Impulsive and Corrective Waves

Source: www.tradingview.com

Prices move in impulsive and corrective waves. Knowing which wave is likely underway, and what recent waves were, helps forecast what the price is likely to do next.

An impulse wave is a large price move and has associated trends. An uptrend keeps reaching higher prices because the moves up are larger than the moves down which occur in between those large up waves.

Corrective waves are the smaller waves that occur within a trend.

Trade in the direction of the impulse waves, because the price is making the largest moves in that direction. Impulse waves provide a better chance of making a large profit than corrective waves do.

Corrective waves are used to enter into a trend trade, in an attempt to capture the next bigger impulse wave.

Buy during pullbacks or corrective waves during uptrends, and ride the next impulse wave as it takes the price higher. Short sell during corrective waves in a downtrend to profit from the next impulse wave down.

The idea of impulsive and corrective waves is also used to determine when a trend is changing direction. If a price chart shows big moves to the upside, with small corrective waves in between, and then a much larger down move occurs, that is a signal the uptrend may be over. Since impulses occur in the trending direction, the big move to the downside—which is bigger than prior corrective waves, and as large as the upward impulse waves - indicates the trend is now down.

If the trend is down, and a big up wave occurs - that is as big as the prior down waves during the downtrend - then the trend is now up and traders will look to buy during the next corrective wave.

Trend and Pullback Price Structures

Source: www.elliottwave.com

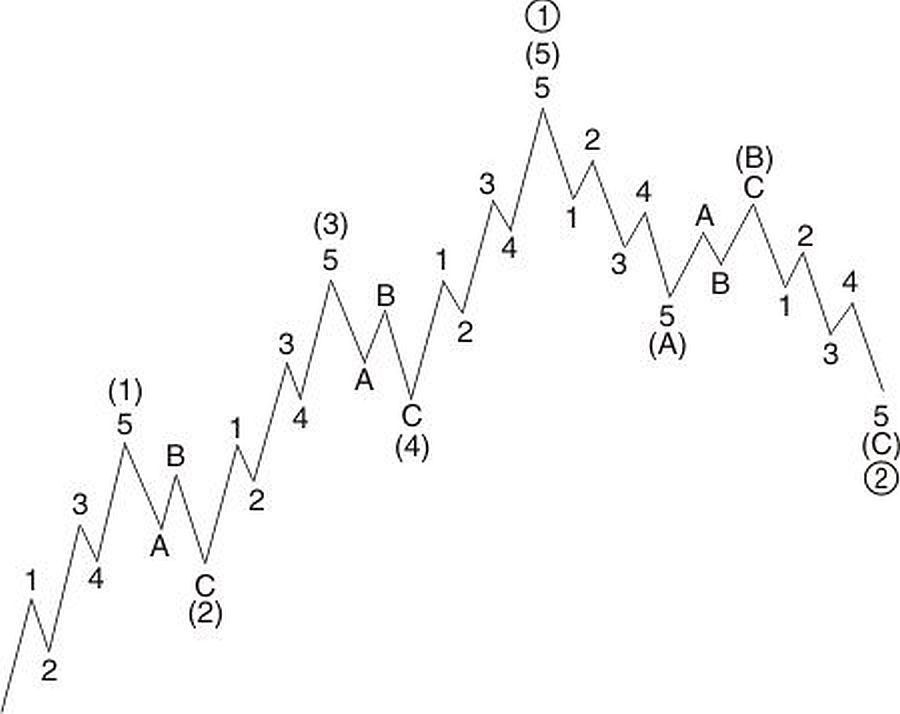

Nelson found that when an uptrend is underway it typically has three large upward price moves, interspersed with two corrections. This creates a five-wave pattern: impulse, correction, impulse, correction, and another impulse. These five waves are labeled wave one through wave five, respectively.

The uptrend is then followed by three waves lower: an impulse down, a correction to the upside, and then another impulse down. These waves are labeled A, B, and C.

Nelson also found that these movements are fractal, meaning the pattern occurs on small and large time frames. For example, the first impulse wave higher within an uptrend on a daily chart is composed of five waves on an hourly chart. Corrective waves are composed of three smaller waves if viewed on a smaller chart time frame.

This fractal pattern span decades, with smaller versions of the pattern even visible on one-minute or tick charts.

Just as impulsive and corrective waves help determine when to enter trades, and in which direction the trend is moving, this price structure can do the same. Assume there was just a big move to the upside—an impulsive wave—then a correction is likely to follow. That correction to the downside will often unfold in three waves: a drop, a small rally, and then another drop. Use this to improve trade timing by waiting for that second drop. Getting it right when the price starts to drop the first time is too early, as another drop is likely coming.

