You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

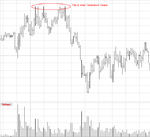

I'll repeat what I wrote as an introduction to the "quiz" chart: "For those who've been following along, with regard to everything you've read since post #69 and particularly with regard to the above post, is the circled area a short or a long?" Those who have not been following along or who have not read the posts beginning with post #69 will not understand what is going on and should therefore either withhold their comments until they are up to speed or post their comments elsewhere.

There is nothing philosophical about any of this: climax, test, movement. If one can't get this, none of the rest will be of any benefit whatsoever.

There is nothing philosophical about any of this: climax, test, movement. If one can't get this, none of the rest will be of any benefit whatsoever.

That's what the template is all about, knowing how one arrived at the point at which a decision has to be made.

If I have to trade, I will go long because demand has come in based on the last few bars. It is nevertheless a counter trend trade going for a RR=1. There is no evidence as yet of a trend change.

wallstreetwarrior87

Senior member

- Messages

- 2,068

- Likes

- 389

To wallstreetwarrior: the purpose of this arc, again, is to apply the template to a chart for the reasons already stated. Extraneous details, while perhaps interesting, are not pertinent. If you want to argue about it, please do so elsewhere.

I leave it where it is, BTW I was not arguing, just maybe trying to take Wykoff theory beyond where he did. So many holes and unanswered questions within it, in its current state. Need to take it further to actually be usable?

In fact there is currently another thread about Wykoff and VSA etc, all the bells and whistles, look here, look there, but once again all retrospect. So whats the point?

Once again, and finally, this is a great thread as a starting point. But for anyone wanting to learn about volume - this can not be done without understand who, what and most importantly WHY.

Sorry again for taking it off course.

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

A more detailed explanation behind a short.

Given the continued (and puzzling) interest in this thread, at least judging by the number of views, I'll go back to post #107 and pick up where I left off by reiterating that the purpose of this arc -- beginning with post #69 -- is to apply the "Wyckoff template" (see post #69) to NQ charts. No lines, no channels, no support or resistance, no news events, no laundry lists of standard trading considerations (entry, exit, management, risk assessment, and on and on, all of which have been addressed elsewhere). Just an examination of the state of the balance between demand and supply. Or buying interest and selling interest. Or buying pressure and selling pressure. It all amounts to the same thing. Once one has become adept at assessing these balances and imbalances as they lead up to what one perceives to be a potential trading opportunity, he ought to be able to assess the situation presented by the chart within a minute of opening it up. It's just a matter of practice.

In this particular case, the chart isn't opened up until after the best two entry opportunities are over and done: the long at the far left, and the short off the climax high. Is one to heave a sigh of regret and move on to something else? Not necessarily. There may be a further trading opportunity here. Or not. But that's the whole point of review and analysis. The analysis, however, has to be quick before price ticks over and the trade is gone. It's the typing and explanation that take forever; the analysis itself can be done, as I said above, in less than a minute.

There is even more here to be noted and annotated than has already been covered by the participants in this discussion, so I'll ignore all that to give whoever is interested the opportunity to examine the dynamics here further. Even so, there are a few things here that have not been noticed, such as bars 30 and 36 (and, yes, I've said repeatedly that "bars" are not as important as the waves that propel price up and down, but this is too high an obstacle for most at this stage, so I'll just leave it for now; those who are interested can read the Trading Price thread). Chrisg pointed out that demand is greater than supply in this area. And that's true. But the retracements pointed out here are also important as they indicate that Big Money is (a) pushing price higher and (b) dangling a carrot, looking for a following. If no following were to appear, price would fold and decline. But a following does appear (which is the purpose of orchestrating the retracement) and price continues to rise. No, it's not the same buyers as started this; they've bought; they're looking to push price higher so that they have somebody to sell to and make a profit (buyers would have no interest in pushing price higher otherwise; why pay more than one has to?). There is then climactic volume to the upside. It is here that Big Money begins to unload what it bought earlier, but gradually, lightly, in order to avoid introducing so much supply that price falls.

(I should point out here that nearly all of the above falls under the category of "why?" and is unnecessary with regard to assessing the trading opportunity at the right edge. After one does this for a while, these assessments of behavior become knowledge, and one no longer has to think about them.) But until then, it is enough to know that price is moving sideways, inching up, thrusting itself out of this range, failing to follow through, and testing what would appear to be a climactic high. Price then falls, rallies (notice anything interesting about where this rally effort comes to a halt?), then falls again, "further faster". Knowing "why" may be interesting, but one never really knows. Fortunately, knowing why isn't necessary in order to evaluate the potential trading opportunity.

As to supply "taking its foot off the gas", yes, but buying interest is also subsiding, as evidenced by the decline in volume (if selling pressure were declining while buying interest held or increased, volume would remain low but price would rise).

As to now what, consider further why price is halting here. This may provide some motivation to act one way or the other -- or at least to prepare to act one way or the other -- rather than just wait for further developments. And while waiting one can note that assessing the balances and imbalances between demand and supply is far easier when the chart is moving than when it is static, which is why practicing on moving charts, whether live or replay, is essential.

