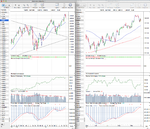

The possible B pullback entry points at the breakout support that I mentioned last week in the equity charts worked out, and stocks have had a good move higher this week, back up close to the September highs. However, it wasn't all positive though, as Friday's price action in the S&P 500 spiked up towards the highs early in the session, but moved lower during the day to end slightly negative.

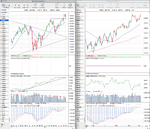

Gold (GC) also had a positive week, but the daily Stage 2 continuation move that I highlighted on Thursday wasn't confirmed by the weekly chart, as it pulled back again in Friday's session into the consolidation once more and also closed below the long term trend line.

Copper (HG) moved slightly higher, but mostly had a consolidation week above it's near term support.

Crude Oil (CL) had a volatile week, trading down to close to it's $87 support level from the summer breakout and pullback, but is holding above it for now, but looks weak.

The weak bounce in the Dollar Index (DX) gave up around the $80 resistance and rolled over and traded down towards the $79 level again. The daily cumulative volume gave another sell signal on Friday and the weekly cumulative volume continued to drift down.

US Treasuries also rolled over and swung back below the 30 week WMA once more in it's Stage 3 range. If you look at the daily chart, the 30 year Treasuries have now made 3 lower highs and 2 lower lows and the relative performance is back below the trend line versus the S&P 500. Most interestingly though, was the fact that the mostly inverse relationship with stocks broke down during Friday's trade as both stocks and the 10 and 30 year Treasuries moved lower together. However, Treasuries are mostly only traded by professional traders, whereas stocks have a mix of all skill levels, so I'm more inclined personally to lean towards what the Treasuries traders are doing and what the institutional volume data is showing - which still favours equities for the time being imo from these collection of markets.

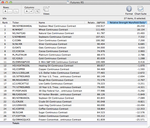

Below is the relative performance versus the S&P 500 table and attached are the major charts for analysis.

There was only minor moves in the table with the FTSE 100 gaining ground back towards it's zero line, but still in negative territory for now. The S&P 100 Mega Caps (^OEX) which has outperformed for the last year moved from 4th to 2nd spot and made a new 52 week high. The Nasdaq 100 (^NDX) dropped to 4th spot and broke through it's long term relative strength trend line versus the S&P 500. But, I believe this was mostly due to Apples (AAPL) weak performance which makes up around 20% of the index.