "

But beware, not all high volume is necessarily good news. High volume which is co-incident with a falling share price at the start of a stage 4 downtrend can just be helping to get that down-hill boulder running even faster.

Then again, high volume at the end of a long and/or fast run down (a Stage 4 downtrend) in the share price can be "exhaustion? volume as the last of the hard-nosed stayers finally jump ship and dump their shares at the bottom - this usually is a pre-cursor to a Stage 1 phase.

Look at the chart of Charter plc.(chtr) See how the exhaustion volume (arrow 1) showed where the bottom was formed and how it increased again (arrow 2) to move it into Stage 2 and a perfect buying point. Notice how the occasional volume spike since then (arrow 3) has encouraged its rise. This share was a "buy" at 75p in August 2003 and is still a hold at 330p!

3. RELATIVE STRENGTH -

The next important factor to check out, in order to narrow down our list of potential buys is the relative strength (RS). I don't mean the RS of one share against another or even of a share's current performance against a previous period. No, it is the RS of the breakout share against its encompassing market index. In this way we get a view of the share's performance as against the overall market. It is obvious, isn't it, that even if a share is rising in price it can show poor performance against its index. Thus if a share rises by say 10% while the FTSE 250 index (in which it resides) rises by 20% then it is lagging badly even though it is rising.

Not only is it not a leader but it is probably being pulled reluctantly higher. Therefore, when the market turns over, there is a good chance that the share will drop like a stone.

The formula for relative strength is simple :

Price of share

Price of market index X 100

It is the use of the RS function that allows us to sort the also-rans from the top performers so that we only have the potential big winning shares in our portfolio.

Look at the chart of Cairn Energy (cne); the relative strength turns positive at the crucial times (marked ?1? and ?2?) - just before the other signals click into place and the two buy signals appear (at points ?A? and ?B?). Note, again, the volume increases.

Bringing these three together forms the -

THE TRIPLE CONFIRMATION PATTERN -

The first factor for any prospective Long position is the entry into a Stage 2 uptrend.

The second is the requirement for the Relative Strength indicator to have swung into a positive position (this is very important for distinguishing between the great buys from the simply good buys).

The third factor is the requirement for impressive volume (which is a key ingredient for a super winner).

Only when all three are "in position" will you have a truly great prospect for super-charged growth. This diagram shows the required triple confirmation pattern that can lead to explosive growth -

FURTHER USE OF TECHNICAL ANALYSIS -

There are a few additional TA techniques that, Weinstein suggests, need to be mastered in order to "fine-tune" your buying (or shorting) decisions and the path the greater profitability.

When you read most books on technical analysis you are introduced to all sorts of formations and jargon which can serve only to confuse. Many of these will have some value but most of the fancy formations will have nothing to do with guiding you to make the right share selections. Although they do have their place, you can forget all about such things as saucer bottoms, pennants, flags, macd's etc. but there are a few which will be of help to you and with which you should become conversant. These are, Weinstein suggests, as follows "

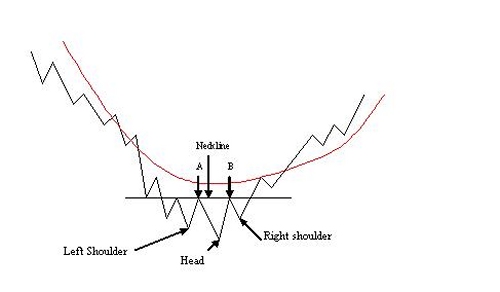

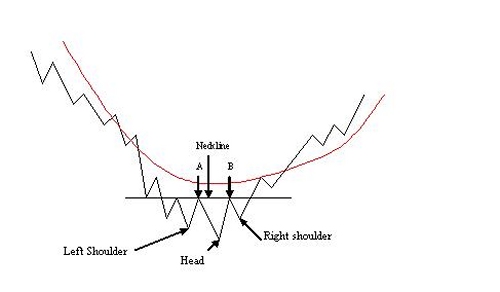

A) Head-and-Shoulders formation

This is one of the most powerful and reliable of all bottom (and top) formations. This dynamic pattern can appear after a share has suffered a major decline (or rise) and is ready to reverse, sharply, to the other side.The diagram below (in this case a bottom formation) shows what to expect "

Briefly - a rally follows a steep decline (point A); next there is another decline which takes the share down to yet another lower bottom. Then comes another rally which takes the price back up to about the same level as last time (point B).