Similarly, once there have been three big moves to the upside, the uptrend may be nearing completion. An impulse wave to the downside would then confirm that the price is likely to head lower and the uptrend is indeed over.

This pattern tends to occur in widely traded markets with high volume, such as the SPDR (The S&P500 ETF) (SPY). The pattern is harder to spot, or doesn't occur, in individual stocks which are more prone to movements based on the buying and selling of only a few individuals.

Typical Correction Size

When buying on corrections during an uptrend or selling on corrections in a downtrend, it is helpful to know how large the typical correction is.

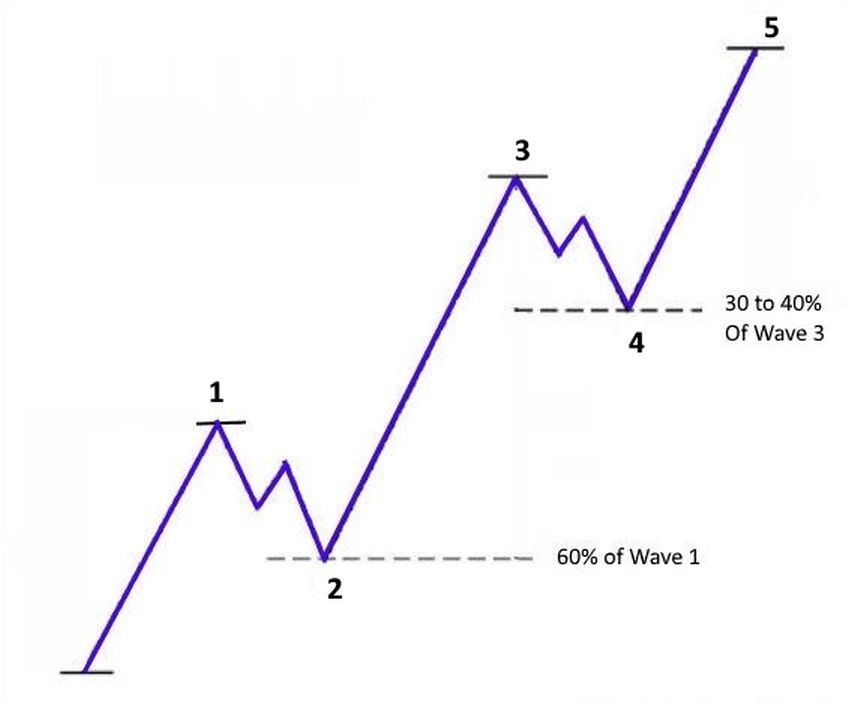

Based on the five wave pattern, wave one is the first impulse wave of a trend and wave two is the first correction. Wave three is the next impulse, followed by corrective wave four and impulse wave five.

Based on the research of Nelson, wave two is typically 60 percent of the length of wave one. If wave one advances $1, then wave two will likely see the price drop by about $0.60. If it is the start of a downtrend, and wave one was $2, the correction to the upside is often about $1.20.

Wave two is followed by impulse wave three. The third wave of a trend is often the largest, usually much bigger than wave one. Wave four comes next and is typically 30% to 40% of the size of wave three. For example, if wave three rallied $3, the price is likely to drop $0.90 to $1.20 during wave four. The same concept holds true for a downtrend.

These are averages seen over many trades and trends. Corrections may be smaller or larger than average on any single trade. Yet, even having an approximate idea of how big a correction is likely to be can help improve trade timing.

Combining The Concepts

Utilize these three concepts by only taking trades in the direction of the impulse waves. Take trades during the corrective waves. Look for trade entry signals once the price has corrected by the average amount. The correction isn't likely to stop exactly at the percentage levels discussed above, so taking trades slightly above or below the described percentage levels is fine.

Consider keeping track of each wave in the overall price structure. For example, after a five wave pattern to the upside, a bigger three wave decline usually follows. Watching the direction of the impulse waves will signal potential trend changes, and that signal is stronger if combined by a five-wave impulse pattern or a three-wave correction pattern ending.

In Summary

These three Elliott Wave concepts may improve trader's analysis skills or improve their trade timing, but it is not without its own problems. The theory can be complex to apply, as it isn't always easy isolating the five wave and three wave patterns. The pattern also isn't often present in individual stocks, but rather applies to only heavily traded assets which aren't susceptible to the buying or selling of only a few traders. The concept of impulse and corrective waves is applicable to all markets and time frames, though, and can still be used even if the theory of the five wave and three wave price patterns isn't.

Cory Mitchell can be contacted at Vantage Point Trading