Thank you for putting forth the extra effort.

OK...Thanks for the 'heads-up',DB

considering the last 20 bars maybe the action can be interpreted so...

bar 91 large volume,large drop,close off low - supply greater than demand,sellers keenest but not by a lot

92 same but slightly higher vol and higher close and shorter drop indicates buyers getting more interested

93 large drop in vol, price lower -buyers easing off more than sellers also easing off

94 vol increase ,further drop -sellers keener

95-96 similar to 93-94

97 more interesting -vol fall with price rise-sellers holding back more than buyers-bar48 was similar at same level,is it BigMoney steadying the fall to distribute more or is that over

100 close off high,higher vol -sellers have come in at same level as 44/ 45 where BigMoney started to distribute

103,104 price drops on lower volume -the mirror image of 42, the BM's changed to being buyers- they want lower prices.

considering the last 20 bars maybe the action can be interpreted so...

bar 91 large volume,large drop,close off low - supply greater than demand,sellers keenest but not by a lot

92 same but slightly higher vol and higher close and shorter drop indicates buyers getting more interested

93 large drop in vol, price lower -buyers easing off more than sellers also easing off

94 vol increase ,further drop -sellers keener

95-96 similar to 93-94

97 more interesting -vol fall with price rise-sellers holding back more than buyers-bar48 was similar at same level,is it BigMoney steadying the fall to distribute more or is that over

100 close off high,higher vol -sellers have come in at same level as 44/ 45 where BigMoney started to distribute

103,104 price drops on lower volume -the mirror image of 42, the BM's changed to being buyers- they want lower prices.

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

To begin with, try not to become too wedded to bars. I know that's difficult for anyone who began trading during the last thirty years, and I know that you're trying to call attention to certain segments of the chart without annotating and uploading. But it is important to look at all of this as flow, which is even more difficult with a static chart, and to remember that there is no such thing as a "close" intraday, only after the market close and only with an instrument that stops trading with the market close (or soon thereafter).

Having said that, I want to emphasize again that this arc (beginning with post #69) is all about the template. There are all sorts of things in Wyckoff and in my book that go way beyond the template, such as the laundry list of trade considerations (risk, management, stops, etc) and of course the SLA, but none of that is necessary to applying the template. There is also the matter of auction market theory, and value, and energy. And even though the template suggests a series of upmoves followed by retracements and downmoves also followed by retracements, no special meaning is assigned to each little effort in either direction.

Even so, it is obvious to anyone that the initial move upward runs out of steam and shifts direction to more or less sideways. The reasons for this are interesting but not critical to making trade decisions. What does matter with regard to the template is the climactic volume which accompanies the "thrust" out of that range, followed by the test on lower volume.

However, without getting into patterns and labels and naming conventions and other extraneous matters, those who are reasonably familiar with trending and ranging know that the median of a range represents a kind of pivot. Those who have read auction market theory understand that this represents "value". It may be purely coincidental that when price drops after the test then attempts to rally back upward it stops dead at the median of that range formed before the climax. Buyers, for whatever reason, don't want to go there, and noticing this adds one more element to consider when balancing a long vs a short (one can't take it here because all this happened before the platform was fired up).

As to those last few bars, you've pointed out that they coincide with another effort at determining value which occurs from bars 35-40. This will be missed by those who don't know what they're looking at, but it does come into play here unless, again, the decline at the right edge stops here purely coincidentally.

Does all this mean that a short is inevitable? That one is in a position to "make a call"? No. But at the very least it prepares one for either outcome, and he can then set his buystop or sellstop or both as well as his covers and take advantage of whatever opportunity is offered here rather than sit and do nothing and wallow in regret over missing what may end up being an important and much-profitable move.

Having said that, I want to emphasize again that this arc (beginning with post #69) is all about the template. There are all sorts of things in Wyckoff and in my book that go way beyond the template, such as the laundry list of trade considerations (risk, management, stops, etc) and of course the SLA, but none of that is necessary to applying the template. There is also the matter of auction market theory, and value, and energy. And even though the template suggests a series of upmoves followed by retracements and downmoves also followed by retracements, no special meaning is assigned to each little effort in either direction.

Even so, it is obvious to anyone that the initial move upward runs out of steam and shifts direction to more or less sideways. The reasons for this are interesting but not critical to making trade decisions. What does matter with regard to the template is the climactic volume which accompanies the "thrust" out of that range, followed by the test on lower volume.

However, without getting into patterns and labels and naming conventions and other extraneous matters, those who are reasonably familiar with trending and ranging know that the median of a range represents a kind of pivot. Those who have read auction market theory understand that this represents "value". It may be purely coincidental that when price drops after the test then attempts to rally back upward it stops dead at the median of that range formed before the climax. Buyers, for whatever reason, don't want to go there, and noticing this adds one more element to consider when balancing a long vs a short (one can't take it here because all this happened before the platform was fired up).

As to those last few bars, you've pointed out that they coincide with another effort at determining value which occurs from bars 35-40. This will be missed by those who don't know what they're looking at, but it does come into play here unless, again, the decline at the right edge stops here purely coincidentally.

