kimo'sabby

Experienced member

- Messages

- 1,622

- Likes

- 287

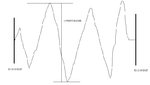

That very much depends on how close to "Straight up" you place your bet and the volatility of the instrument. Also of course on where your target is.

In the extreme, if you placed a long trade on say the DAX with a 1 tick stop loss and a tiny little 10 tick target, you'd get taken out most of the time.

On the one hand, you have the theoretical 90% loss rate but break even P&L that such a stop & target would yield. On the other hand the volatility would probably see you hit more that 90% of the time.

Add into that mix a little bit of hope and you would most certainly be looking at 100% losers.

Ok. Firstly, i asked you for a percentage outcome, rather than 50%, you answered with your own theoretical answer. You decided not to give a direct and absolute answer, instead you created an answer to suit your own particular view on one very random and unique set of circumstances. Do you think that your own theory would be applicable to all traders in every scenario?

Theoretical = monotonous🙂