Thus we now have a (potential) Left shoulder and a Head formed. Now another decline sets in but, this time, it doesn't drop the share to a new low and, in fact, it forms a higher low (than the "Head") for the first time and the share starts to rally once more.

Once the price breaks above the neckline you want to know about it as it is a strong bullish signal.

A cautionary note though; we must see the price above its MA and the MA must have turned upwards, otherwise we must leave the share alone.

Here are two examples of Head and Shoulder formations. On the downside look at the Corus (cs) chart; this was a super Short trade down from 72p all the way to 13p once the Head and Shoulders had given the signal.

Then look at Ashtead Grp (aht) on the Long side; here the trade went from 38p to 134 p after the Head and Shoulders (with all the other signals in place as well of course) "

B) Double Bottom -

Not as dynamic as the head and shoulders formation but a good bullish indicator none-the-less. Again though, the ideal is that it is matched by increased volume and minimal or no overhead resistance and that it is read in conjunction with the upward price break of the MA and the turn up of the MA itself.

Double bottoms are far from an unusual occurrence (whereas Head and Shoulders are few and far between) and so one has to be careful and demanding of the surrounding criteria so that one does not end up buying before the uptrend is in evidence.

Brambles Ind.plc chart shows a classic double-bottom formation which preceded the buy of this share in Sept/Oct 2003 "

Head-and-shoulders and double bottoms etc. apart, the pre-requisite is for the three main technical aspects, as described above, to come together at the same time.

Here are three share examples of this "triple whammy" effect plus some additional TA that gives rise to explosive growth and some super profits "

Charter (chtr) "

caption: Charter (chtr)

caption: Ashtead (aht)

caption: Savilles (svs)

One last "rule": Weinstein advises that you be aware of the main trend of the market in which you intend to invest. There is a far greater risk involved in buying a share when the market index for that share is in a Stage 3 or Stage 4 formation.

For "bear" markets (Stage 4s) it is simply a case of reversing the indicators and shorting the shares rather than buying them; and that can be even more profitable as shares will go down faster than they go up.

Enjoy your share selections. Remember, the trend really is your friend; but you need to know whether it is a Stage 1,2,3 or 4 trend before you open a trade and Weinstein's stage identification techniques really do make trading simpler and profitable.

Most trading systems that I come across are given to using too much jargon or gobbledegook and are complicated - unnecessarily so in my opinion. And that is why I appreciated - and now benefit from - the brilliant simplicity of Weinstein's "Stage Analysis" approach to the buying and selling of shares.

'STAGE ANALYSIS' is straightforward, simplified, technical analysis.

There is nothing new in using technical analysis (TA) to identify shares for investment yet the truth is that TA is considered by many private investors as akin to black magic. But it need not be confusing or complicated and can, of itself, identify real potential winning shares.

All of the "fundamental" information about a company, its products, its market share, its dividend policy, its management and, when relevant, its takeover or merger potential is factored into the share price and, therefore, it is already in the chart waiting to be deciphered. And that is where the straight forward simplicity of Weinstein's "Stage Analysis" technical approach can help us all.

If you can read what the chart is telling you (and that is not difficult as this article intends to show you) then you have no need of sourcing your share buys from newspapers, hours of study of the "fundamentals" or from tipsters but rather from the information that the chart is giving you. And that comes from the simple TA provided by Weinstein which identifies those dynamic shares which are in a "breakout" mode.

Weinstein has given us the gift of simplifying TA down to a few basic truths. He created a set of rules which, when followed, allows for the identification of top performing shares that are likely to produce explosive profits irrespective of whether the market is in a "bull" or "bear" phase. This makes for share trading which is not just profitable and predictable but which also is a lot more enjoyable.