Does all this mean that a short is inevitable? That one is in a position to "make a call"? No. But at the very least it prepares one for either outcome, and he can then set his buystop or sellstop or both as well as his covers and take advantage of whatever opportunity is offered here rather than sit and do nothing and wallow in regret over missing what may end up being an important and much-profitable move.

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

From my book:

Unfortunately, a lot of people – i.e., those who have trouble determining the existence of trend, much less its direction, which is a hell of a lot more people that you'd imagine – try to short uptrends all the way to the top ("it's too high"). They'll note, perhaps, that volume tapers off after the first hour, suggesting that buyers aren't as enthusiastic as they should be. However, these traders ignore the obvious, that price is rising. The declining volume suggests nothing more than that sellers are allowing price to rise rather than make buyers fight for it (if buyers had to fight for it, volume would be higher; if buyers weren't interested, the price wouldn't be rising). These same traders, if price were going in the opposite direction, would try again and again to "catch the bottom".

If you don't have that "stairstep" look where each pullback comes back only to or higher than the last swing high before resuming the advance, then you may be looking at a slowing of momentum or even a trend change, if not a complete reversal. The trend can continue upward, but it will be a much slower "grind", with swing lows actually penetrating the previous swing, and it will be increasingly difficult to place stops (sometimes this "grind" establishes itself from the very beginning and one finds himself faced with what is called "creep", an even slower form of grind, difficult to play without wide stops and all the additional risk they entail).

Therefore, don't get trapped into looking at all of this as lines and angles. Think of the traders involved and what they paid and when they'll be profitable and when they'll be underwater and where they might be trapped into taking the wrong side of the trade. That is, after all, where all these movements come from. Gauging their strength by their movement will tell you who's got the upper hand and where the intent is likely to lie.

Unfortunately, a lot of people – i.e., those who have trouble determining the existence of trend, much less its direction, which is a hell of a lot more people that you'd imagine – try to short uptrends all the way to the top ("it's too high"). They'll note, perhaps, that volume tapers off after the first hour, suggesting that buyers aren't as enthusiastic as they should be. However, these traders ignore the obvious, that price is rising. The declining volume suggests nothing more than that sellers are allowing price to rise rather than make buyers fight for it (if buyers had to fight for it, volume would be higher; if buyers weren't interested, the price wouldn't be rising). These same traders, if price were going in the opposite direction, would try again and again to "catch the bottom".

The market always tells you what to do. It tells you: Get in. Get out. Move your stop. Close out. Stay neutral. Wait for a better chance. All these things the market is continually impressing upon you, and you must get into the frame of mind where you are in reality taking your orders from the action of the market itself — from the tape.

Your judgment will become poorer from the very time when you decide that you know more about the market than the market is telling you. From that moment your results will be unsatisfactory, for in this trading business the tape is the boss. You must learn to obey its orders, doing exactly what it tells you. When you can accomplish this, you are on the high road to success in your stock trading.

– Richard Wyckoff

Therefore, in order to avoid becoming one of these pitiful creatures, learn how to determineYour judgment will become poorer from the very time when you decide that you know more about the market than the market is telling you. From that moment your results will be unsatisfactory, for in this trading business the tape is the boss. You must learn to obey its orders, doing exactly what it tells you. When you can accomplish this, you are on the high road to success in your stock trading.

– Richard Wyckoff

(1) whether or not there is a trend (do you have higher highs and higher lows, or lower highs and lower lows, or is there no discernible pattern?)

(2) if so, the direction of the trend (up or down)

(3) the strength of the trend (what is the angle of the ascent or decline; is it becoming more or less severe)

(4) a change of trend (i.e., from up/down to sideways)

(5) a trend reversal (a move above the Last Swing High or below the Last Swing Low)

Think about buyers and sellers and the prices they're paying and the pressures they're putting on each other. If price begins to advance, then pulls back to what had been the old high without falling back into the range, then resumes its advance, then there is serious intent here.(2) if so, the direction of the trend (up or down)

(3) the strength of the trend (what is the angle of the ascent or decline; is it becoming more or less severe)

(4) a change of trend (i.e., from up/down to sideways)

(5) a trend reversal (a move above the Last Swing High or below the Last Swing Low)

If you don't have that "stairstep" look where each pullback comes back only to or higher than the last swing high before resuming the advance, then you may be looking at a slowing of momentum or even a trend change, if not a complete reversal. The trend can continue upward, but it will be a much slower "grind", with swing lows actually penetrating the previous swing, and it will be increasingly difficult to place stops (sometimes this "grind" establishes itself from the very beginning and one finds himself faced with what is called "creep", an even slower form of grind, difficult to play without wide stops and all the additional risk they entail).

Therefore, don't get trapped into looking at all of this as lines and angles. Think of the traders involved and what they paid and when they'll be profitable and when they'll be underwater and where they might be trapped into taking the wrong side of the trade. That is, after all, where all these movements come from. Gauging their strength by their movement will tell you who's got the upper hand and where the intent is likely to lie.

