You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

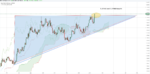

If using ascending triangle pattern (looks good to me by the way) to get in, does this mean you'll be automatically exiting at the target? Or possibly holding on after re-assessment?

My target first target is 1.22900. Then I will be targeting 1.24000. This will be my level to sell.

Attachments

1.21900 and 1.22900 are the next targets of the pair.

I disagree that it is a triangle pattern because it doesn't meet the conditions used to define a triangle. For example, the triangle pattern contains five overlapping waves that subdivide 3-3-3-3-3 (page 49 Elliot Wave principle by Frost and Prechter). The key conditions I have highlighted.

There are variations of it such as :

Brumby, I 'm not saying these guys aren't good technical analysts, but they don't have a world monopoly on the definition of an ascending triangle. Other definitions exist and are perfectly usable.

I am not being pedantic for the sake of it. Triangles are unique because they provide reasonably precise minimum measured move targets due to the internal price structure of the triangle. Additionally a triangle always occurs in a position prior to the final actionary wave in the pattern of one larger degree.

Looking at the price pattern of the example in question I am happy to be pointed to an authority regarding another definition that will fit in the example used. I referred to Edwards and Magee and reading that chapter on triangle I would be hard pressed to make that argument of a triangle. I did not check Bulkowski though.

I am not being pedantic for the sake of it. Triangles are unique because they provide reasonably precise minimum measured move targets due to the internal price structure of the triangle. Additionally a triangle always occurs in a position prior to the final actionary wave in the pattern of one larger degree.

Looking at the price pattern of the example in question I am happy to be pointed to an authority regarding another definition that will fit in the example used. I referred to Edwards and Magee and reading that chapter on triangle I would be hard pressed to make that argument of a triangle. I did not check Bulkowski though.

But that's my point, chart patterns do not provide precise targets so increased precision in their identification is not a route towards improved outcomes.

Patterns are like impressionist art rather than photographs - you can tell what's there from the mass of colour and form, but you'd never take it into court for ID-ing a suspect. Getting closer and closer to an impressionist picture just doesn't help.

But that's my point, chart patterns do not provide precise targets so increased precision in their identification is not a route towards improved outcomes.

Patterns are like impressionist art rather than photographs - you can tell what's there from the mass of colour and form, but you'd never take it into court for ID-ing a suspect. Getting closer and closer to an impressionist picture just doesn't help.

The title of the thread is coined a triangle breakout and not just simply breakout. The specificity itself suggest a particular pattern is being considered. I did not set the premise but I am questioning the accuracy of the premise. Secondly, I have said that triangles are unique in its attributes in terms of post breakout measured moves. It is a different conversation on whether clearer identification will result in an improved outcome.

I am still open to you or the OP that will point to some authoritative work that fits the definition of a triangle pattern as evident before us.

The title of the thread is coined a triangle breakout and not just simply breakout. The specificity itself suggest a particular pattern is being considered. I did not set the premise but I am questioning the accuracy of the premise. Secondly, I have said that triangles are unique in its attributes in terms of post breakout measured moves. It is a different conversation on whether clearer identification will result in an improved outcome.

I am still open to you or the OP that will point to some authoritative work that fits the definition of a triangle pattern as evident before us.

I didn't want to go down this road, as the chart shows a tradable ascending triangle and that's good enough. I think the search for authorities who can better and better fit or define a pattern is just a search for spurious accuracy and reliability and I don't see it as improving the bottom line which is what's most important.

However as you ask, Bulkowski in Encyclopedia of Chart Patterns has this to say -

Identification Characteristics of Ascending Triangles

"Triangle shape

Two price trendlines, the top one horizontal and the bottom one sloping up, form a triangle pattern. The two lines join at the triangle apex.

Horizontal top line

Prices rise up to and fall away from a horizontal resistance line at least twice (two minor highs). Prices need not touch the trendline but should come reasonably close (say, within'/s). The line need not be completely horizontal but usually is.

