isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

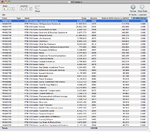

Stage 1A - examples

As a follow up to my previous post outlining the break down of the four stages, I've been going through the Global Trend Alert Newsletter to get some real life examples of the various stages to use as a reference in the future.

Stage 1A - Start of a base. Needs much more time

Key

(+) Outstanding pattern in that Stage.

(–) Unexciting pattern in that Stage.

As a follow up to my previous post outlining the break down of the four stages, I've been going through the Global Trend Alert Newsletter to get some real life examples of the various stages to use as a reference in the future.

Stage 1A - Start of a base. Needs much more time

Key

(+) Outstanding pattern in that Stage.

(–) Unexciting pattern in that Stage.

Attachments

-

AGN_2-25-05.png58.7 KB · Views: 1,729

AGN_2-25-05.png58.7 KB · Views: 1,729 -

AVY_2-25-05.png61.2 KB · Views: 1,536

AVY_2-25-05.png61.2 KB · Views: 1,536 -

BRCM_2-25-05.png55.6 KB · Views: 1,341

BRCM_2-25-05.png55.6 KB · Views: 1,341 -

CCE_2-25-05.png56.5 KB · Views: 1,140

CCE_2-25-05.png56.5 KB · Views: 1,140 -

JBL_2-25-05.png59.4 KB · Views: 1,134

JBL_2-25-05.png59.4 KB · Views: 1,134 -

TER_2-25-05.png59.5 KB · Views: 1,038

TER_2-25-05.png59.5 KB · Views: 1,038 -

PGN_2-25-05.png64.4 KB · Views: 1,024

PGN_2-25-05.png64.4 KB · Views: 1,024 -

MXIM_2-25-05.png62.3 KB · Views: 1,089

MXIM_2-25-05.png62.3 KB · Views: 1,089 -

KSS_2-25-05.png62.1 KB · Views: 1,036

KSS_2-25-05.png62.1 KB · Views: 1,036 -

KO_2-25-05.png59.4 KB · Views: 1,099

KO_2-25-05.png59.4 KB · Views: 1,099 -

THC_2-25-05.png54.6 KB · Views: 1,043

THC_2-25-05.png54.6 KB · Views: 1,043 -

TIF_2-25-05.png56.1 KB · Views: 1,006

TIF_2-25-05.png56.1 KB · Views: 1,006 -

XLNX_2-25-05.png60.3 KB · Views: 1,131

XLNX_2-25-05.png60.3 KB · Views: 1,131