isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

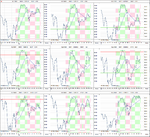

Attached is the updated market breadth charts. A few changes this week as the short term NYSE Percent of Stocks Above their 50 Day Moving Averages reversed to Xs on Tuesday as noted by bearsworth yesterday when he said about the low pole reversal, but Friday's negative price action negated the whole weeks gains in one day and it's now back on Bear Confirmed status.

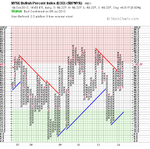

The medium term NYSE Percent of Stocks Above their 150 Day Moving Averages also changed this week back to Xs and so regained it's Bull Confirmed status and in doing so defined the break down level necessary to give a P&F sell signal if it breaches it. So if it falls below the 66% level then the medium term chart would give a sell signal as well and change to Bear Confirmed. Which it is very close to doing as Friday's price action dropped it back to 69.25%, so I'll be watching it closely next week.

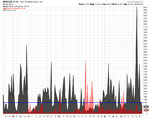

The line chart of the NYSE Percent of Stocks Above their 150 Day Moving Averages has a lower sell level though, as I use the 30 week weighted moving average for additional confirmation, which is currently at 61.02%. And so it would need to get below 61% for that to go to a sell as well.

Below is the table and attached are the charts

The medium term NYSE Percent of Stocks Above their 150 Day Moving Averages also changed this week back to Xs and so regained it's Bull Confirmed status and in doing so defined the break down level necessary to give a P&F sell signal if it breaches it. So if it falls below the 66% level then the medium term chart would give a sell signal as well and change to Bear Confirmed. Which it is very close to doing as Friday's price action dropped it back to 69.25%, so I'll be watching it closely next week.

The line chart of the NYSE Percent of Stocks Above their 150 Day Moving Averages has a lower sell level though, as I use the 30 week weighted moving average for additional confirmation, which is currently at 61.02%. And so it would need to get below 61% for that to go to a sell as well.

Below is the table and attached are the charts