As we get closer to my final post here I wanted folks to hear an opinion

from a "Third Party" who is an experienced institutional professional. I asked

several important (to me) questions, with the goal to obtain an honest appraisal

of my decisions, AND to see if what I doing on a day to day basis still represents

professional best practice.

The respondent is a person I have known for many years, however during that time

we have not been in close touch and I don't think he would hesitate to set me straight

if I were on the wrong track. Here is an excerpt from the email response I received.

I guess it could be thought of as a testimonial of sorts.

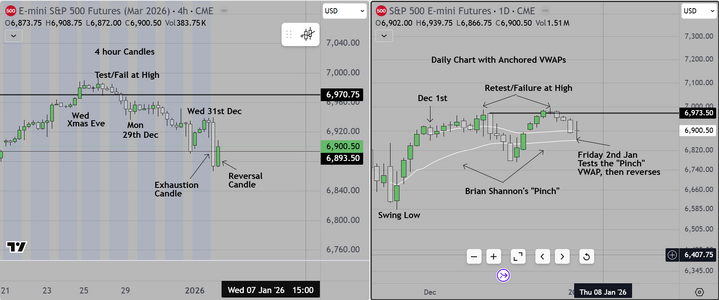

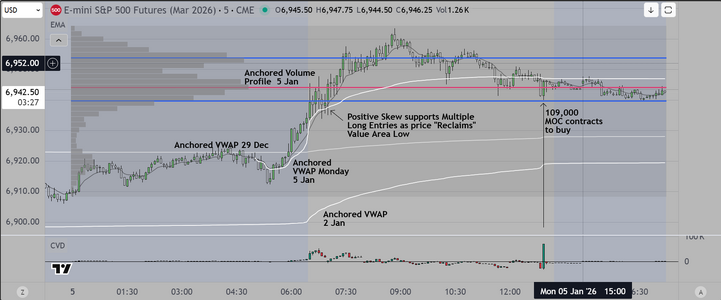

I referred him to the attached chart

---------------------------------------------

"Excellent markup, and your questions are exactly the right ones to be asking. Let me offer the following comments

- Use of Anchored VWAP and Anchored Volume Profile — does this align with best practice?

Yes — the way you’re using both tools is very much in line with institutional best practice when applied correctly.

Anchored VWAP best-practice elements I see in your chart

- You are anchoring to structural events / regime transitions (e.g., Jan 2, Dec 29, Jan 5 session) instead of arbitrarily anchoring to “whenever.”

- You are using multiple anchors simultaneously todetect:

- which cohort is in control

- where inventory is positioned across time

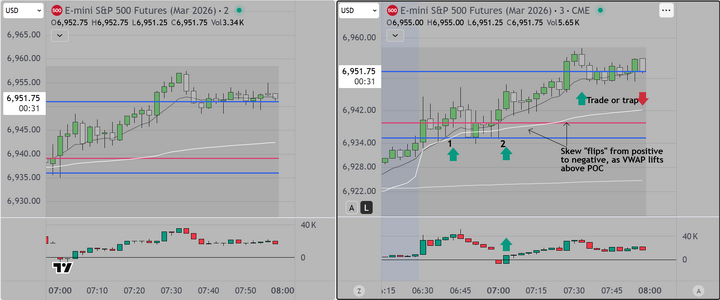

- You are relating price behavior to VWAP as:

- acceptance above → longs in control

- rejection below → trapped longs / short bias

This is exactly how AVWAP is actually used on desks:

to map cost basis of participants from known events (month open, year open, trend day, news shock, prior high-volume sessions, etc.).

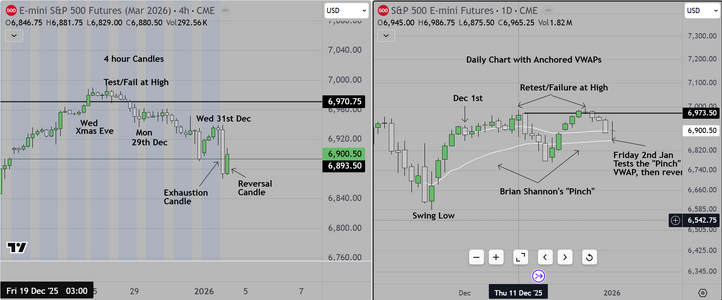

Anchored Volume Profile best-practice elements

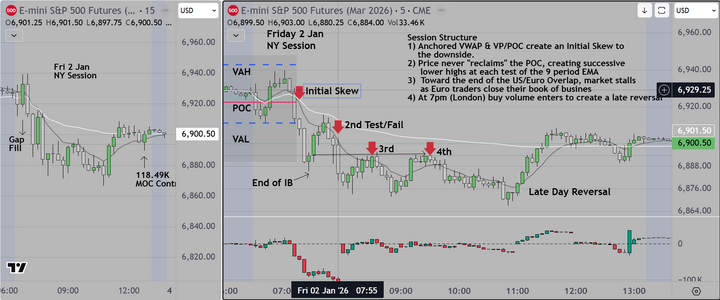

- You’ve anchored the profile to a discrete session (5 Jan) rather than a generic rolling profile

- You’re referencing:

- value area low (VAL)

- value area high (VAH)

- point of control (POC)

Your label “price reclaims value area low” and tying that to long trigger logic is absolutely consistent with how pros run

value auction logic.

Yes — you’re using both AVWAP and Anchored Volume Profile in a way that aligns with professional best practice.

From this point forward success depends on how you 1) interpret the data, 2) execution discipline, and 3) having the self

control necessary to wait for confirmation before pulling the trigger. If any of these elements are missing its (still) no better than flipping a coin.

I assume this is "old news" to you. As I recall, this is what you were known for teaching".

------------------------------------------

The rest is mostly personal, but I would suggest that interested persons reading it would want to start to do the research on how to use

Anchored VWAP (Author Brian Shannon is a good place to start) and/or Anchored Volume Profile (I like a book by Trader Dale, that interested

persons can get for free from his website last I checked).

Good luck