Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

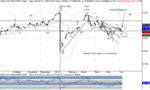

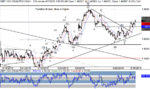

USDCHF Daily Wave Count

Similar to USDCAD, we’re looking for a turn higher. But, the bounce from the wave (ii) low is only in three waves, so a decline to complete wave (ii) is still possible. In addition, there’s an awful lot of overhead resistance, unlike the other pairs. That’s not a reason to completely dismiss the upside here, though, especially since many may not be positioned for franc weakness. Should prices push above the wave (i) high, many traders may scramble to cover shorts and become new longs.

Similar to USDCAD, we’re looking for a turn higher. But, the bounce from the wave (ii) low is only in three waves, so a decline to complete wave (ii) is still possible. In addition, there’s an awful lot of overhead resistance, unlike the other pairs. That’s not a reason to completely dismiss the upside here, though, especially since many may not be positioned for franc weakness. Should prices push above the wave (i) high, many traders may scramble to cover shorts and become new longs.