**** this: I'll practice more

If there's anything I learned from the post above that I should just keep on practicing more to see if I can learn to accept losses without being destabilized by them so much that I throw away the method that caused them.

So I'll now do more 10-trades series for the 10 candles method, because that's much easier on my brain.

I'll post them here below.

Wait: I will add a little variation. I can stay as long as 10 weeks (10 weekly candles) but I can also exit sooner if I want to. I still have to make the trade as soon as the chart is shown to me. I was tempted to allow myself to pass, but that way I would not be forced to understand all types of markets. Instead: I am forcing myself to make a bet on ANY situation I see.

Oh, and, not to cheat, I have to stay at least 5 candles. Otherwise it would be too easy to make the trade and get out after 1 candle.

So the rules are:

1) start trade immediately

2) stay from 5 to 10 candles (discretionary)

Done first series:

-62%

http://chartgame.com/trackrecord.cgi?ew6cuy-27,10

I am learning. I learned that the green or red candle doesn't really matters. What matters is all the previous candles and support and resistance. You often get this optical illusion when you see a white/green (depending on software) candle, that makes you feel NOW things are going to rise. That's misleading I think. We'll see.

Changed rules again:

1) start trade immediately

2) stay 10 candles no matter what

I changed them because I often get scared when the markets go against me but within the 10 candles they go my way if I was right, and I shouldn't have gotten out. Being trapped in a trade can be better than being able to get out. Anyway, as i said yesterday, you need something to forbid your self-defeating tendency to cut winners and let losses run. Freedom is not that good. Even Jesse Livermore said it, that when he first switched to regular stock trading, he lost money, and that in the bucket shops he was trading better because they had a fixed stoploss.

Some things I am sure about are these:

1) if price is rising and the previous peaks (I only see 4 years of it) are higher, it is likely to keep on rising. Viceversa for the falling.

2) if price is rising beyond the previous peak, it is also likely to keep on rising. Viceversa for the falling.

But when is a rising/falling price not likely to continue then?

3) if price is rising and has reached the previous peak, it is likely to correct for a little while. Viceversa for the falling.

These three rules above are basically the concept of support and resistance. Above support and above resistance a rising price will keep on rising. Below support and below resistance a falling price will keep on falling. I don't know all the implications, but those two lines work as bus stops. And where are those two lines? Roughly speaking, since I am given 4 years, at the top and bottom of the chart: the lowest it fell and the highest it rose. But this is all discretionary, because it has a lot to do with the way candles appear on the chart.

Anyway, essentially, whenever I am presented with a new chart, I have to identify where the bus stops are and where the bus is going (up or down).

If the bus is going up and it is beyond the last bus stop, within the next 10 candles it will keep on going there. I have to bet for that bus ride to continue, no matter what green/red candles I see.

If the bus stop has reached a bus stop, things change.... I'll have to play more before I can finish this comparison.

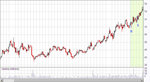

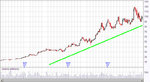

But here's a simple example I am seeing now. I am shown 4 years and I have to make my bet immediately. I see the last bus stop behind us, and the bus is going up, so i am betting it will continue - with the requirement that we have to stay on the bus for 10 periods (10 weekly candles), because otherwise we cannot focus on the big picture and even now I am thinking that a requirement of 20 candles would be better but I'll keep 10.

Anyway, I am betting that the bus will keep on going up, since there are no bus stops in sight.

Ok, and it did. Here's the chart. Too bad I had to stay exactly for just 10 candles:

Let's do a couple more example with more pictures.

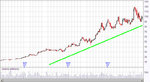

Next chart.

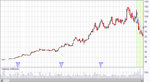

Ok, here there no stops in sight, and no bus stops even behind us. And it is going up.

So I am betting that it will keep on going up. Let's see what happens:

How was I supposed to know that at 120 there was an invisible bus stop and that it would have turned around? I don't think I could have predicted this. So I am satisfied with my (huge) loss. Just because I am writing here, otherwise I would shut down the web page and abandon the project.

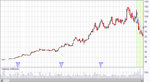

Let's do one more:

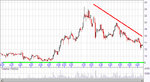

Ok, this is going down and the bus stop is still far. I am betting it will keep on going down:

And it did, but then, after reaching the bus stop (almost) it came back up. So we might benefit from a rule that when the bus stop is reached we can get off the bus: