Good stuff guys i had 915 down on ETI as my potential buy trap price.

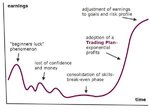

When i first read the Come in to my Trading Room what really struck home was the mindset required to trade. Then i picked the system parts of the book and lifted them so to speak and wrote them on word as rules and guidelines. There's a method in the book but it's not visually displayed. I've used the concept and built a system around it. I don't change any parameters at all. Normally if something hasn't worked and i make a loss, it's a 'business man risk' that I've taken. Or I look at how i managed the trade and my entry also. I don't think that changing my indicators would have made any difference to the outcome. Because it's the mental game that takes longer to conquer than finding a method.

When i first read the Come in to my Trading Room what really struck home was the mindset required to trade. Then i picked the system parts of the book and lifted them so to speak and wrote them on word as rules and guidelines. There's a method in the book but it's not visually displayed. I've used the concept and built a system around it. I don't change any parameters at all. Normally if something hasn't worked and i make a loss, it's a 'business man risk' that I've taken. Or I look at how i managed the trade and my entry also. I don't think that changing my indicators would have made any difference to the outcome. Because it's the mental game that takes longer to conquer than finding a method.