Never forget that markets are made up of people. Think constantly about what others are doing, what they might do in the current circumstances, or what they might do when those circumstances change. Remember that whenever you buy and hope to sell higher, the person you sell to will have to see some opportunity at that higher price in order to be induced to buy.

– J Peter Steidlmayer

– J Peter Steidlmayer

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

So what's the point of all this?

The point of all this is to learn to recognize climactic volume, buying and selling climaxes, and the subsequent tests of those climaxes, a behavioral phenomenon which has defined turning points millions of times over centuries. The trader who learns how to recognize these turning points will not waste his time on trivial trades nor will he miss important moves.

Fortunately, it is not necessary for the trader to be able to recognize these climaxes in "real time"; it is necessary only that he recognize that the climax has in fact occurred and be ready for the test, for the test constitutes the practical turning point, one which is even more tradeable because the trader is watching for it, waiting for it (as is every other experienced trader). Is it necessary that the trader catch the absolute bottom or the absolute top? No. It is necessary only that he be able to judge the immediate direction of the market -- the line of least resistance -- and ride the force of the move to its demonstrable conclusion. And if other traders are helping to propel price, so much the better.

The action of the whole market tells you when the selling is better than the buying and vice versa. You do not care why insiders are buying or selling, but you should care a lot about the action of their stock on the tape, for that is what tells you the truth.*

The Law of Supply and Demand is not a theory; it is a law. It manifests itself in the markets through the behaviors of those who trade those markets, i.e., their trades. The motives behind these behaviors can be cloaked, but they cannot be hidden. If there is a trade, there is a print. If there is a print, one can begin to gather his data which will eventually enable him to make a trading decision.

How are we to know in advance why and to what extent someone else is prompted to buy or sell? We cannot know; it is impossible for us to foretell what actuates all of those whose orders are poured into the vast intake of the Stock Exchange machinery during the day's session.

But if we study the action of prices; the responses; the speed of the ticker, indicating urgency or the contrary; the intensity of the buying or selling, as indicated by the volumes; and the intervals when the volume is heavy or light -- all these in relation to each other -- then we gain insight or the design and the purposes of those who are dominant in the market situation for the time being.

All the varying phases of stock market technique may thus be studied and interpreted from the buying and selling waves as they appear on the tape. From these we form a conclusion as to the balance of the probabilities. On this we base our commitments.*

Is an understanding of volume necessary? It is vital.

Is it necessary to predict or "call" the turning points? Not at all. It is necessary only to recognize a climax, most likely in hindsight, and to act on the test of that climax in real time.

*Richard Wyckoff

The point of all this is to learn to recognize climactic volume, buying and selling climaxes, and the subsequent tests of those climaxes, a behavioral phenomenon which has defined turning points millions of times over centuries. The trader who learns how to recognize these turning points will not waste his time on trivial trades nor will he miss important moves.

Fortunately, it is not necessary for the trader to be able to recognize these climaxes in "real time"; it is necessary only that he recognize that the climax has in fact occurred and be ready for the test, for the test constitutes the practical turning point, one which is even more tradeable because the trader is watching for it, waiting for it (as is every other experienced trader). Is it necessary that the trader catch the absolute bottom or the absolute top? No. It is necessary only that he be able to judge the immediate direction of the market -- the line of least resistance -- and ride the force of the move to its demonstrable conclusion. And if other traders are helping to propel price, so much the better.

The action of the whole market tells you when the selling is better than the buying and vice versa. You do not care why insiders are buying or selling, but you should care a lot about the action of their stock on the tape, for that is what tells you the truth.*

The Law of Supply and Demand is not a theory; it is a law. It manifests itself in the markets through the behaviors of those who trade those markets, i.e., their trades. The motives behind these behaviors can be cloaked, but they cannot be hidden. If there is a trade, there is a print. If there is a print, one can begin to gather his data which will eventually enable him to make a trading decision.

How are we to know in advance why and to what extent someone else is prompted to buy or sell? We cannot know; it is impossible for us to foretell what actuates all of those whose orders are poured into the vast intake of the Stock Exchange machinery during the day's session.

But if we study the action of prices; the responses; the speed of the ticker, indicating urgency or the contrary; the intensity of the buying or selling, as indicated by the volumes; and the intervals when the volume is heavy or light -- all these in relation to each other -- then we gain insight or the design and the purposes of those who are dominant in the market situation for the time being.

All the varying phases of stock market technique may thus be studied and interpreted from the buying and selling waves as they appear on the tape. From these we form a conclusion as to the balance of the probabilities. On this we base our commitments.*

Is an understanding of volume necessary? It is vital.

Is it necessary to predict or "call" the turning points? Not at all. It is necessary only to recognize a climax, most likely in hindsight, and to act on the test of that climax in real time.

*Richard Wyckoff

Attachments

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

Trading plans invariably become egocentric. A few traders get past that and move on to a different level, but most of those who begin the process of developing a trading plan do not (most traders, of course, don't begin at all). Because the process is egocentric, the chief concerns are where do I enter, where do I exit, what should my target be, what should my stop be, how much risk can I tolerate, and so on. The character of the market itself is a secondary issue at best. What is paramount is how the market can serve the ego rather than the other way around.

