Our Weekend Pre-Market Preparation begins with evaluation of Pending Economic

Reports

1) This week's list begins Monday (US holiday Martin Luther King) and the initial focus is on

China (GDP).

2) From that point of departure, Institutions then look at "Services CPI" because these reports

(especially if revised) have the potential to activate "Sell Algos" that will put a cap on the

upward "drift" of the market. For those serious about trading with an edge, we suggest

you read this post carefully. We base our scenarios on the following assumptions

REPORTS

China Economic News/Monday

China GDP (Monday): This report influences global growth sentiment and commodity-linked assets (like the AUD and NZD currencies), with its impact on the S&P 500 futures largely absorbed before the Tuesday morning bell in New York. While we acknowledge that it CAN be significant, based on

what we know AT THIS TIME, it is not expected to have a big impact on the NY Session. We will update after the report is released.

NY Session Open/Tuesday

The

Eurozone CPI report, will be released Tuesday morning. While the US Markets are closed Monday, the S&P 500 futures will trade in the overnight session and react to the news in real time. By Tuesday's NY open, much of the market's initial reaction to the China data will likely be priced in, though residual volatility may remain. It is this "residual volatility" that we want to trade. Again updates to our scenarios are likely.

Institutional Expectation

The market is currently pricing in potential Fed rate cuts later in the year, and any inflation data (even from the Eurozone) that challenges this narrative creates potentially negative response for the S&P 500 futures, thus the emphasis on China GDP and Eurozone CPI

The release on Tuesday is the final reading for December, with initial estimates suggesting a return to "target" levels. These are the currently

available "consensus" opinions.

- Headline CPI: Expected to hold steady at 2.0% to 2.1% year-over-year.

- Core CPI: Forecasted around 2.2% to 2.3%, as service-sector price pressures remain more persistent than headline energy and food costs.

- 2026 Outlook: The ECB and other major institutions (OECD, IMF) project an average annual inflation rate of approximately 1.9% for 2026.

Important Note

Institutional desks currently view SERVICES PRICE GROWTH as the primary obstacle to a definitive end to the inflation cycle.

We will be monitoring Services CPI carefully because any deviation from recent numbers (3.4-3.5%) WILL activate ALGOS (on the sell side)

For institutional traders tracking services-specific inflation as a gauge for underlying price stickiness, there are two distinct releases to watch:

The first is,

Eurozone final data this week, then the

U.S. January report next month.

A detailed breakdown of services inflation for the Euro area is scheduled for release

Monday, January 19, 2026 (with full final data typically processed by desks at the Tuesday, January 20 open).

- Context: While the "Flash" estimate on January 7 provided a preliminary services inflation figure of 3.4% (down from 3.5% in November), the release on JAN 19th/20th IS EXPECTED TO PROVIDE CONFIRMATION.

- Significance: Services remains the stickiest component of Eurozone inflation, and any upward revision in the final report would be viewed as hawkish by institutional desks

Also Important;

INSTITUTIONS WILL BE CLOSELY WATCHING the

PCE Price Index on

Thursday, January 22, 2026. This report includes the "Supercore" inflation measure (services ex housing and energy). THIS is currently the Federal Reserve's preferred metric for evaluating wage-related inflation pressures.

Final Summary/Upcoming Releases

- January 19/20, 2026: Final Eurozone HICP (Full services breakdown).

- January 22, 2026: U.S. PCE Price Index (Supercore services data).

- February 11, 2026: U.S. January CPI (Services less energy services).

Bottom line for Professional Traders

For this week, our Scenarios are shown below in order of preference.

SCENARIO 1

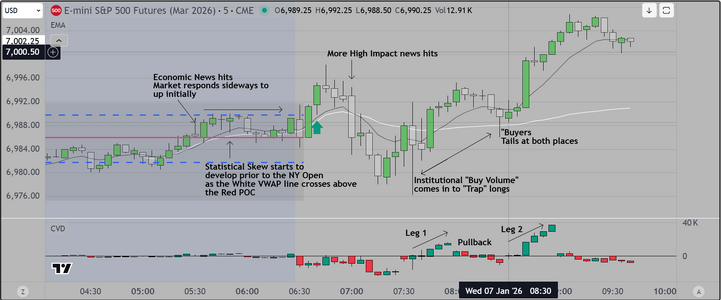

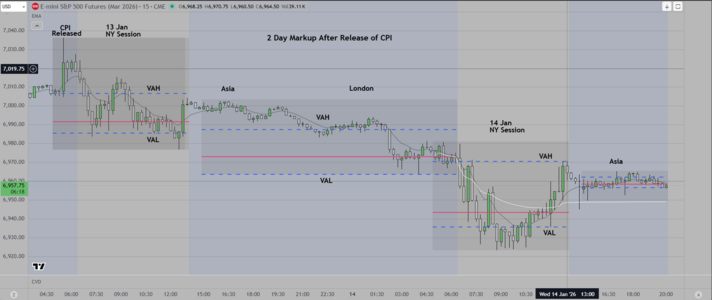

Professional traders will treat upward revisions in services inflation as a signal that "supercore" inflation remains problematic. Because services are heavily influenced by labor costs, stickiness here suggests that wage-price spirals are not fully extinguished, potentially delaying the next wave of global monetary easing. This creates a "valuation ceiling" for the S&P 500, especially as the index trades near logical resistance levels like 7,000. The

"expected" scenarios are a) a break to the upside, followed by a failure reversal lower, trapping buyers (trapping buy volume), OR if the news

is significant, a trend day to the downside, in which case we would identify the "give up" bar and "go with", meaning we would get short and hold

looking for a logical exit at about +50 pts. This could occur Monday, but is more likely Tuesday or Wednesday

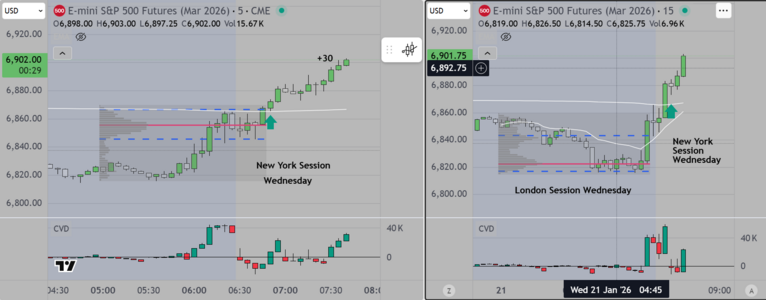

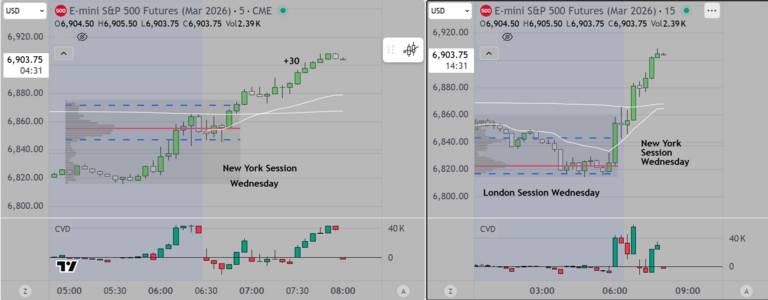

SCENARIO 2

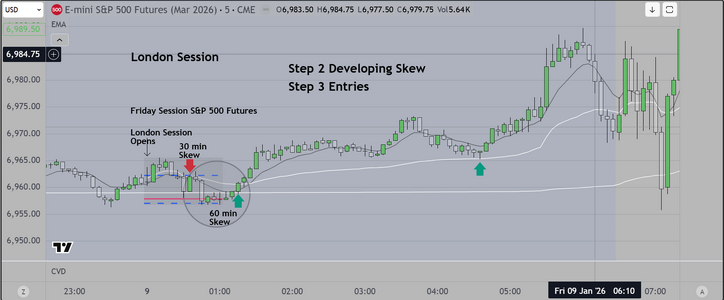

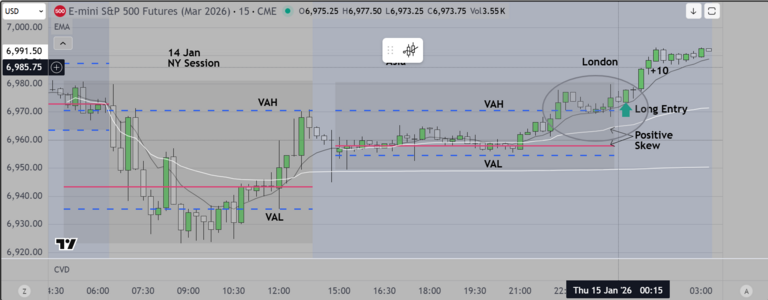

If there are no upward revisions, markets will start "neutral" on Tuesday and that would be apparent by monitoring the Monday London Session.

For this scenario, the market sweeps lower during the early going (London), then reverses at the end of the US/Euro Overlap, trapping shorts and reversing to the upside to retest 7,000. The "Tell" would be early trading range, followed by a false break to the downside, and then the reversal we mentioned

Good luck