I am going to outline three of Weinstein's master techniques which, when applied consistently, simultaneously and conservatively and when used in conjunction with sensible money management and exit-stop procedures (the subject of a later article) will develop your recognition abilities and hone your trading skills so that you can make profits - and potentially large profits - year after year.

First of all, let us agree on some of the basic terms used in technical analysis "

Let me also add that Stage Analysis, dynamic though it is, is not for the adrenalin junkies who trade intra-day. Weinstein emphasizes how important it is not to overtrade and always to allow sufficient room for a share to "breath? normally and so his system is based on weekly prices. My own experience is that it is far more profitable to trade shares based on their weekly price history than trading shares based on daily prices (where the volatility is comparatively greater and trend changes more numerous). That is why the ShareHunterSelect service is also based on weekly prices.

Let us begin with the first of Weinstein's analytical trio "

1. STAGE ANALYSIS

It is said that a picture is worth a thousand words - well, Weinstein rephrases that to "a chart is worth a thousand earnings forecasts?! Look at the picture below - there is no need for any words; the chart says it all - at a glance. And that's it - your ability to "read" a chart and decide which share is going to make you pots of money, starts right here with this diagram?

Let's look at each of these 4 Stages in turn :

Stage 1: The Basing Area (or Accumulation):

After a share has been declining for many months it will eventually lose its downward momentum and start to trend sideways. What's actually happening is that whereas sellers were in preponderance, the buyers and sellers are starting to move into equilibrium. Volume will usually lessen as a base (stage 1) forms.

How it appears on the chart is that the 30-week moving average (MA) loses its downward slope and starts to flatten out. In addition, intermittent rallies and declines will toss the share above and below the MA. This basing action can go on for months, if not years in some cases.

There are two main dangers here - impatient investors will move in to catch the low price - but there is little value by so doing as your money can be tied up, going nowhere, for months or years. Even worse, premature investors can lose patience and end up selling out after months of inaction just before the big move up starts.

Stage 2: The Advancing Phase (or Uptrend)

This is the ideal time to buy a share - when it is finally swinging out of its Stage 1 base into this more dynamic stage. Such a price breakout above the top of the resistance zone and of the 30-week MA should be accompanied by increased volume (the buyers, usually the professionals, are buying the share).

The Chart will show the 30-week MA starting to curve upwards (slightly after the breakout) and this is followed by the classic uptrend picture of consecutively higher highs and higher lows as more buying takes place and others take their profits (too soon!). This is important as there will always be downside corrections mixed in with the rises. This is the market place in action - two steps forward and one back - but, so long as it is all happening above the share's rising 30-week MA there is no need to worry (or to exit the trade) as all is in order.

Over several months of this bullish action more and more investors are becoming aware of the share and jumping on the wagon. Eventually the share will start to sag closer to its MA and the angle of ascent of the MA will start to slow down; the share is over-extended and definitely no longer a buy (but it is a "hold" for you who bought it at the start of its Stage 2 rise).

Stage 3: The Top Area (or Distribution Phase)

Eventually, all good things come to an end and, in the stock market, this is takes the form of a Stage 3 top as the share loses its upward momentum and starts to trade sideways.

What's going on under the surface is that buyers and sellers are again more or less of equal strength.

Volume is often quite heavy and the moves, up and down, can be quite "choppy". The heavy volume is caused by new (and late!) buyers who are excited by the impression that the share's bull run is likely to continue (and the "buy now" stories and tips) being met in equal measure by the "canny" investors who bought in at the start of the Stage 2 rise and who are now heading for the exit.

The chart shows all of this in the form of the 30-week MA losing its upward momentum and starting to flatten out. And, whereas those declines in Stage 2 all held above the MA, in Stage 3 the share price will straddle the MA - above and below it.

ShareHunter investors will often take half their profits at this stage, leaving the other half either to enjoy a renewed, late run or until the latest exit-stop price is hit.

Whatever else, this is most definitely not the time to even think about buying the share as Stage 3 is usually followed by a Stage 4!

Stage 4: The Decline (or Downtrend)

This is the stage when the factors that sustained a share's rising price give way to fatigue and pressures caused by fearful sellers (not to mention the modern phenomenon of Hedge fund shorting).

