Silvertip

Member

- Messages

- 88

- Likes

- 3

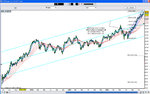

Hang Seng & Nikkei both very bullish during the night session. Everything is on track for the FTSE to open strong resulting in a nice little rally of the Dow to 12500. If traders are holding onto economic fundamentals as the factor to turn the trend in this market after absorbing the recent PPI, CPI data, not to mention crude with its longstanding $60+ value, OPEC production cuts and the disappearance of M3 data from the imperial vortex itself, then you must be short of a textbook solution or two! Is it remotely possible we could still be in a bull market!?