I’m starting this journal to improve my record keeping and increase the time I spend reviewing my trades. Hopefully this will help me lessen the frequency of doing really stupid things. See my next post for some examples of said stupidity.

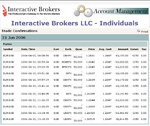

I am currently trading EUR/USD spot on an ECN. I plan to switch to CME currency futures when my account is large enough to trade using at least somewhat reasonable leverage. I am a day trader, rarely holding overnight positions.

I will post my executions blotter each day after I have finished trading. The end of the “day” is 5pm New York time. Most days I will also include some analysis and a chart. Occasionally, when I have time, I will also post a trade in near real time. This is most likely to happen when I think it’s a trend day and choose to let the trade run for a long period.

My broker does not provide forex charts so I use free charts from a bucket shop. The price data on the chart can be a pip or two off from the ECN, but it is pretty close. The charts show London time and the executions blotter shows New York time. Yes, I realize what a pain in the ass this is but it can’t be changed so deal with it 🙂 . The date in the executions blotter is in month/day/year format. The Gross P/L column on the executions blotter does not include the cost of commissions and fees: I pay $5.00 per round turn for a forex trade and $5.64 per round turn per contract for a currency futures trade. Last, in my analysis, when I write about a “trade” I am talking about a round turn and not a side.

Constructive and/or friendly comments appreciated.

I am currently trading EUR/USD spot on an ECN. I plan to switch to CME currency futures when my account is large enough to trade using at least somewhat reasonable leverage. I am a day trader, rarely holding overnight positions.

I will post my executions blotter each day after I have finished trading. The end of the “day” is 5pm New York time. Most days I will also include some analysis and a chart. Occasionally, when I have time, I will also post a trade in near real time. This is most likely to happen when I think it’s a trend day and choose to let the trade run for a long period.

My broker does not provide forex charts so I use free charts from a bucket shop. The price data on the chart can be a pip or two off from the ECN, but it is pretty close. The charts show London time and the executions blotter shows New York time. Yes, I realize what a pain in the ass this is but it can’t be changed so deal with it 🙂 . The date in the executions blotter is in month/day/year format. The Gross P/L column on the executions blotter does not include the cost of commissions and fees: I pay $5.00 per round turn for a forex trade and $5.64 per round turn per contract for a currency futures trade. Last, in my analysis, when I write about a “trade” I am talking about a round turn and not a side.

Constructive and/or friendly comments appreciated.