The market couldn't care less about the trader's entries and exits and stops. The market couldn't care less about what the trader wants. The market couldn't care less about the trader's personality or psychic needs. The market functions in a certain way. It has a certain structure. If a trader is to be truly successful, i.e., more than just "getting by", he must understand these functions and this structure, neither of which have anything whatsoever to do with him.

One begins, of course, again, by observing the market, characterizing it, then formulating hypotheses that tentatively explain its movements. One then tests those hypotheses in order to determine whether or not they are true, i.e., predictable and reliable. Only after all this do the matters of how to take advantage of what one has determined come into the picture, i.e., entrances, exits, stops, etc. It is at this point that the process becomes almost entirely egocentric, e.g., how much risk can I tolerate, and the market itself becomes largely ignored except insofar as it serves the trader's needs and wants. But the market couldn't care less about the trader's needs and wants. And this results in a perpetual frustration among those who focus on themselves rather than on the behavior of price (which is the aggregate of the behaviors of everyone who is participating in the market). If, for example, the trader is focused not only on breakeven but on getting to breakeven as quickly as possible, he is focusing not on the market but on himself. One of the more obvious consequences of this, particularly if the trader is "stopped out", is that the trader dwells or even obsesses over his "failed trade" and completely ignores what the market has told him by having come back to or exceeded his entry point, thus preventing him from evaluating the situation and preparing for the next trade, especially if it happens to be in the opposite direction.

I suggest, therefore, that those who are serious about developing trading plans focus on themarket and on price behavior rather than on themselves, unless they want to spend years trying to reconcile two forces which are in many ways mutually incompatible. If one enters correctly, for example, issues of stops and breakeven and size and "targets" become irrelevant. If one doesn't enter correctly, then of course he has to exit. But his doing so has nothing to do with his hopes and needs and wants and desires. Rather it has to do with the fact that he read the market incorrectly. One should, in fact, once he has entered a trade, forget about the fact that he entered the trade at all and focus instead on the market. Only in this way will he become "available" to profit from what the market has to offer.

Nearly all traders except for beginners are in a quandary: they are eager to trade yet are afraid to trade (beginners have not yet learned fear, but they soon will unless they put together thoroughly-tested and consistently-profitable trading plans before they begin trading). Thus traders seek to exploit the market while simultaneously insulating themselves from any negative consequences of attempting to do so. That's what the bulk of the millions of trading forum posts and blogs and books and articles and newsletters and trading rooms et al infinitum hawked at Trade-O-Rama are all about. Only an infinitesimally small number of them are focused on why price moves as it does. Which is why there are so many millions (billions?) of posts (and books and blogs and so forth).

The principles of successful stock speculation are based on the supposition that people will continue in the future to make the mistakes that they have made in the past.

–T F Woodlock

The market couldn't care less about the trader's entries and exits and stops. The market couldn't care less about what the trader wants. The market couldn't care less about the trader's personality or psychic needs. The market functions in a certain way. It has a certain structure. If a trader is to be truly successful, i.e., more than just "getting by", he must understand these functions and this structure, neither of which have anything whatsoever to do with him.

One begins, of course, again, by observing the market, characterizing it, then formulating hypotheses that tentatively explain its movements. One then tests those hypotheses in order to determine whether or not they are true, i.e., predictable and reliable. Only after all this do the matters of how to take advantage of what one has determined come into the picture, i.e., entrances, exits, stops, etc. It is at this point that the process becomes almost entirely egocentric, e.g., how much risk can I tolerate, and the market itself becomes largely ignored except insofar as it serves the trader's needs and wants. But the market couldn't care less about the trader's needs and wants. And this results in a perpetual frustration among those who focus on themselves rather than on the behavior of price (which is the aggregate of the behaviors of everyone who is participating in the market). If, for example, the trader is focused not only on breakeven but on getting to breakeven as quickly as possible, he is focusing not on the market but on himself. One of the more obvious consequences of this, particularly if the trader is "stopped out", is that the trader dwells or even obsesses over his "failed trade" and completely ignores what the market has told him by having come back to or exceeded his entry point, thus preventing him from evaluating the situation and preparing for the next trade, especially if it happens to be in the opposite direction.

I suggest, therefore, that those who are serious about developing trading plans focus on themarket and on price behavior rather than on themselves, unless they want to spend years trying to reconcile two forces which are in many ways mutually incompatible. If one enters correctly, for example, issues of stops and breakeven and size and "targets" become irrelevant. If one doesn't enter correctly, then of course he has to exit. But his doing so has nothing to do with his hopes and needs and wants and desires. Rather it has to do with the fact that he read the market incorrectly. One should, in fact, once he has entered a trade, forget about the fact that he entered the trade at all and focus instead on the market. Only in this way will he become "available" to profit from what the market has to offer.

Nearly all traders except for beginners are in a quandary: they are eager to trade yet are afraid to trade (beginners have not yet learned fear, but they soon will unless they put together thoroughly-tested and consistently-profitable trading plans before they begin trading). Thus traders seek to exploit the market while simultaneously insulating themselves from any negative consequences of attempting to do so. That's what the bulk of the millions of trading forum posts and blogs and books and articles and newsletters and trading rooms et al infinitum hawked at Trade-O-Rama are all about. Only an infinitesimally small number of them are focused on why price moves as it does. Which is why there are so many millions (billions?) of posts (and books and blogs and so forth).

The principles of successful stock speculation are based on the supposition that people will continue in the future to make the mistakes that they have made in the past.

–T F Woodlock

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

Trading climaxes and tests is of course not all there is to it. Though beginners ought to focus on one signal until they at least come close to mastering it (and in the meantime pick up worthwhile bits about just how the market moves, bits to be filed away for future investigation and use), those who move the market telegraph their intentions in more than one way. This has been particularly evident this week with regard to another common behavioral phenomenon that Wyckoff called the "hinge" and Schabacker (one-time financial editor of Forbes) and his followers called the "coil". The hinge is an excellent example of that which traders won't even notice if they don't know what it is or what it looks like or why it occurs. And of course one can't trade what one doesn't see. This has been particularly true in the NQ this week. But first . . .

A hinge is a trading range that's tired of screwing around. While price in a trading range will bounce up and down in search of equilibrium, or "value", with no particular timetable in mind, price in a hinge conducts that search more seriously, giving itself a deadline, i.e., that point – the apex – where the diagonal lines meet. Hinges are created by successive lower highs and higher lows and represent a tightening and compression. If interest is sufficient, this compression will eventually lead to a worthwhile move (if it isn't, price may simply dribble off into nothing worth bothering with). As Schabacker wrote, these hinges -- or coils -- should be "filled with price", that is, there is no aimless drift but a struggle between those who want to move price ahead and those who don't. Price, therefore, should bounce in an ever-tightening range which culminates in a release of pent-up energy and a tradeable move (the tightening and compression leading, typically, to this release led to the use of the term "coil", as in "coiled spring"). A particularly attractive feature of the hinge is that it's so easy to recognize in real time: as soon as you note a higher low and a lower high (or vice-versa), be on the lookout. A hinge may be on the horizon.

Genuine hinges -- those which form as the result of successive negotiations between buyers and sellers to find equilibrium -- share common characteristics and can therefore be traded in much the same way. If shorting what appears in real time to be a downside breakout, keep a tight stop. If it doesn't go, you're out at breakeven. If price returns to the midpoint, one can place a sellstop below this activity so that one can be stopped in on a second attempt at a decline. If none of that goes, one can buy an upside break, again with a tight stop. If he is again stopped out but the return to the midpoint turns out to be a test, he can place a buystop above this test and be stopped in on a second attempt at an advance.

For an example, see the chart below.

(to be cont'd)

A hinge is a trading range that's tired of screwing around. While price in a trading range will bounce up and down in search of equilibrium, or "value", with no particular timetable in mind, price in a hinge conducts that search more seriously, giving itself a deadline, i.e., that point – the apex – where the diagonal lines meet. Hinges are created by successive lower highs and higher lows and represent a tightening and compression. If interest is sufficient, this compression will eventually lead to a worthwhile move (if it isn't, price may simply dribble off into nothing worth bothering with). As Schabacker wrote, these hinges -- or coils -- should be "filled with price", that is, there is no aimless drift but a struggle between those who want to move price ahead and those who don't. Price, therefore, should bounce in an ever-tightening range which culminates in a release of pent-up energy and a tradeable move (the tightening and compression leading, typically, to this release led to the use of the term "coil", as in "coiled spring"). A particularly attractive feature of the hinge is that it's so easy to recognize in real time: as soon as you note a higher low and a lower high (or vice-versa), be on the lookout. A hinge may be on the horizon.

Genuine hinges -- those which form as the result of successive negotiations between buyers and sellers to find equilibrium -- share common characteristics and can therefore be traded in much the same way. If shorting what appears in real time to be a downside breakout, keep a tight stop. If it doesn't go, you're out at breakeven. If price returns to the midpoint, one can place a sellstop below this activity so that one can be stopped in on a second attempt at a decline. If none of that goes, one can buy an upside break, again with a tight stop. If he is again stopped out but the return to the midpoint turns out to be a test, he can place a buystop above this test and be stopped in on a second attempt at an advance.

For an example, see the chart below.

(to be cont'd)

Attachments

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

The dynamics of this endgame are not difficult to understand. The hinge, after all, is created because of differences of opinion. That this testing should continue once one side or the other pushes price out of the hinge should not come as a surprise. But clearly one has to be quick on one's feet to avoid getting trampled.

Many beginning traders -- and many not-so-beginning traders -- have trouble trading this because they think that the market, or the "big" money, or the "smart" money, is out to get them, to trick them. It never occurs to them that neither the market nor the big/smart money could care less about them. Therefore they are forever looking out for the trick, the trap, the gotcha, and are thus guarding themselves against a threat that doesn't exist, making all the wrong decisions at the wrong times.

