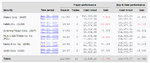

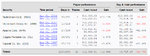

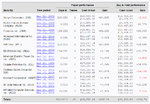

The chart game took "waiting" out of the picture, and showed me I am profitable

Holy ****! This game is teaching me to have total faith in support and resistance levels, teaching me how to read them, and teaching me that they work very very well.

Furthermore, it's teaching me that if I am confident in a method trading is much less stressful, almost not at all. It's not because I am paper trading, as someone may object, because yesterday I remember how totally stressed out I was, when I was making those 5-trade series, and trying to make the right calls on the market. But now I have found out, gradually and increasingly, that I have an edge, and that profit happens. I can make profit happen. It's the most important thing. Until now I noticed that my automated trading systems could make profit happen but I didn't know exactly how they did it, nor how long it would last. They did it by waiting. Something I don't do when I trade, since I always overtrade. I guess we're all profitable from the start - the only problem is that we don't get rid of those trades we're not positive about. Anyone can see the good opportunities in the markets, but very few can wait until they see them.

With this "accelerated" simulator the problem of waiting went away and I suddenly realized that I am capable of being profitable and having an edge.

At this point, i'm tempted to dare further and go SHORT as well as LONG but I will postpone it because first I want to get this right and never really fail (given a certain number of trades), which is being the case in the last few trades. Also I must not forget what I said two posts ago: going in the most probable direction not only gives you an edge, but also allows your mind to rest as necessary. I can't expect to bet on every single move of the market (on top of it with a worse edge), because this will just drive me crazy. I love how how I've been able to let some stocks go without being bothered by the idea that there might have been good opportunities. The problem is that these are weeks that are going by, one week goes by at each click, whereas in real trading I couldn't just let 1 year go by and do nothing for a whole year. Not even for one week.

The good thing is that it's teaching me to wait until the s/r level is actually reached and not anticipate it.

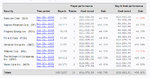

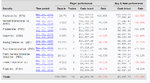

This above was like the fourth series of profitable trades in a row: I am getting used to making money with this method (see previous posts for method), and even beating the buy and hold approach. But I have to be careful now, because my psychology is changing, and i noticed that on two occasions I didn't respect a stoploss and started hoping because I didn't want to ruin a string of wins, and didn't really accept that I could be wrong.

Anyway, the chart game took "waiting" out of the picture, and showed me I am profitable: if I can wait. So I can be profitable with real money via discretionary trading, if I can allow myself to act as an automated system and trade only once a day, or rather at one moment of the day. Possibly at the reversal time near the US close. Best if by only going LONG on those futures I monitor. And better if I do so in an uptrend, which will be signalled by the fact that my automated systems will have made money the previous week.

The "one trade per day" part has been kicking in recently. After getting from 30k to 3k in six months, and staying at about 3k for the past month or two.

The ideal trading environment for me would be staying at work until 20 CET (13 CST), so I can't trade, and having access to charts so I can look and study what the best opportunities are. Then only get home at reversal time, which is about 14 CST, on pretty much all the futures I trade. But this situation is science fiction, since I get home at 16.00 CET, and then the time is not right to trade (for my bottom picking, I mean). So hopefully good habits will help me out. Because I have zero discipline.