Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

The message box, both in "advanced" and "quick reply" modes, is not working properly on internet explorer. Fifty percent of what I type doesn't show, every other key I press doesn't produce a character on the message box. It's very frustrating. Instead it works on opera, firefox, chrome. Also, I checked if similar message boxes work on yahoo and google mail and they do. The only thing left to do is if the message box works on internet explorer in another computer, which would surprise me, because it would mean I have a problem on trade2win's message boxes only on this computer and only on internet explorer. Which would make me reinstall internet explorer, which is a pain in the ass. Let's see.

Ok, I just checked and damn me. It works perfectly fine. So I basically screwed up something on internet explorer that only affects this box on this web site. I can't even double-check by registering another t2w account, because I might get banned, like last time.

Ok, let's try to reset internet explorer's settings to default first, before having to reinstall it.

Ok, done. Let's see if it works now.

Damn. Still not working.

Now I will reboot my computer, and if it still doesn't work, the next step is to try system restore, to yesterday or the day before.

Ok, rebooting doesn't solve it either. Now I will try a system restore to 2 days ago.

I have to remember I just had an idea about starting the systems after a loss. It might not help at all, and it might be incoherent probability thinking: I know it doesn't make a difference on random events, such as dice and the roulette. But, hey, even on those betting on black after a red came out does not hurt. If anything it leaves your chances of getting it right to the original 50%.

And, if instead there's some probabilistic reason that enabling those seven systems one at a time, each one after a big loss/drawdown, puts the probability on my side, then why not do it? Being wrong about this hypothesis won't hurt me for sure, because if it's totally random like for coin tossing and dice and roulette, then I won't affect the next outcome either by waiting one outcome. If instead I am right and it's not random, and after a loss or big drawdown, it is less likely to happen another one, then I will benefit from it. So now my idea is to enable those 7 systems, but one at a time and each one after a loss or drawdown. If I am wrong, it won't hurt, and if I am right, I will benefit from it.

So now i'll do the system restore.

Oh, good. Now it finally all works. As to the culprit, the only two possible causes are:

1) I installed hotspot shield, a proxy software, in order to watch some SNL episodes on hulu.com and vidcube.com, which would not stream to italy, but then, once i did that, it was useless, because they only streamed for free for 1 minute and a half. Anyway, I later found out that for most episodes the videos can be found at good places and not just these two paying websites. So this is the link anyway, if anyone cares:

Watch Saturday Night Live online (TV Show) - on 1Channel | LetMeWatchThis

2) I was trying to get rid of google search autocomplete feature, and i followed the instructions in this video:

Google - How to turn off Google autocomplete - YouTube

But then today the mother ****ing autocomplete (google is getting worse, just like windows, office and a lot of other software lately) came back anyway, and maybe it also caused, out of revenge, this problem on trade2win's message boxes.

Yesterday, among the other things, while browsing on letmewatchthis.com, which is my favorite and only movie website, I discovered this very good tv show:

Watch Mob Wives online (TV Show) - download MobWives - on 1Channel | LetMeWatchThis

Mob wives is quality stuff. I haven't reasoned on why yet, but it's very engrossing. First of all, I think it's well-made (good editing of the interesting parts). And second of all, I am Italian, lived in the states for a few years, so this is related to things I both know and also am curious about. But then there must be other reasons. Some brainstorming, in random order:

1) there's action, because the husbands are in jail or go to jail during the movie

2) among my favorite movies are mafia movies such as goodfellas (the mob wives are just like ray liotta's friends and wife in that movie), the godfather, and so on.

3) I've always liked documentaries, and in many ways a reality show is a documentary (at least for the way these women talk, and think)

4) among the things that make me say that it's well-made there's the fact that this show doesn't just show the daily life and behaviour of these women, but also some moral dilemmas, such as "should I leave my husband now that he's in jail?", "should I cheat on him?", "is it ok for my husband to kill people?".

Speaking of reality shows and documentaries, yesterday I always watched this good movie:

Watch Cinema Verite online - on 1Channel | LetMeWatchThis

[...]

So, I was saying about the enabling of the seven systems, one at a time, after they have drawdown or a loss. Does it make sense? As I said, if it doesn't make sense, it still will not hurt, so I'll do it anyway. But let me see if there's a way to test this. [...]

No, I don't know of a scientific way of testing this. There is for sure, but I don't know and can't think of this. Not now. I have other worries and I am distracted. Tomorrow the roommate is coming back, and it's going to be unpleasant as usual. He'll be a clown all day long. Not as bad a clown as vito, but close to it. Even half as much a clown as vito is too much for me.

