Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

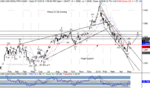

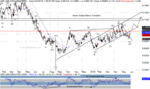

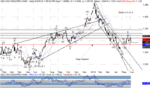

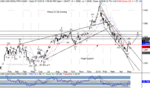

USDCAD Wave Count

Our USDCAD count shows the difference between trading and analysis. While we have a completed rally into the January high, it was accompanied by Sustainable Bull readings on RSI, with no divergence. Then, prices collapsed in a relentless selloff, with multiple Sustainable Bear readings, and no divergence into the low. So, even though we've been expecting this wave B rally for sometime from an analysis perspective, we haven't once become aggressively bullish. As traders, when a picture isn't crystal clear - DO NOT TRADE IT. A mentor once compared trading to fishing. Most of the time you're sitting around, waiting for a bite, you're not constantly reeling 'em in, right? So, we're expecting a further bounce to complete B, but is wave (b) of B complete? Is the rally going to a new high per the Sustainable Bull reading? Too many questions, when the counts elsewhere are clear.

Our USDCAD count shows the difference between trading and analysis. While we have a completed rally into the January high, it was accompanied by Sustainable Bull readings on RSI, with no divergence. Then, prices collapsed in a relentless selloff, with multiple Sustainable Bear readings, and no divergence into the low. So, even though we've been expecting this wave B rally for sometime from an analysis perspective, we haven't once become aggressively bullish. As traders, when a picture isn't crystal clear - DO NOT TRADE IT. A mentor once compared trading to fishing. Most of the time you're sitting around, waiting for a bite, you're not constantly reeling 'em in, right? So, we're expecting a further bounce to complete B, but is wave (b) of B complete? Is the rally going to a new high per the Sustainable Bull reading? Too many questions, when the counts elsewhere are clear.