It shows up on the chart in the form of the share price breaking down below the bottom edge of the neutral trading range that formed in Stage 3 with the 30-week MA turning downwards and the share price moving, and staying, below it.

Be aware that the "fundamentals" of the share may still look in good shape; the conventional thinking is likely to be that the share is just "undergoing a correction". This is wrong, the "correction" took place in Stage 3 and the upside potential in Stage 4 is very small indeed while the downside risk is considerable. (At ShareHunter we use Stage 4 to highlight our prospects for shorting shares).

Here is a chart of W.S.Atkins (atk) where all 4 stages can be easily identified -

There are two very significant advantages for an investor in using this simple Stage Analysis. The first is, of course, the ability to identify the right time to buy (or short-sell) the share ("timing is everything") and the second is the ability to avoid ever again buying a share that is in a Stage 4 decline. That alone can save a lot of pain and '000s of pounds; and the third is the ability to identify the right time to short the share for maximum profit.

A large number of private investors create a lot of heartache for themselves by closing out their winners far too early and for small profits - yet they will often hold on, in some form of "macho" demonstration, to their losers and racking up ever increasing losses. Examine your own experience; how many times have you held a share that you should have sold at 700p only to watch it drop to 500p, then 300p and then 100p? And then worse still - oh calamity - to have bought more at 500p and again at 300p because "if it was good value at 700p it must be even better value at these prices".

And then you dump out (at 70p or so in the above chart) at a large loss just as the Stage 1 in that share is about to start!

Does any of that sound familiar? Well with Stage Analysis you need never again suffer this sort of nightmare. Stage Analysis lets you take charge and adopt a path to consistent trading profits - in both bull and bear markets.

2. VOLUME -

Once you have identified a Stage 2 breakout the next most important factor to concentrate on is volume. If you use this tool properly then you will be well on the way to separating the so-so buys from the potentially explosive big winners.

Volume is a gauge of how powerful the buyers (or sellers!) are and, when read in conjunction with what is happening to the share price, is a powerful indicator in its own right. Shares can fall under their own weight (there does not have to be an increase in volume) but for a share price to advance it takes a lot of buying power. Try pushing a boulder uphill; it takes a large expenditure of energy to move it up the hill but let it go and it can build up plenty of downside momentum on its own !

The rule is very simple: Never trust a breakout that isn't accompanied by a significant increase in volume.

The diagram below shows exactly how a healthy volume pattern should unfold "

But beware, not all high volume is necessarily good news. High volume which is co-incident with a falling share price at the start of a stage 4 downtrend can just be helping to get that down-hill boulder running even faster.

Then again, high volume at the end of a long and/or fast run down (a Stage 4 downtrend) in the share price can be "exhaustion? volume as the last of the hard-nosed stayers finally jump ship and dump their shares at the bottom - this usually is a pre-cursor to a Stage 1 phase.

Look at the chart of Charter plc.(chtr) See how the exhaustion volume (arrow 1) showed where the bottom was formed and how it increased again (arrow 2) to move it into Stage 2 and a perfect buying point. Notice how the occasional volume spike since then (arrow 3) has encouraged its rise. This share was a "buy" at 75p in August 2003 and is still a hold at 330p!

3. RELATIVE STRENGTH -

The next important factor to check out, in order to narrow down our list of potential buys is the relative strength (RS). I don't mean the RS of one share against another or even of a share's current performance against a previous period. No, it is the RS of the breakout share against its encompassing market index. In this way we get a view of the share's performance as against the overall market. It is obvious, isn't it, that even if a share is rising in price it can show poor performance against its index. Thus if a share rises by say 10% while the FTSE 250 index (in which it resides) rises by 20% then it is lagging badly even though it is rising.

Not only is it not a leader but it is probably being pulled reluctantly higher. Therefore, when the market turns over, there is a good chance that the share will drop like a stone.

The formula for relative strength is simple :

Price of share

Price of market index X 100

It is the use of the RS function that allows us to sort the also-rans from the top performers so that we only have the potential big winning shares in our portfolio.