But I will proceed by rule-of-thumb, because I can't wait too long. I am gonna do it this way. I will enable them, as i said, one at a time, not after a drawdown, but after a big loss.

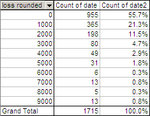

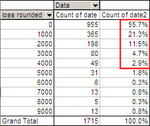

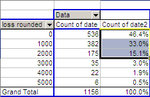

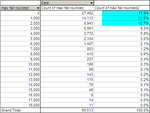

Let's at least analyze how they've been doing lately.

Ok, I am reasoning week by week, even though there might more than one trade per week, and then I'll have to apply this according to the same reasoning (week by week, rather than trade by trade). But usually there's just one trade per week.

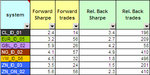

Ok, system by system (this is just to help my reasoning, by no means a reliable statistic):

CL_ID_01: by waiting for a losing week (rather than starting from the first week), I would have missed a bunch of profitable weeks, and incurred in more losses. Bad outcome.

EUR_ID_05: same as above

GBL_ID_02: same as above

NG_ID_02: this would have saved me a big loss

ZN_ID_03: irrelevant benefit ( would have avoided a small loss)

ZN_ID_06: it would have worked (avoiding loss, without missing profit before)

ZN_ON_02: I would have avoided a big loss, but would have missed even more profit before it, so overall a bad outcome.

I noticed a few things:

1) the losses are sometimes clustered together, which would speak against the hypothesis of waiting till there's a loss to start trading.

2) waiting for a loss, obviously always gets you to avoid that loss, but makes you miss all the profit before it, which is often more than what you lose

So, all in all, I can conclude (by guesstimates) that it doesn't make sense to wait for a loss, because, even when losses are not clustered together (which would be like looking for trouble), for a profitable systems (and those I use are highly profitable), waiting around, as a rule, causes you miss more profitable trades than losses.

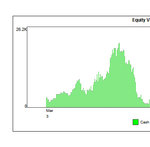

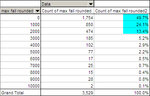

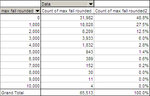

So I am concluding that it doesn't make sens to wait for a loss or a drawdown, but I am still thinking that it is favorable to start after a long drawdown, such as the one I am seeing right now on many systems (yellow-shaded cells). I don't know if I can keep my reasoning going, because so far it's been good, but I sense that there's something to be gained from starting after a long drawdown.

Indeed, "max drawdown" means the maximum fall from a previous peak, and statistically we all assume it will hold or not be exceeded by much. This is true for the same reason that we do not have the concept of "max drawdown" in dice or coin tossing, where everything is random, and you cannot have the expectation of "max drawdown" (the max drawdown recorded on a sample of coin tosses). If we do have the concept of "max drawdown" is because we think that it won't be exceeded (or close to it). Whereas in coin tosses, whatever happened is irrelevant. But if we're building trading systems, it means we believe the market is not random walk, and therefore we believe previous drawdown helps us predict future drawdown.

And if we believe that, then we could also say that it makes sense to start trading after a big drawdown, since a big drawdown is LESS likely to be followed by more losses.

But then there's these two guys, Ralph Vince and pecas, who say otherwise and say each trade is like a coin toss and drawdown is meaningless:

Portfolio management formulas: mathematical trading methods for the futures ... - Ralph Vince - Google Books

http://www.trade2win.com/boards/pla...ting-future-maximum-drawdown.html#post1691624

So, my final conclusion, regardless of what these guys say, is this:

1) it doesn't make sense to wait for a loss because it could be followed by more losses but especially preceded by a lot of wins, which could outbalance the future losses, but which you'd miss by waiting for that loss

2) it doesn't make sense to waiti for a big drawdown, because with profitable systems, such as those we should be trading, you're more likely to waste profit (same as above) while waiting for that drawdown, profit which could make up for the future drawdown

3) it seems ideal to enter after a big drawdown has happened, if you're lucky enough to start at that point...

...But then would it not make sense to wait for that drawdown? Well, no, because time is money, and time is wasted profit as a rule. So it's good to start after the drawdown but not good to wait for it. It's not making total sense to me, and maybe those two guys above are right, but this would in turn mean that the concept of drawdown is meaningless. But if this is the case, then the whole idea of predicting the future based on the past is also meaningless, and therefore trading systems are meaningless.

I'm gonna need a lot more math than I've covered so far. But at least now I have a better assessment of what I don't know.

It will help to read this goddamn book, The Mathematics of Money Management by Ralph Vince, even though it's too heavy for me right now. I need to do less, in my own way, and better, before starting to fill up my head with his notions. Actually you know what? Since he has a chapter on Markowitz, I will now remove Markowitz, which is hard as hell, and replace it with Ralph Vince. I mean on my signature, at the end of each post.

[...]

Here's a thread totally focused on my previous question of when to start trading (randomly or after a loss/drawdown):

http://www.tradingblox.com/forum/viewtopic.php?t=8980

Not much is concluded, even though the forum has got users with great expertise on these subjects.

Ok, I just checked and damn me. It works perfectly fine. So I basically screwed up something on internet explorer that only affects this box on this web site. I can't even double-check by registering another t2w account, because I might get banned, like last time.

Ok, let's try to reset internet explorer's settings to default first, before having to reinstall it.

Ok, done. Let's see if it works now.

Damn. Still not working.

Now I will reboot my computer, and if it still doesn't work, the next step is to try system restore, to yesterday or the day before.

Ok, rebooting doesn't solve it either. Now I will try a system restore to 2 days ago.

I have to remember I just had an idea about starting the systems after a loss. It might not help at all, and it might be incoherent probability thinking: I know it doesn't make a difference on random events, such as dice and the roulette. But, hey, even on those betting on black after a red came out does not hurt. If anything it leaves your chances of getting it right to the original 50%.

And, if instead there's some probabilistic reason that enabling those seven systems one at a time, each one after a big loss/drawdown, puts the probability on my side, then why not do it? Being wrong about this hypothesis won't hurt me for sure, because if it's totally random like for coin tossing and dice and roulette, then I won't affect the next outcome either by waiting one outcome. If instead I am right and it's not random, and after a loss or big drawdown, it is less likely to happen another one, then I will benefit from it. So now my idea is to enable those 7 systems, but one at a time and each one after a loss or drawdown. If I am wrong, it won't hurt, and if I am right, I will benefit from it.

So now i'll do the system restore.

Oh, good. Now it finally all works. As to the culprit, the only two possible causes are:

1) I installed hotspot shield, a proxy software, in order to watch some SNL episodes on hulu.com and vidcube.com, which would not stream to italy, but then, once i did that, it was useless, because they only streamed for free for 1 minute and a half. Anyway, I later found out that for most episodes the videos can be found at good places and not just these two paying websites. So this is the link anyway, if anyone cares:

Watch Saturday Night Live online (TV Show) - on 1Channel | LetMeWatchThis

2) I was trying to get rid of google search autocomplete feature, and i followed the instructions in this video:

Google - How to turn off Google autocomplete - YouTube

But then today the mother ****ing autocomplete (google is getting worse, just like windows, office and a lot of other software lately) came back anyway, and maybe it also caused, out of revenge, this problem on trade2win's message boxes.

Yesterday, among the other things, while browsing on letmewatchthis.com, which is my favorite and only movie website, I discovered this very good tv show:

Watch Mob Wives online (TV Show) - download MobWives - on 1Channel | LetMeWatchThis

Mob wives is quality stuff. I haven't reasoned on why yet, but it's very engrossing. First of all, I think it's well-made (good editing of the interesting parts). And second of all, I am Italian, lived in the states for a few years, so this is related to things I both know and also am curious about. But then there must be other reasons. Some brainstorming, in random order:

1) there's action, because the husbands are in jail or go to jail during the movie

2) among my favorite movies are mafia movies such as goodfellas (the mob wives are just like ray liotta's friends and wife in that movie), the godfather, and so on.

3) I've always liked documentaries, and in many ways a reality show is a documentary (at least for the way these women talk, and think)

4) among the things that make me say that it's well-made there's the fact that this show doesn't just show the daily life and behaviour of these women, but also some moral dilemmas, such as "should I leave my husband now that he's in jail?", "should I cheat on him?", "is it ok for my husband to kill people?".

Speaking of reality shows and documentaries, yesterday I always watched this good movie:

Watch Cinema Verite online - on 1Channel | LetMeWatchThis

[...]

So, I was saying about the enabling of the seven systems, one at a time, after they have drawdown or a loss. Does it make sense? As I said, if it doesn't make sense, it still will not hurt, so I'll do it anyway. But let me see if there's a way to test this. [...]

No, I don't know of a scientific way of testing this. There is for sure, but I don't know and can't think of this. Not now. I have other worries and I am distracted. Tomorrow the roommate is coming back, and it's going to be unpleasant as usual. He'll be a clown all day long. Not as bad a clown as vito, but close to it. Even half as much a clown as vito is too much for me.