Up-sloping bottom trendline

Prices decline to and rise away from an up-sloping trendline. Prices need not touch the trendline but should come close (within '4). At least two trendline touches (minor lows) are required.

Crossing pattern

Prices should cross the chart pattern several times; they should not leave a vast amount of white space in the center of the triangle.

Volume

Volume is heavier at the start of the formation than near the end. Volume is usually low just before the breakout.

Premature breakouts

Somewhat prone to premature breakouts, both up and down. Volume on a false breakout is also heavy, just as the genuine breakout.

Upside breakout -

Volume is heavy (but need not be) and continues to be heavy for several days.

Price action after breakout -

Once prices pierce the horizontal resistance line confirming a breakout, prices move up and away from

the formation. Throwbacks to the formation top are common. If prices continue to climb rapidly, volume will probably remain high. For downside breakouts, volume is high at first and usually tapers off unless the price decline is rapid, in which case volume will probably remain high."

Please be aware this isn't my preferred definition, its probably not the best definition, its just that you demanded an authority and I'm happy to quote this one.

I didn't want to go down this road, as the chart shows a tradable ascending triangle and that's good enough. I think the search for authorities who can better and better fit or define a pattern is just a search for spurious accuracy and reliability and I don't see it as improving the bottom line which is what's most important.

However as you ask, Bulkowski in Encyclopedia of Chart Patterns has this to say -

Identification Characteristics of Ascending Triangles

"Triangle shape

Two price trendlines, the top one horizontal and the bottom one sloping up, form a triangle pattern. The two lines join at the triangle apex.

Horizontal top line

Prices rise up to and fall away from a horizontal resistance line at least twice (two minor highs). Prices need not touch the trendline but should come reasonably close (say, within'/s). The line need not be completely horizontal but usually is.

Up-sloping bottom trendline

Prices decline to and rise away from an up-sloping trendline. Prices need not touch the trendline but should come close (within '4). At least two trendline touches (minor lows) are required.

Crossing pattern

Prices should cross the chart pattern several times; they should not leave a vast amount of white space in the center of the triangle.

Volume

Volume is heavier at the start of the formation than near the end. Volume is usually low just before the breakout.

Premature breakouts

Somewhat prone to premature breakouts, both up and down. Volume on a false breakout is also heavy, just as the genuine breakout.

Upside breakout -

Volume is heavy (but need not be) and continues to be heavy for several days.

Price action after breakout -

Once prices pierce the horizontal resistance line confirming a breakout, prices move up and away from

the formation. Throwbacks to the formation top are common. If prices continue to climb rapidly, volume will probably remain high. For downside breakouts, volume is high at first and usually tapers off unless the price decline is rapid, in which case volume will probably remain high."

Please be aware this isn't my preferred definition, its probably not the best definition, its just that you demanded an authority and I'm happy to quote this one.

Thanks for your reference on Bulkowski. I also managed to find my copy. The definition is so loose that basically almost any breakout in an uptrend can be argued as a triangle breakout. No wonder your view of its usefulness in terms of post breakout measured move is ambivalent.

As an example, I have taken the same EURUSD chart and pointed out all the recent breakouts to be qualifying as triangle breakouts (per Bulkoswki's definition) which makes the pattern usefulness rather meaningless.

Thanks for your reference on Bulkowski. I also managed to find my copy. The definition is so loose that basically almost any breakout in an uptrend can be argued as a triangle breakout. No wonder your view of its usefulness in terms of post breakout measured move is ambivalent.

As an example, I have taken the same EURUSD chart and pointed out all the recent breakouts to be qualifying as triangle breakouts (per Bulkoswki's definition) which makes the pattern usefulness rather meaningless.

The frequency of a given pattern on a given chart over a given period doesn't make the next in the series less likely to be profitably tradable. In fact, all the triangles on your chart look valid and its noticeable that the two which have completed were winners.

Chart patterns like this should have rather loose definitions in order to be traded. Its the successful trading that justifies the pattern identification, not the other way round.

Similar threads

- Replies

- 8

- Views

- 3K

F

- Replies

- 3

- Views

- 1K