Look at the chart of Cairn Energy (cne); the relative strength turns positive at the crucial times (marked ?1? and ?2?) - just before the other signals click into place and the two buy signals appear (at points ?A? and ?B?). Note, again, the volume increases.

Bringing these three together forms the -

THE TRIPLE CONFIRMATION PATTERN -

The first factor for any prospective Long position is the entry into a Stage 2 uptrend.

The second is the requirement for the Relative Strength indicator to have swung into a positive position (this is very important for distinguishing between the great buys from the simply good buys).

The third factor is the requirement for impressive volume (which is a key ingredient for a super winner).

Only when all three are "in position" will you have a truly great prospect for super-charged growth. This diagram shows the required triple confirmation pattern that can lead to explosive growth -

FURTHER USE OF TECHNICAL ANALYSIS -

There are a few additional TA techniques that, Weinstein suggests, need to be mastered in order to "fine-tune" your buying (or shorting) decisions and the path the greater profitability.

When you read most books on technical analysis you are introduced to all sorts of formations and jargon which can serve only to confuse. Many of these will have some value but most of the fancy formations will have nothing to do with guiding you to make the right share selections. Although they do have their place, you can forget all about such things as saucer bottoms, pennants, flags, macd's etc. but there are a few which will be of help to you and with which you should become conversant. These are, Weinstein suggests, as follows "

A) Head-and-Shoulders formation

This is one of the most powerful and reliable of all bottom (and top) formations. This dynamic pattern can appear after a share has suffered a major decline (or rise) and is ready to reverse, sharply, to the other side.The diagram below (in this case a bottom formation) shows what to expect "

Briefly - a rally follows a steep decline (point A); next there is another decline which takes the share down to yet another lower bottom. Then comes another rally which takes the price back up to about the same level as last time (point B).

Thus we now have a (potential) Left shoulder and a Head formed. Now another decline sets in but, this time, it doesn't drop the share to a new low and, in fact, it forms a higher low (than the "Head") for the first time and the share starts to rally once more.

Once the price breaks above the neckline you want to know about it as it is a strong bullish signal.

A cautionary note though; we must see the price above its MA and the MA must have turned upwards, otherwise we must leave the share alone.

Here are two examples of Head and Shoulder formations. On the downside look at the Corus (cs) chart; this was a super Short trade down from 72p all the way to 13p once the Head and Shoulders had given the signal.

Then look at Ashtead Grp (aht) on the Long side; here the trade went from 38p to 134 p after the Head and Shoulders (with all the other signals in place as well of course) "

B) Double Bottom -

Not as dynamic as the head and shoulders formation but a good bullish indicator none-the-less. Again though, the ideal is that it is matched by increased volume and minimal or no overhead resistance and that it is read in conjunction with the upward price break of the MA and the turn up of the MA itself.

Double bottoms are far from an unusual occurrence (whereas Head and Shoulders are few and far between) and so one has to be careful and demanding of the surrounding criteria so that one does not end up buying before the uptrend is in evidence.

Brambles Ind.plc chart shows a classic double-bottom formation which preceded the buy of this share in Sept/Oct 2003 "

Head-and-shoulders and double bottoms etc. apart, the pre-requisite is for the three main technical aspects, as described above, to come together at the same time.

Here are three share examples of this "triple whammy" effect plus some additional TA that gives rise to explosive growth and some super profits "

Charter (chtr) "

caption: Charter (chtr)

caption: Ashtead (aht)

caption: Savilles (svs)

One last "rule": Weinstein advises that you be aware of the main trend of the market in which you intend to invest. There is a far greater risk involved in buying a share when the market index for that share is in a Stage 3 or Stage 4 formation.

For "bear" markets (Stage 4s) it is simply a case of reversing the indicators and shorting the shares rather than buying them; and that can be even more profitable as shares will go down faster than they go up.

Enjoy your share selections. Remember, the trend really is your friend; but you need to know whether it is a Stage 1,2,3 or 4 trend before you open a trade and Weinstein's stage identification techniques really do make trading simpler and profitable.

Last edited by a moderator: