Ah, the ever present question as to where a trader should place stops. We all encounter this as we are trading. Let’s face it, there is a fine balance in placing a stop that allows you to minimize damage from a bad trade and a stop that is too close to the market which will get shaken out with normal volatility. So what is a trader to do? In past lessons, I have suggested some volatility stops and even using average prices.

Successful traders follow rule-based strategies to minimize emotions. That is exactly what we teach in our courses. This week, I will discuss a rule-based stop method that is based on using the definition of trends to determine when to exit.

An uptrend is a series of higher lows usually accompanied by higher highs in price. A downtrend, in contrast, is a series of lower highs accompanied by lower lows. As traders, we are taught to trade in the direction of the prevailing trend for our selected trading time frame. Logic dictates that if that trend ends, it would be wise to exit from your trade before losses grow or profits are given back. By using the previously mentioned definitions and fully understanding trend, we can construct a strategy to place effective stops.

As I mentioned, an uptrend is a series of higher lows. More specifically, higher swing lows. A swing low is a low with a higher low on either side of it. The time frame you are trading on doesn’t matter; this works the same on all time frames and charts of all securities.

Fig 1 – Swing Lows

It works similarly for downtrends, except that we focus on lower swing highs to maintain the trend. A swing high is a high with a lower high on either side of it.

Fig 2 – Swing Highs

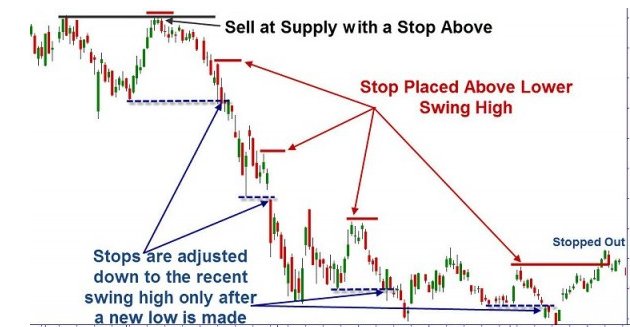

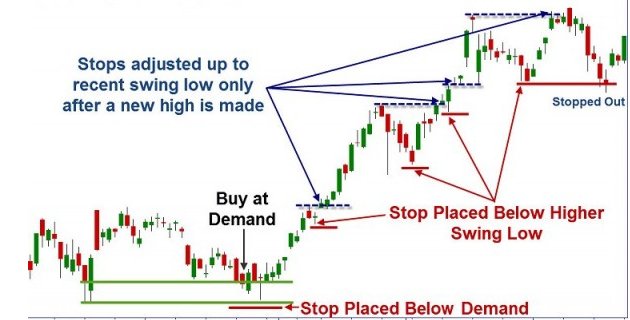

If you are trading to the long side, you want to see a continued series of higher swing lows. You would exit your trade at the supply level you designated for your target or if the trend ended by making a lower swing low. When I am trading, I will always place a protective stop on my trade. Once I am profitable, I need to move my stop to protect those profits in the event the trend changes before I achieve my intended target. Placing stops under the highest swing low in the trend accomplishes this.

Fig 3

Many of you may be saying, “That makes sense.” Or perhaps you are thinking, “I already do that for my stops, but keep getting stopped out too soon.” The key lies in knowing when to adjust your stop to the next level. Most traders adjust the stop too soon and are subject to the market volatility or a rogue market maker. You do not want to adjust your stops tighter until the trend has proceeded to make new highs. In other words, the price needs to make a higher swing low and then continue the trend upwards to establish a new high for the trend. Let’s examine this at work in a stock.

