Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

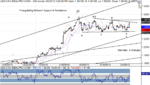

NZDUSD 240-minute Wave Count

There’s several counts on the table with NZDUSD, but similar to the others, prices failed at resistance. There’s five waves up from the low, although it’s overlapped in two key areas, so the near term count is a bit fuzzy. It could be a leading diagonal up, which would have us looking for a deep retracement, or it could be an abc up with an ending diagonal for c (our “top” view). What’s clear is that price have rallied in two equal waves up from the low, and failed at structural resistance from former support at the wave (.b) low. Here, too, though, new lows directly aren’t guaranteed. It’ll be the nature of the early week decline (corrective or impulsive) that will tell the tale. Stay tuned to Twitter for mid-week updates. As long as prices are above last week’s low at .7421, there’s a chance for the B wave rally to develop further.

There’s several counts on the table with NZDUSD, but similar to the others, prices failed at resistance. There’s five waves up from the low, although it’s overlapped in two key areas, so the near term count is a bit fuzzy. It could be a leading diagonal up, which would have us looking for a deep retracement, or it could be an abc up with an ending diagonal for c (our “top” view). What’s clear is that price have rallied in two equal waves up from the low, and failed at structural resistance from former support at the wave (.b) low. Here, too, though, new lows directly aren’t guaranteed. It’ll be the nature of the early week decline (corrective or impulsive) that will tell the tale. Stay tuned to Twitter for mid-week updates. As long as prices are above last week’s low at .7421, there’s a chance for the B wave rally to develop further.