isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Hi isatrader, it's amazing how long you've been contributing to this thread... Just want to say good job!

Out of curiosity - how has your performance been so far following this method? It's been a while I see... Thanks

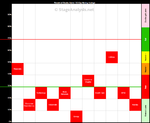

Performance has been reasonable, but I've made a lot of mistakes that weren't related to the method, and so I only have around a 25% return in my SIPP currently from the account I started in August 2013. Which I'm still pleased with for a pension account, but would have been much better if I'd not made some impulsive choices that broke the rules. As the method is sound. But you have to stay disciplined, which isn't always easy, especially during the pullback periods that you need to sit through with the investor method. It has taught me a lot of patience though.

Anyway, I moved over to my own website a few years ago, as this thread was getting too big to manage the content. That now has thousands of posts and multiple threads all to do with Stage Analysis, and I have daily watchlists for the method for US and UK stocks. You can find it by searching for Stage Analysis Forum on Google.