Whatsthat Guy

Junior member

- Messages

- 29

- Likes

- 27

Good afternoon,

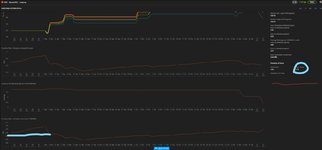

i'm new on investment (early retired) and i wish i would know more from pure pip producer because the risk management is better on the maximum drawdown. I study darwinex since few weeks and view from Germany, there is no doubt the one who has the better drawdown management is the one who is right. All other speeches are useless. Only the risk management speaks. View from the darwinex point of view, if i understand well, the one who has the lower (what they call) value at risk, is the better one and so the one who has to be listened. I've money to invest and for me, the most important is the risk management : maximum drawdown and now the value at risk looks also important. all the rest is not important especially if the trader speaks well or not to the others. numbers speaks only. I'll never put some money in traders who says they will lose for months and say that one day maybe the money would come back. There is already the stocks markets for that, right? What i 'm looking for is someone sure of his talent and with and low drawdown/value at risk. Because if something goes wrong that give me the advantage to know it very quickly!

i'm new on investment (early retired) and i wish i would know more from pure pip producer because the risk management is better on the maximum drawdown. I study darwinex since few weeks and view from Germany, there is no doubt the one who has the better drawdown management is the one who is right. All other speeches are useless. Only the risk management speaks. View from the darwinex point of view, if i understand well, the one who has the lower (what they call) value at risk, is the better one and so the one who has to be listened. I've money to invest and for me, the most important is the risk management : maximum drawdown and now the value at risk looks also important. all the rest is not important especially if the trader speaks well or not to the others. numbers speaks only. I'll never put some money in traders who says they will lose for months and say that one day maybe the money would come back. There is already the stocks markets for that, right? What i 'm looking for is someone sure of his talent and with and low drawdown/value at risk. Because if something goes wrong that give me the advantage to know it very quickly!