Fig 4

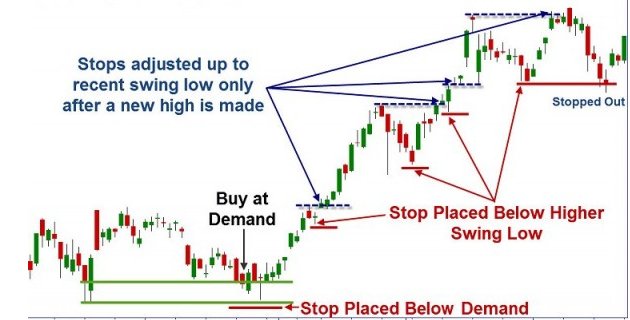

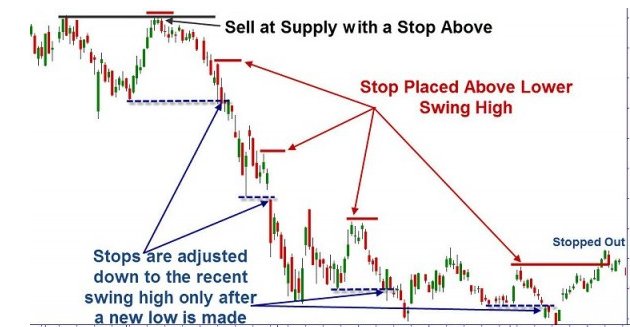

The same system can be applied to shorting opportunities. You would adjust your stop by placing it above the most recent swing high when you proceed to make fresh lows in price that drop below prior lows as seen in this chart.

Fig 5

No matter what method you select for setting your stops, the important thing is that you do set them. You cannot be consistently successful in trading if you take large losses. No trader is right all of the time. The best way to prevent those large losses is to stop out of trades that are no longer going the direction you had traded. Until next time, trade safe and trade well!

Brandon Wendell can be contacted by email on this link: Brandon Wendell

Successful traders follow rule-based strategies to minimize emotions. That is exactly what we teach in our courses. This week, I will discuss a rule-based stop method that is based on using the definition of trends to determine when to exit.

An uptrend is a series of higher lows usually accompanied by higher highs in price. A downtrend, in contrast, is a series of lower highs accompanied by lower lows. As traders, we are taught to trade in the direction of the prevailing trend for our selected trading time frame. Logic dictates that if that trend ends, it would be wise to exit from your trade before losses grow or profits are given back. By using the previously mentioned definitions and fully understanding trend, we can construct a strategy to place effective stops.

As I mentioned, an uptrend is a series of higher lows. More specifically, higher swing lows. A swing low is a low with a higher low on either side of it. The time frame you are trading on doesn’t matter; this works the same on all time frames and charts of all securities.

Fig 1 – Swing Lows

It works similarly for downtrends, except that we focus on lower swing highs to maintain the trend. A swing high is a high with a lower high on either side of it.

Fig 2 – Swing Highs

If you are trading to the long side, you want to see a continued series of higher swing lows. You would exit your trade at the supply level you designated for your target or if the trend ended by making a lower swing low. When I am trading, I will always place a protective stop on my trade. Once I am profitable, I need to move my stop to protect those profits in the event the trend changes before I achieve my intended target. Placing stops under the highest swing low in the trend accomplishes this.

Fig 3

Many of you may be saying, “That makes sense.” Or perhaps you are thinking, “I already do that for my stops, but keep getting stopped out too soon.” The key lies in knowing when to adjust your stop to the next level. Most traders adjust the stop too soon and are subject to the market volatility or a rogue market maker. You do not want to adjust your stops tighter until the trend has proceeded to make new highs. In other words, the price needs to make a higher swing low and then continue the trend upwards to establish a new high for the trend. Let’s examine this at work in a stock.

Fig 4

The same system can be applied to shorting opportunities. You would adjust your stop by placing it above the most recent swing high when you proceed to make fresh lows in price that drop below prior lows as seen in this chart.

Fig 5

No matter what method you select for setting your stops, the important thing is that you do set them. You cannot be consistently successful in trading if you take large losses. No trader is right all of the time. The best way to prevent those large losses is to stop out of trades that are no longer going the direction you had traded. Until next time, trade safe and trade well!

Brandon Wendell can be contacted by email on this link: Brandon Wendell

Last edited by a moderator: