Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

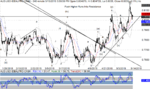

NZDUSD Daily Wave Count

As the rest of the pairs were at least making some headway against the USD early in the week, the Kiwi continued to soften. While prices are at support near .7400, there’s low expectations that’ll hold – at least under the top count. Looking back at the bigger picture, it’s clear that stiff resistance held below .7800, after three attempts to push through, and the action up from the low is choppy and overlapped. That’s the hallmark of corrective action. In addition, notice that daily RSI failed to reach into “Sustainable Bull” territory, and that there were two bearish divergences into the wave iii and v of (c) tops. So, we’ll continue to prefer the bearish view, at least while prices remain below the .7600. Above there, and it’ll depend on the structure of the rally that will tell the tale.

As the rest of the pairs were at least making some headway against the USD early in the week, the Kiwi continued to soften. While prices are at support near .7400, there’s low expectations that’ll hold – at least under the top count. Looking back at the bigger picture, it’s clear that stiff resistance held below .7800, after three attempts to push through, and the action up from the low is choppy and overlapped. That’s the hallmark of corrective action. In addition, notice that daily RSI failed to reach into “Sustainable Bull” territory, and that there were two bearish divergences into the wave iii and v of (c) tops. So, we’ll continue to prefer the bearish view, at least while prices remain below the .7600. Above there, and it’ll depend on the structure of the rally that will tell the tale.