It's really just a matter of looking for trades, which is after all the business of trading. If traders can find trades out of the bottom of a trading range, great. If there are none, traders will search for trades out of the top of the range. This doesn't mean that anybody "tricked" anybody into selling the breakdown. It means only that there was no business there. This is also why first exits from hinges are so often in the opposite direction from the ultimate move. Knowing this gives the trader the confidence to reverse his position. And, yes, sometimes there are no trades out of the opposite side, either. Then everybody returns to their corners and futzes around inside the range for a while, and the "price action" trader is standing aside, waiting for everybody to decide what they want to do. Quite often what they want to do is go to lunch.

There are, of course, many hinges without drama. They more closely resemble rest stops than combat zones. In these cases, everyone decides after discussion and negotiation that they want to go up:

(to be cont'd)

Many beginning traders -- and many not-so-beginning traders -- have trouble trading this because they think that the market, or the "big" money, or the "smart" money, is out to get them, to trick them. It never occurs to them that neither the market nor the big/smart money could care less about them. Therefore they are forever looking out for the trick, the trap, the gotcha, and are thus guarding themselves against a threat that doesn't exist, making all the wrong decisions at the wrong times.

It's really just a matter of looking for trades, which is after all the business of trading. If traders can find trades out of the bottom of a trading range, great. If there are none, traders will search for trades out of the top of the range. This doesn't mean that anybody "tricked" anybody into selling the breakdown. It means only that there was no business there. This is also why first exits from hinges are so often in the opposite direction from the ultimate move. Knowing this gives the trader the confidence to reverse his position. And, yes, sometimes there are no trades out of the opposite side, either. Then everybody returns to their corners and futzes around inside the range for a while, and the "price action" trader is standing aside, waiting for everybody to decide what they want to do. Quite often what they want to do is go to lunch.

There are, of course, many hinges without drama. They more closely resemble rest stops than combat zones. In these cases, everyone decides after discussion and negotiation that they want to go up:

(to be cont'd)

Attachments

RachasfromPortugal

Junior member

- Messages

- 33

- Likes

- 1

The dynamics of this endgame are not difficult to understand. The hinge, after all, is created because of differences of opinion. That this testing should continue once one side or the other pushes price out of the hinge should not come as a surprise. But clearly one has to be quick on one's feet to avoid getting trampled.

Many beginning traders -- and many not-so-beginning traders -- have trouble trading this because they think that the market, or the "big" money, or the "smart" money, is out to get them, to trick them. It never occurs to them that neither the market nor the big/smart money could care less about them. Therefore they are forever looking out for the trick, the trap, the gotcha, and are thus guarding themselves against a threat that doesn't exist, making all the wrong decisions at the wrong times.

It's really just a matter of looking for trades, which is after all the business of trading. If traders can find trades out of the bottom of a trading range, great. If there are none, traders will search for trades out of the top of the range. This doesn't mean that anybody "tricked" anybody into selling the breakdown. It means only that there was no business there. This is also why first exits from hinges are so often in the opposite direction from the ultimate move. Knowing this gives the trader the confidence to reverse his position. And, yes, sometimes there are no trades out of the opposite side, either. Then everybody returns to their corners and futzes around inside the range for a while, and the "price action" trader is standing aside, waiting for everybody to decide what they want to do. Quite often what they want to do is go to lunch.

There are, of course, many hinges without drama. They more closely resemble rest stops than combat zones. In these cases, everyone decides after discussion and negotiation that they want to go up:

(to be cont'd)

I dont understand why traders still looking for trend line chanels and very old fundamentals of trading.. price are moving for algos and you need to understand the anatomy of swing level and price action. in my opinion you must to understand why price make a lot of zig zagging. if tou look for my style of trading in my chanel youtube, i not use this kind of very old school fundamentals, are completely wrong in this days...

I remmeber this wedge price action, i trade this...

https://www.youtube.com/channel/UCUKq-VkJ-Dj5LaeRDvChGuw

hope it helps.

Last edited:

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

The dynamics of this endgame are not difficult to understand. The hinge, after all, is created because of differences of opinion. That this testing should continue once one side or the other pushes price out of the hinge should not come as a surprise. But clearly one has to be quick on one's feet to avoid getting trampled.

Many beginning traders -- and many not-so-beginning traders -- have trouble trading this because they think that the market, or the "big" money, or the "smart" money, is out to get them, to trick them. It never occurs to them that neither the market nor the big/smart money could care less about them. Therefore they are forever looking out for the trick, the trap, the gotcha, and are thus guarding themselves against a threat that doesn't exist, making all the wrong decisions at the wrong times.

It's really just a matter of looking for trades, which is after all the business of trading. If traders can find trades out of the bottom of a trading range, great. If there are none, traders will search for trades out of the top of the range. This doesn't mean that anybody "tricked" anybody into selling the breakdown. It means only that there was no business there. This is also why first exits from hinges are so often in the opposite direction from the ultimate move. Knowing this gives the trader the confidence to reverse his position. And, yes, sometimes there are no trades out of the opposite side, either. Then everybody returns to their corners and futzes around inside the range for a while, and the "price action" trader is standing aside, waiting for everybody to decide what they want to do. Quite often what they want to do is go to lunch.

There are, of course, many hinges without drama. They more closely resemble rest stops than combat zones. In these cases, everyone decides after discussion and negotiation that they want to go up:

(to be cont'd)

Many beginning traders -- and many not-so-beginning traders -- have trouble trading this because they think that the market, or the "big" money, or the "smart" money, is out to get them, to trick them. It never occurs to them that neither the market nor the big/smart money could care less about them. Therefore they are forever looking out for the trick, the trap, the gotcha, and are thus guarding themselves against a threat that doesn't exist, making all the wrong decisions at the wrong times.

It's really just a matter of looking for trades, which is after all the business of trading. If traders can find trades out of the bottom of a trading range, great. If there are none, traders will search for trades out of the top of the range. This doesn't mean that anybody "tricked" anybody into selling the breakdown. It means only that there was no business there. This is also why first exits from hinges are so often in the opposite direction from the ultimate move. Knowing this gives the trader the confidence to reverse his position. And, yes, sometimes there are no trades out of the opposite side, either. Then everybody returns to their corners and futzes around inside the range for a while, and the "price action" trader is standing aside, waiting for everybody to decide what they want to do. Quite often what they want to do is go to lunch.

There are, of course, many hinges without drama. They more closely resemble rest stops than combat zones. In these cases, everyone decides after discussion and negotiation that they want to go up:

(to be cont'd)

Attachments

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

Then there are those which require very little discussion and even less negotiation. Long before the hinge completes itself, most decide they want to go down. Buyers may give it the old college try after exiting the hinge, but they have too much trouble pushing their way back inside the hinge and beat a reluctant retreat. After all, it's Friday afternoon and everyone wants to go home:

Price moves because traders are trading, and bots notwithstanding, traders are people, and people -- at least groups of people -- behave in expected ways. The hinge is a sign of this, which is why looking at it as nothing more than a "pattern" won't help the trader much in terms of making a trading decision. The hinge exists because traders are looking for -- and in the process, determining -- a new value level. If they weren't, the hinge would never form. The hinge therefore is a kind of reset, and whatever came before is not necessarily pertinent to what happens after due to the task that traders are performing. In short, all bets are off.

Playing a pattern usually entails following a relatively rigid set of rules: flags, pennants, heads-and-shoulders, wedges, 2Bs, 123s, N4s, N7s, hooks, springs, and on and on. However, playing the behavior that creates the pattern rather than adhering to lists of rules involves understanding what it is that traders are doing that prompts the "pattern" to form in the first place, where they're doing it, what buyers and sellers are trying to accomplish. If one understands this, he is more likely to trade it profitably than be yanked around by other traders into a state of immobilized frustration.

Therefore, one must abandon whatever biases he may have or have had and let the market tell him what to do. If he doesn't understand what the market is telling him, then he should back off and just listen until the sense of it becomes clear. If one is the corporate sort, he might think of the hinge as a closed meeting. Once the meeting is over, the rank-and-file finds out what conclusions were reached in the meeting by what the participants then do. The participants exit and go about their business according to those conclusions, and in this case, those conclusions were to head downward. Whether these decisions make sense to the trader or upset his plans in any way is entirely beside the point.

(to be cont'd)

(below)

Price moves because traders are trading, and bots notwithstanding, traders are people, and people -- at least groups of people -- behave in expected ways. The hinge is a sign of this, which is why looking at it as nothing more than a "pattern" won't help the trader much in terms of making a trading decision. The hinge exists because traders are looking for -- and in the process, determining -- a new value level. If they weren't, the hinge would never form. The hinge therefore is a kind of reset, and whatever came before is not necessarily pertinent to what happens after due to the task that traders are performing. In short, all bets are off.

Playing a pattern usually entails following a relatively rigid set of rules: flags, pennants, heads-and-shoulders, wedges, 2Bs, 123s, N4s, N7s, hooks, springs, and on and on. However, playing the behavior that creates the pattern rather than adhering to lists of rules involves understanding what it is that traders are doing that prompts the "pattern" to form in the first place, where they're doing it, what buyers and sellers are trying to accomplish. If one understands this, he is more likely to trade it profitably than be yanked around by other traders into a state of immobilized frustration.

Therefore, one must abandon whatever biases he may have or have had and let the market tell him what to do. If he doesn't understand what the market is telling him, then he should back off and just listen until the sense of it becomes clear. If one is the corporate sort, he might think of the hinge as a closed meeting. Once the meeting is over, the rank-and-file finds out what conclusions were reached in the meeting by what the participants then do. The participants exit and go about their business according to those conclusions, and in this case, those conclusions were to head downward. Whether these decisions make sense to the trader or upset his plans in any way is entirely beside the point.

(to be cont'd)

Attachments

mpups

Experienced member

- Messages

- 1,022

- Likes

- 144

An example from last week:

hinges should be good for swing trading :cheesy:

are there any current ones in the making you can share db?

Last edited:

Similar threads

- Replies

- 0

- Views

- 2K