But I will proceed by rule-of-thumb, because I can't wait too long. I am gonna do it this way. I will enable them, as i said, one at a time, not after a drawdown, but after a big loss.

Let's at least analyze how they've been doing lately.

Ok, I am reasoning week by week, even though there might more than one trade per week, and then I'll have to apply this according to the same reasoning (week by week, rather than trade by trade). But usually there's just one trade per week.

Ok, system by system (this is just to help my reasoning, by no means a reliable statistic):

CL_ID_01: by waiting for a losing week (rather than starting from the first week), I would have missed a bunch of profitable weeks, and incurred in more losses. Bad outcome.

EUR_ID_05: same as above

GBL_ID_02: same as above

NG_ID_02: this would have saved me a big loss

ZN_ID_03: irrelevant benefit ( would have avoided a small loss)

ZN_ID_06: it would have worked (avoiding loss, without missing profit before)

ZN_ON_02: I would have avoided a big loss, but would have missed even more profit before it, so overall a bad outcome.

I noticed a few things:

1) the losses are sometimes clustered together, which would speak against the hypothesis of waiting till there's a loss to start trading.

2) waiting for a loss, obviously always gets you to avoid that loss, but makes you miss all the profit before it, which is often more than what you lose

So, all in all, I can conclude (by guesstimates) that it doesn't make sense to wait for a loss, because, even when losses are not clustered together (which would be like looking for trouble), for a profitable systems (and those I use are highly profitable), waiting around, as a rule, causes you miss more profitable trades than losses.

So I am concluding that it doesn't make sens to wait for a loss or a drawdown, but I am still thinking that it is favorable to start after a long drawdown, such as the one I am seeing right now on many systems (yellow-shaded cells). I don't know if I can keep my reasoning going, because so far it's been good, but I sense that there's something to be gained from starting after a long drawdown.

Indeed, "max drawdown" means the maximum fall from a previous peak, and statistically we all assume it will hold or not be exceeded by much. This is true for the same reason that we do not have the concept of "max drawdown" in dice or coin tossing, where everything is random, and you cannot have the expectation of "max drawdown" (the max drawdown recorded on a sample of coin tosses). If we do have the concept of "max drawdown" is because we think that it won't be exceeded (or close to it). Whereas in coin tosses, whatever happened is irrelevant. But if we're building trading systems, it means we believe the market is not random walk, and therefore we believe previous drawdown helps us predict future drawdown.

And if we believe that, then we could also say that it makes sense to start trading after a big drawdown, since a big drawdown is LESS likely to be followed by more losses.

But then there's these two guys, Ralph Vince and pecas, who say otherwise and say each trade is like a coin toss and drawdown is meaningless:

Portfolio management formulas: mathematical trading methods for the futures ... - Ralph Vince - Google Books

http://www.trade2win.com/boards/pla...ting-future-maximum-drawdown.html#post1691624

So, my final conclusion, regardless of what these guys say, is this:

1) it doesn't make sense to wait for a loss because it could be followed by more losses but especially preceded by a lot of wins, which could outbalance the future losses, but which you'd miss by waiting for that loss

2) it doesn't make sense to waiti for a big drawdown, because with profitable systems, such as those we should be trading, you're more likely to waste profit (same as above) while waiting for that drawdown, profit which could make up for the future drawdown

3) it seems ideal to enter after a big drawdown has happened, if you're lucky enough to start at that point...

...But then would it not make sense to wait for that drawdown? Well, no, because time is money, and time is wasted profit as a rule. So it's good to start after the drawdown but not good to wait for it. It's not making total sense to me, and maybe those two guys above are right, but this would in turn mean that the concept of drawdown is meaningless. But if this is the case, then the whole idea of predicting the future based on the past is also meaningless, and therefore trading systems are meaningless.

I'm gonna need a lot more math than I've covered so far. But at least now I have a better assessment of what I don't know.

It will help to read this goddamn book, The Mathematics of Money Management by Ralph Vince, even though it's too heavy for me right now. I need to do less, in my own way, and better, before starting to fill up my head with his notions. Actually you know what? Since he has a chapter on Markowitz, I will now remove Markowitz, which is hard as hell, and replace it with Ralph Vince. I mean on my signature, at the end of each post.

[...]

Here's a thread totally focused on my previous question of when to start trading (randomly or after a loss/drawdown):

http://www.tradingblox.com/forum/viewtopic.php?t=8980

Not much is concluded, even though the forum has got users with great expertise on these subjects.

Last edited: